Instructions For Form Ftb 8633 - California Application To Participate In The E-File Program - 2001

ADVERTISEMENT

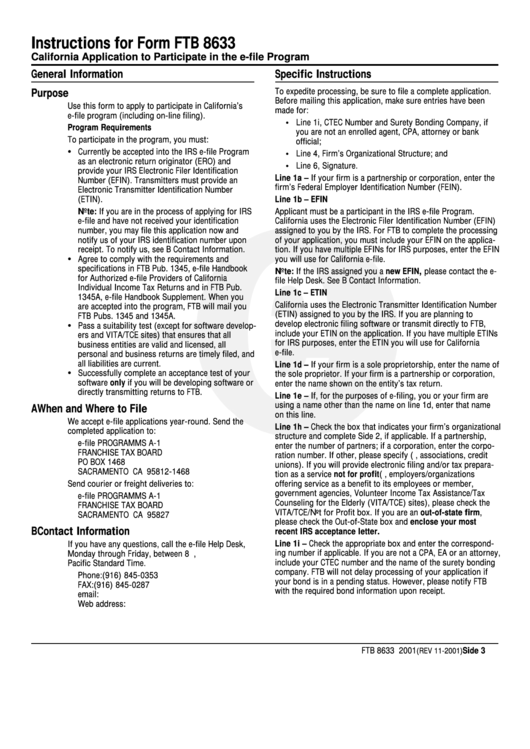

Instructions for Form FTB 8633

California Application to Participate in the e-file Program

General Information

Specific Instructions

To expedite processing, be sure to file a complete application.

Purpose

Before mailing this application, make sure entries have been

Use this form to apply to participate in California’s

made for:

e-file program (including on-line filing).

• Line 1i, CTEC Number and Surety Bonding Company, if

Program Requirements

you are not an enrolled agent, CPA, attorney or bank

To participate in the program, you must:

official;

•

Currently be accepted into the IRS e-file Program

• Line 4, Firm’s Organizational Structure; and

as an electronic return originator (ERO) and

• Line 6, Signature.

provide your IRS Electronic Filer Identification

Line 1a – If your firm is a partnership or corporation, enter the

Number (EFIN). Transmitters must provide an

firm’s Federal Employer Identification Number (FEIN).

Electronic Transmitter Identification Number

(ETIN).

Line 1b – EFIN

Note: If you are in the process of applying for IRS

Applicant must be a participant in the IRS e-file Program.

e-file and have not received your identification

e

California uses the Electronic Filer Identification Number (EFIN)

number, you may file this application now and

assigned to you by the IRS. For FTB to complete the processing

notify us of your IRS identification number upon

of your application, you must include your EFIN on the applica-

receipt. To notify us, see B Contact Information.

tion. If you have multiple EFINs for IRS purposes, enter the EFIN

•

Agree to comply with the requirements and

you will use for California e-file.

specifications in FTB Pub. 1345, e-file Handbook

Note: If the IRS assigned you a new EFIN, please contact the e-

for Authorized e-file Providers of California

file Help Desk. See B Contact Information.

Individual Income Tax Returns and in FTB Pub.

Line 1c – ETIN

1345A, e-file Handbook Supplement. When you

California uses the Electronic Transmitter Identification Number

are accepted into the program, FTB will mail you

(ETIN) assigned to you by the IRS. If you are planning to

FTB Pubs. 1345 and 1345A.

•

develop electronic filing software or transmit directly to FTB,

Pass a suitability test (except for software develop-

include your ETIN on the application. If you have multiple ETINs

ers and VITA/TCE sites) that ensures that all

for IRS purposes, enter the ETIN you will use for California

business entities are valid and licensed, all

e-file.

personal and business returns are timely filed, and

all liabilities are current.

Line 1d – If your firm is a sole proprietorship, enter the name of

•

Successfully complete an acceptance test of your

the sole proprietor. If your firm is a partnership or corporation,

software only if you will be developing software or

enter the name shown on the entity’s tax return.

directly transmitting returns to FTB.

Line 1e – If, for the purposes of e-filing, you or your firm are

using a name other than the name on line 1d, enter that name

A When and Where to File

on this line.

We accept e-file applications year-round. Send the

Line 1h – Check the box that indicates your firm’s organizational

completed application to:

structure and complete Side 2, if applicable. If a partnership,

e-file PROGRAM MS A-1

enter the number of partners; if a corporation, enter the corpo-

FRANCHISE TAX BOARD

ration number. If other, please specify (e.g., associations, credit

PO BOX 1468

unions). If you will provide electronic filing and/or tax prepara-

SACRAMENTO CA 95812-1468

tion as a service not for profit (e.g., employers/organizations

Send courier or freight deliveries to:

offering service as a benefit to its employees or member,

government agencies, Volunteer Income Tax Assistance/Tax

e-file PROGRAM MS A-1

Counseling for the Elderly (VITA/TCE) sites), please check the

FRANCHISE TAX BOARD

VITA/TCE/Not for Profit box. If you are an out-of-state firm,

SACRAMENTO CA 95827

please check the Out-of-State box and enclose your most

B Contact Information

recent IRS acceptance letter.

Line 1i – Check the appropriate box and enter the correspond-

If you have any questions, call the e-file Help Desk,

ing number if applicable. If you are not a CPA, EA or an attorney,

Monday through Friday, between 8 a.m. and 5 p.m.,

include your CTEC number and the name of the surety bonding

Pacific Standard Time.

company. FTB will not delay processing of your application if

Phone:

(916) 845-0353

your bond is in a pending status. However, please notify FTB

FAX:

(916) 845-0287

with the required bond information upon receipt.

email:

e-file@ftb.ca.gov

Web address:

FTB 8633 2001

Side 3

(REV 11-2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2