New Mexico Taxation And Revenue Department Letter Of Intent Page 2

ADVERTISEMENT

Page 2 of 3

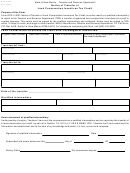

New Mexico Taxation and Revenue Department

LETTER OF INTENT

For Forms Developers

Provide a description of the product developed (check all that apply):

A forms library product for sale or lease

Tax preparation software

q

On-line software

q

Over-the-counter software

q

For self-prepared returns

q

For paid preparers

q

Other _______________________________________________________________

q

q

NACTP Membership

r Mark this box if you are NOT a member of the NATCP. If you are NOT a member of the NACTP,

enter a contact email address for Department notifications, updates and alerts.

Contact email address _______________________________________________________________________

Agreement

I have read the specifications and approval procedures and I understand that:

•

All submissions must be a complete package. A complete package means that all forms

and schedules supported by the software product are included in the package. Forms and

schedules should not be submitted separately for approval, and will be rejected if not sub-

mitted in a complete package. Separate packages for each tax program may be submitted.

•

Unapproved forms made available in software packages must include a visual indicator

with appropriate text prominently displayed on the forms alerting the end user that the

form cannot be filed and will be rejected by the State of New Mexico.

•

Once approved, substitute tax forms cannot be altered without the authorization of TRD.

Customers must be notified that changing the tax form’s font, paper size, paper orienta-

tion or otherwise altering the design of the form in any way can result in tax errors, pro-

cessing delays, and could result in the rejection of the form.

•

Customers must be provided with proper instructions for printing the approved forms

(to include instructions for the PV, ES, and EXT payment vouchers). Customers also must

be notified that failure to follow the printing instructions can result in tax errors, process-

ing delays, and inability to successfully process the tax form and information entered on

the form.

•

When an error relating to form design, written instruction, 2D barcode or other scanna-

ble feature of the form is discovered, the software developer will promptly research the

cause, correct the error if applicable, and issue a release of a revised product. TRD and

customers will be notified of the required revision to the software product generating the

form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2 3

3