TOB: SCH D-INST

5/14

A

D

r

lAbAmA

epArtment of

evenue

b

& l

t

D

• t

t

s

usiness

icense

Ax

ivision

obAcco

Ax

ection

p.o. box 327555 • montgomery, Al 36132-7555 • (334) 242-9627

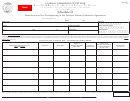

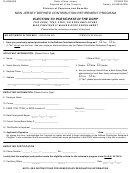

instructions for manufacturers not participating and participating in

the tobacco master settlement Agreement (schedule D)

DEFINITIONS:

Complete this form and submit it monthly if:

– You are a cigarette wholesaler,

Cigarette – Any product that contains nicotine, is intended to be burned or heated

– You are a tobacco products distributor; or

under ordinary conditions of use, and consists of or contains (i) any roll of tobacco

– You are a retailer receiving unstamped cigarettes and/or untaxed roll-your-own

wrapped in paper or in any substance not containing tobacco; or (ii) tobacco, in any

tobacco.

form, that is functional in the product, which, because of its appearance, the type of

This report must be completed for every cigarette brand that is stamped for sale

tobacco used in the filler, or its packaging and labeling, is likely to be offered to, or

within this state, roll-your-own which excise tax is required to be paid, and any ciga-

purchased by, consumers as a cigarette; or (iii) any roll of tobacco wrapped in any

rette brand and roll-your-own sold in a transaction not exempted from Alabama tax-

substance containing tobacco which, because of its appearance, the type of tobacco

ation by federal statute or constitution. Part I and Part II of the form must be

used in the filler, or its packaging and labeling, is likely to be offered to, or purchased

completed showing NPM and/or PM activity. If you did not have monthly activity, the

by, consumers as a cigarette described in item (i).

report must be filed and “No Activity” shown on Part I and Part II of the report. A list

**Roll-Your-Own – The term “cigarette” includes “roll-your-own,” i.e. any tobacco

of Participating Manufacturers is included on this form. This list, along with the Par-

which, because of its appearance, type, packaging, or labeling is suitable for use

ticipating Manufacturer's brands, is maintained and updated at the National Associ-

and likely to be offered to, or purchased by, consumers as tobacco for making ciga-

ation of Attorneys General (NAAG) Web site,

rettes. For purposes of this definition of cigarette, 0.09 ounces of roll-your-own to-

Column A – Enter the FULL name and address of the NPM and/or PM. See reverse

bacco shall constitute one individual cigarette.

side for a listing of Participating Manufacturers.

*Units Sold – The number of individual cigarettes sold in the state by the applicable

Column B – Enter the FULL name and address of the Importer, if applicable. See

tobacco product manufacturer, whether directly or through a distributor, retailer, or

the definition of an importer in the previous column. If you received the tobacco prod-

similar intermediary or intermediaries, during the year in question, as measured by

ucts/brands from an entity which meets this definition, enter the importer’s full name

excise taxes collected by the state on packs, or roll-your-own tobacco containers,

and address. If you are unaware if the company you are purchasing cigarettes and/or

bearing the excise tax stamp of the state and which the state had power to under

roll-your-own tobacco from is an importer, please contact them to inquire if they are

federal law, but did not, impose and/or collect excise tax.

operating as an importer on behalf of the tobacco product manufacturer.

Without limiting the foregoing, this term specifically includes the following cigarettes,

Column C – Enter the brand code of the product (cigarettes or roll-your-own) man-

provided such cigarettes were not sold in a transaction that is exempted from Ala-

ufactured by the NPM and/or PM and sold tax-paid in Alabama or sold in a transaction

bama taxation by federal statute or constitution: (i) cigarettes sold to a consumer

not exempted from Alabama taxation by federal statute or constitution. A brand code

without payment of the cigarette excise tax on the reservation lands of a federally-

must be listed for each brand shown. This listing can be found at

recognized Native American tribe, (ii) cigarettes sold for retail sale in Alabama which

alabama.gov/ tobaccotax/ index.html. If you can not find a brand code for a product,

were exempted from taxation pursuant to Chapter 9, Article 1 of Title 40 and/or any

please contact our office at (334) 242-9627.

rule or regulation promulgated pursuant thereto, and (iii) cigarettes sold by a seller

located outside of Alabama directly to a consumer in this state, without payment of

Column D – Enter the full brand name of the product (cigarettes or roll-your-own)

the cigarette excise tax, via mail order, telephone, internet, or other remote means.

manufactured by the NPM and/or PM and sold tax-paid in Alabama or sold in a trans-

action not exempted from Alabama taxation by federal statute or constitution. Do not

Nonparticipating Manufacturer (NPM) is identified as any tobacco product manu-

abbreviate the brand name. Do not break the brand name down into sub-categories,

facturer who has not signed the Master Settlement Agreement entered into on No-

such as regular, menthol, light, etc. For example, for a cigarette named “Alpha Bravo

vember 23, 1998 with this State.

Gold Menthol Lights,” report only “Alpha Bravo Gold.” Do not report as “A B Gold” or

Importer – Any person in the United States to whom non-tax paid tobacco products

“A B Gold Menthol Lights.”

or cigarette papers or tubes, or any processed tobacco, manufactured in a foreign

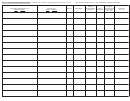

Column E – Enter the number of Alabama taxed individual cigarettes (Units Sold)

country, Puerto Rico, the Virgin Islands, or a possession of the United States are

or cigarettes sold in a transaction not exempted from Alabama taxation by federal

shipped or consigned; any person who removes cigars or cigarettes for sale or con-

statute or constitution received directly or indirectly from NPMs and/or PMs. Show

sumption in the United States from a customs bonded manufacturing warehouse;

the monthly total per NPM and/or PM and according to brand name. Show only cig-

and any person who smuggles or otherwise unlawfully brings tobacco products or

arettes contained in packages to which you affixed the Alabama excise tax stamp.

cigarette papers or tubes, or any processed tobacco, into the United States.

Do not show cigarettes that were purchased with the Alabama tax stamp already af-

Participating Manufacturer (PM) is identified as any tobacco product manufacturer

fixed. The distributor affixing the stamp must show this activity on their report.

that is or becomes a signatory to the Master Settlement Agreement.

Column F – Enter monthly total ounces of Alabama taxed roll-your-own or roll-your-

INSTRUCTIONS FOR COMPLETING THE REPORT:

own sold in a transaction not exempted from Alabama taxation by federal statute or

constitution per NPM and/or PM and according to brand name. Do not show roll-

Each qualified wholesaler, distributor, retailer, manufacturer, or any other person,

your-own if the excise tax was paid to the Alabama Department of Revenue by an-

firm, corporation, club or association selling, receiving, distributing, storing or using

other distributor. The distributor paying the tax to Alabama must show this activity

tobacco products in the State of Alabama shall report, by brand family, the total num-

on their report.

ber of cigarettes or in the case of roll your own, the equivalent stick count for which

the wholesalers and distributors affixed stamps during the previous month or other-

Column G – Convert roll-your-own ounces to individual cigarette units by dividing

wise paid the tax due for any cigarettes. In addition to the aforementioned, any cig-

Column E by 0.09. Enter the results in this column.

arettes and roll-your-own sold in a transaction not exempted from Alabama taxation

Column H – Enter total units sold by adding Columns D and F of each line.

by federal statute or constitution shall also be reported by brand family.

1

1 2

2 3

3 4

4