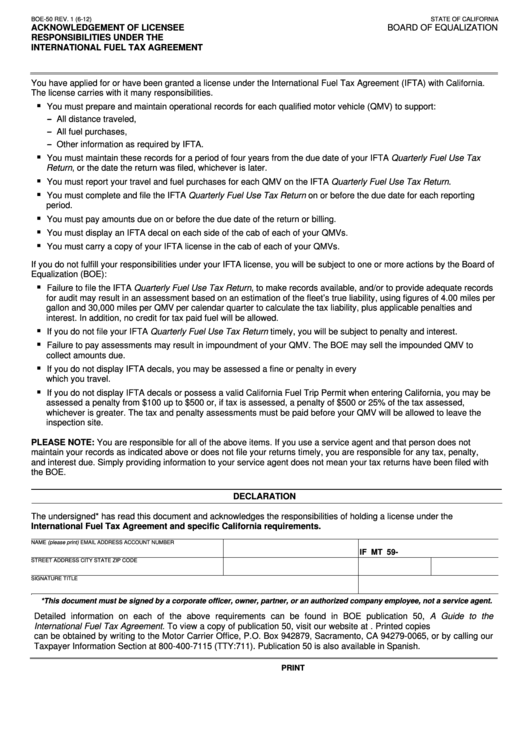

BOE-50 REV. 1 (6-12)

STATE OF CALIFORNIA

ACKNOWLEDGEMENT OF LICENSEE

BOARD OF EQUALIZATION

RESPONSIBILITIES UNDER THE

INTERNATIONAL FUEL TAX AGREEMENT

You have applied for or have been granted a license under the International Fuel Tax Agreement (IFTA) with California.

The license carries with it many responsibilities.

You must prepare and maintain operational records for each qualified motor vehicle (QMV) to support:

- All distance traveled,

- All fuel purchases,

- Other information as required by IFTA.

You must maintain these records for a period of four years from the due date of your IFTA Quarterly Fuel Use Tax

Return, or the date the return was filed, whichever is later.

You must report your travel and fuel purchases for each QMV on the IFTA Quarterly Fuel Use Tax Return.

You must complete and file the IFTA Quarterly Fuel Use Tax Return on or before the due date for each reporting

period.

You must pay amounts due on or before the due date of the return or billing.

You must display an IFTA decal on each side of the cab of each of your QMVs.

You must carry a copy of your IFTA license in the cab of each of your QMVs.

If you do not fulfill your responsibilities under your IFTA license, you will be subject to one or more actions by the Board of

Equalization (BOE):

Failure to file the IFTA Quarterly Fuel Use Tax Return, to make records available, and/or to provide adequate records

for audit may result in an assessment based on an estimation of the fleet’s true liability, using figures of 4.00 miles per

gallon and 30,000 miles per QMV per calendar quarter to calculate the tax liability, plus applicable penalties and

interest. In addition, no credit for tax paid fuel will be allowed.

If you do not file your IFTA Quarterly Fuel Use Tax Return timely, you will be subject to penalty and interest.

Failure to pay assessments may result in impoundment of your QMV. The BOE may sell the impounded QMV to

collect amounts due.

If you do not display IFTA decals, you may be assessed a fine or penalty in every U.S. State or Canadian Province in

which you travel.

If you do not display IFTA decals or possess a valid California Fuel Trip Permit when entering California, you may be

assessed a penalty from $100 up to $500 or, if tax is assessed, a penalty of $500 or 25% of the tax assessed,

whichever is greater. The tax and penalty assessments must be paid before your QMV will be allowed to leave the

inspection site.

PLEASE NOTE: You are responsible for all of the above items. If you use a service agent and that person does not

maintain your records as indicated above or does not file your returns timely, you are responsible for any tax, penalty,

and interest due. Simply providing information to your service agent does not mean your tax returns have been filed with

the BOE.

DECLARATION

The undersigned* has read this document and acknowledges the responsibilities of holding a license under the

International Fuel Tax Agreement and specific California requirements.

NAME (please print)

EMAIL ADDRESS

ACCOUNT NUMBER

IF MT 59-

STREET ADDRESS

CITY

STATE

ZIP CODE

SIGNATURE

TITLE

*This document must be signed by a corporate officer, owner, partner, or an authorized company employee, not a service agent.

Detailed information on each of the above requirements can be found in BOE publication 50, A Guide to the

International Fuel Tax Agreement. To view a copy of publication 50, visit our website at Printed copies

can be obtained by writing to the Motor Carrier Office, P.O. Box 942879, Sacramento, CA 94279-0065, or by calling our

Taxpayer Information Section at 800-400-7115 (TTY:711). Publication 50 is also available in Spanish.

CLEAR

PRINT

1

1