Page 6 of 7 IT-2104 (2017)

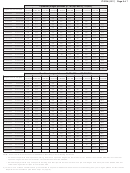

Part 5 –

These charts are only for single taxpayers and head of household taxpayers with more than one job, and whose combined

wages are between $107,650 and $2,263,265.

Enter the additional withholding dollar amount on line 3.

The additional dollar amount, as shown below, is accurate for a weekly payroll. If you are not paid on a weekly basis, you will need to

adjust these dollar amount(s). For example, if you are paid biweekly, you must double the dollar amount(s) computed.

Combined wages between $107,650 and $538,749

$107,650

$129,250

$150,750

$172,300

$193,850

$236,950

$280,100

$323,200

$377,100

$430,950

$484,900

Higher wage

$129,249

$150,749

$172,299

$193,849

$236,949

$280,099

$323,199

$377,099

$430,949

$484,899

$538,749

$53,800

$75,299

$13

$18

$75,300

$96,799

$13

$19

$26

$25

$96,800

$118,399

$8

$17

$23

$26

$28

$118,400

$129,249

$2

$11

$18

$21

$25

$28

$129,250

$139,999

$4

$15

$18

$22

$28

$140,000

$150,749

$2

$11

$14

$19

$28

$26

$150,750

$161,549

$4

$11

$15

$28

$24

$161,550

$172,499

$2

$8

$13

$27

$25

$21

$172,500

$193,849

$3

$11

$25

$28

$22

$24

$193,850

$236,949

$8

$21

$30

$27

$24

$18

$236,950

$280,099

$8

$16

$24

$19

$18

$13

$280,100

$323,199

$7

$15

$22

$15

$16

$323,200

$377,099

$8

$16

$22

$15

$377,100

$430,949

$8

$16

$22

$430,950

$484,899

$8

$16

$484,900

$538,749

$8

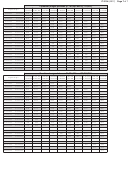

Combined wages between $538,750 and $1,185,399

$538,750

$592,650

$646,500

$700,400

$754,300

$808,200

$862,050

$915,950

$969,900 $1,023,750 $1,077,550 $1,131,500

Higher wage

$592,649

$646,499

$700,399

$754,299

$808,199

$862,049

$915,949

$969,899 $1,023,749 $1,077,549 $1,131,499 $1,185,399

$236,950

$280,099

$9

$280,100

$323,199

$9

$8

$323,200

$377,099

$17

$8

$8

$8

$377,100

$430,949

$15

$17

$8

$8

$8

$8

$430,950

$484,899

$22

$15

$17

$8

$8

$8

$8

$8

$484,900

$538,749

$16

$22

$15

$17

$8

$8

$8

$8

$8

$8

$538,750

$592,649

$8

$16

$22

$15

$17

$8

$8

$8

$8

$8

$226

$452

$592,650

$646,499

$8

$16

$22

$15

$17

$8

$8

$8

$8

$226

$452

$646,500

$700,399

$8

$16

$22

$15

$17

$8

$8

$8

$226

$452

$700,400

$754,299

$8

$16

$22

$15

$17

$8

$8

$226

$452

$754,300

$808,199

$8

$16

$22

$15

$17

$8

$226

$452

$808,200

$862,049

$8

$16

$22

$15

$17

$226

$452

$862,050

$915,949

$8

$16

$22

$15

$234

$452

$915,950

$969,899

$8

$16

$22

$232

$461

$969,900

$1,023,749

$8

$16

$239

$458

$1,023,750

$1,077,549

$8

$233

$466

$1,077,550

$1,131,499

$115

$247

$1,131,500

$1,185,399

$14

(Part 5 continued on page 7)

Privacy notification

Need help?

See our website or Publication 54, Privacy Notification.

Visit our website at

• get information and manage your taxes online

• check for new online services and features

Telephone assistance

Automated income tax refund status:

(518) 457-5149

Personal Income Tax Information Center: (518) 457-5181

To order forms and publications:

(518) 457-5431

Text Telephone (TTY) Hotline (for persons with

hearing and speech disabilities using a TTY): (518) 485-5082

1

1 2

2 3

3 4

4 5

5 6

6 7

7