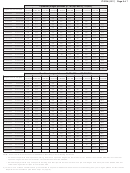

IT-2104 (2017) Page 5 of 7

Combined wages between $1,185,400 and $1,724,299

$1,185,400 $1,239,250 $1,293,200 $1,347,050 $1,400,950 $1,454,850 $1,508,700 $1,562,550 $1,616,450 $1,670,400

Higher earner’s wages

$1,239,249 $1,293,199 $1,347,049 $1,400,949 $1,454,849 $1,508,699 $1,562,549 $1,616,449 $1,670,399 $1,724,299

$592,650

$646,499

$14

$17

$646,500

$700,399

$14

$17

$21

$24

$700,400

$754,299

$14

$17

$21

$24

$27

$30

$754,300

$808,199

$14

$17

$21

$24

$27

$30

$33

$36

$808,200

$862,049

$14

$17

$21

$24

$27

$30

$33

$36

$39

$42

$862,050

$915,949

$23

$17

$21

$24

$27

$30

$33

$36

$39

$42

$915,950

$969,899

$21

$26

$21

$24

$27

$30

$33

$36

$39

$42

$969,900

$1,023,749

$18

$24

$29

$24

$27

$30

$33

$36

$39

$42

$1,023,750

$1,077,549

$26

$22

$27

$32

$27

$30

$33

$36

$39

$42

$1,077,550

$1,131,499

$29

$28

$23

$28

$34

$28

$31

$35

$38

$41

$1,131,500

$1,185,399

$19

$29

$28

$23

$28

$34

$28

$31

$35

$38

$1,185,400

$1,239,249

$9

$19

$29

$28

$23

$28

$34

$28

$31

$35

$1,239,250

$1,293,199

$9

$19

$29

$28

$23

$28

$34

$28

$31

$1,293,200

$1,347,049

$9

$19

$29

$28

$23

$28

$34

$28

$1,347,050

$1,400,949

$9

$19

$29

$28

$23

$28

$34

$1,400,950

$1,454,849

$9

$19

$29

$28

$23

$28

$1,454,850

$1,508,699

$9

$19

$29

$28

$23

$1,508,700

$1,562,549

$9

$19

$29

$28

$1,562,550

$1,616,449

$9

$19

$29

$1,616,450

$1,670,399

$9

$19

$1,670,400

$1,724,299

$9

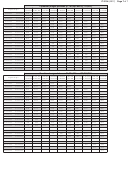

Combined wages between $1,724,300 and $2,263,265

$1,724,300 $1,778,150 $1,832,050 $1,885,950 $1,939,800 $1,993,700 $2,047,600 $2,101,500 $2,155,350 $2,209,300

Higher earner’s wages

$1,778,149 $1,832,049 $1,885,949 $1,939,799 $1,993,699 $2,047,599 $2,101,499 $2,155,349 $2,209,299 $2,263,265

$862,050

$915,949

$45

$49

$915,950

$969,899

$45

$49

$52

$55

$969,900

$1,023,749

$45

$49

$52

$55

$58

$61

$1,023,750

$1,077,549

$45

$49

$52

$55

$58

$61

$64

$67

$1,077,550

$1,131,499

$44

$47

$50

$53

$56

$59

$63

$66

$484

$917

$1,131,500

$1,185,399

$41

$44

$47

$50

$53

$56

$59

$63

$481

$916

$1,185,400

$1,239,249

$38

$41

$44

$47

$50

$53

$56

$59

$478

$913

$1,239,250

$1,293,199

$35

$38

$41

$44

$47

$50

$53

$56

$475

$910

$1,293,200

$1,347,049

$31

$35

$38

$41

$44

$47

$50

$53

$472

$907

$1,347,050

$1,400,949

$28

$31

$35

$38

$41

$44

$47

$50

$468

$904

$1,400,950

$1,454,849

$34

$28

$31

$35

$38

$41

$44

$47

$465

$901

$1,454,850

$1,508,699

$28

$34

$28

$31

$35

$38

$41

$44

$462

$898

$1,508,700

$1,562,549

$23

$28

$34

$28

$31

$35

$38

$41

$459

$895

$1,562,550

$1,616,449

$28

$23

$28

$34

$28

$31

$35

$38

$456

$892

$1,616,450

$1,670,399

$29

$28

$23

$28

$34

$28

$31

$35

$453

$888

$1,670,400

$1,724,299

$19

$29

$28

$23

$28

$34

$28

$31

$450

$885

$1,724,300

$1,778,149

$9

$19

$29

$28

$23

$28

$34

$28

$447

$882

$1,778,150

$1,832,049

$9

$19

$29

$28

$23

$28

$34

$444

$879

$1,832,050

$1,885,949

$9

$19

$29

$28

$23

$28

$449

$876

$1,885,950

$1,939,799

$9

$19

$29

$28

$23

$444

$881

$1,939,800

$1,993,699

$9

$19

$29

$28

$439

$876

$1,993,700

$2,047,599

$9

$19

$29

$443

$871

$2,047,600

$2,101,499

$9

$19

$444

$875

$2,101,500

$2,155,349

$9

$434

$877

$2,155,350

$2,209,299

$219

$467

$2,209,300

$2,263,265

$14

Note: These charts do not account for additional withholding in the following instances:

• a married couple with both spouses working, where one spouse’s wages are more than $1,131,632 but less than $2,263,265, and the other

spouse’s wages are also more than $1,131,632 but less than $2,263,265;

• married taxpayers with only one spouse working, and that spouse works more than one job, with wages from each job under $2,263,265, but

combined wages from all jobs is over $2,263,265.

If you are in one of these situations and you would like to request an additional dollar amount of withholding from your wages, please contact the Tax

Department for assistance (see Need help? on page 6).

1

1 2

2 3

3 4

4 5

5 6

6 7

7