Form St-4 - Form Of Appeal To The Commissioner Of Central Excise (Appeals)

ADVERTISEMENT

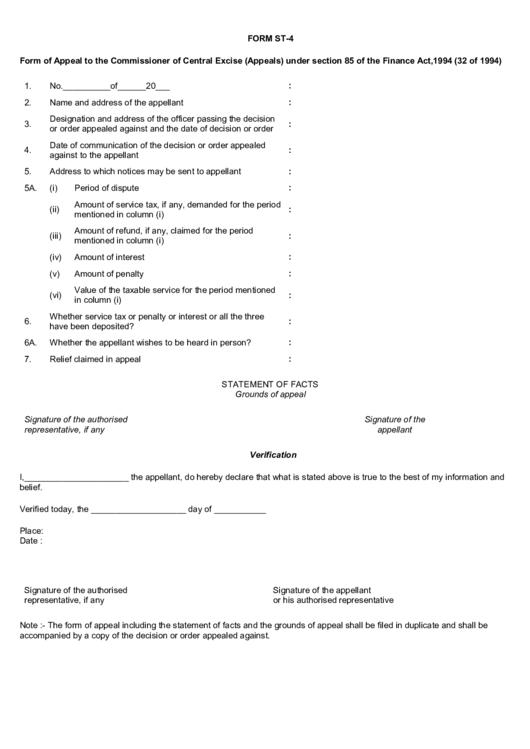

FORM ST-4

Form of Appeal to the Commissioner of Central Excise (Appeals) under section 85 of the Finance Act,1994 (32 of 1994)

:

1.

No.__________of______20___

2.

Name and address of the appellant

:

Designation and address of the officer passing the decision

3.

:

or order appealed against and the date of decision or order

Date of communication of the decision or order appealed

4.

:

against to the appellant

5.

Address to which notices may be sent to appellant

:

:

5A.

(i)

Period of dispute

Amount of service tax, if any, demanded for the period

(ii)

:

mentioned in column (i)

Amount of refund, if any, claimed for the period

:

(iii)

mentioned in column (i)

(iv)

Amount of interest

:

(v)

Amount of penalty

:

Value of the taxable service for the period mentioned

(vi)

:

in column (i)

Whether service tax or penalty or interest or all the three

6.

:

have been deposited?

6A.

Whether the appellant wishes to be heard in person?

:

7.

Relief claimed in appeal

:

STATEMENT OF FACTS

Grounds of appeal

Signature of the authorised

Signature of the

representative, if any

appellant

Verification

I,______________________ the appellant, do hereby declare that what is stated above is true to the best of my information and

belief.

Verified today, the ____________________ day of ___________

Place:

Date :

Signature of the authorised

Signature of the appellant

representative, if any

or his authorised representative

Note :- The form of appeal including the statement of facts and the grounds of appeal shall be filed in duplicate and shall be

accompanied by a copy of the decision or order appealed against.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1