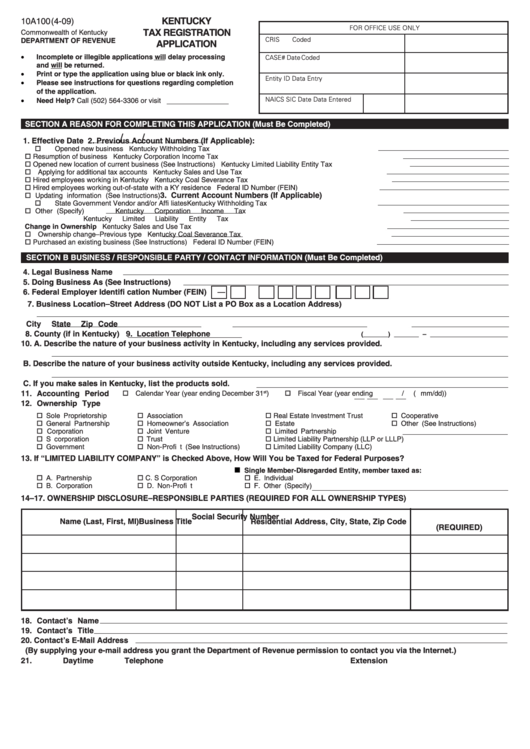

KENTUCKY

10A100 (4-09)

FOR OFFICE USE ONLY

TAX REGISTRATION

Commonwealth of Kentucky

CRIS

Coded

DEPARTMENT OF REVENUE

APPLICATION

•

Incomplete or illegible applications will delay processing

CASE#

Date Coded

and will be returned.

•

Print or type the application using blue or black ink only.

Entity ID

Data Entry

•

Please see instructions for questions regarding completion

of the application.

•

NAICS

SIC

Date Data Entered

Need Help? Call (502) 564-3306 or visit

SECTION A

REASON FOR COMPLETING THIS APPLICATION (Must Be Completed)

/

/

1. Effective Date

2. Previous Account Numbers (If Applicable):

Opened new business

Kentucky Withholding Tax

Resumption of business

Kentucky Corporation Income Tax

Opened new location of current business (See Instructions)

Kentucky Limited Liability Entity Tax

Applying for additional tax accounts

Kentucky Sales and Use Tax

Hired employees working in Kentucky

Kentucky Coal Severance Tax

Hired employees working out-of-state with a KY residence

Federal ID Number (FEIN)

3. Current Account Numbers (If Applicable)

Updating information (See Instructions)

State Government Vendor and/or Affi liates

Kentucky Withholding Tax

Other (Specify)

Kentucky Corporation Income Tax

Kentucky Limited Liability Entity Tax

Change in Ownership

Kentucky Sales and Use Tax

Ownership change–Previous type

Kentucky Coal Severance Tax

Purchased an existing business (See Instructions)

Federal ID Number (FEIN)

SECTION B

BUSINESS / RESPONSIBLE PARTY / CONTACT INFORMATION (Must Be Completed)

4. Legal Business Name

5. Doing Business As (See Instructions)

6. Federal Employer Identifi cation Number (FEIN)

—

7. Business Location–Street Address (DO NOT List a PO Box as a Location Address)

City

State

Zip Code

8. County (if in Kentucky)

9. Location Telephone

(_______) _______ – ______________________

10. A. Describe the nature of your business activity in Kentucky, including any services provided.

B. Describe the nature of your business activity outside Kentucky, including any services provided.

C. If you make sales in Kentucky, list the products sold.

11. Accounting Period

Calendar Year (year ending December 31

st

)

Fiscal Year (year ending

/

(mm/dd))

12. Ownership Type

Cooperative

Sole Proprietorship

Association

Real Estate Investment Trust

General Partnership

Homeowner’s Association

Estate

Other (See Instructions)

Corporation

Joint Venture

Limited Partnership

S corporation

Trust

Limited Liability Partnership (LLP or LLLP)

Government

Non-Profi t (See Instructions)

Limited Liability Company (LLC)

13. If “LIMITED LIABILITY COMPANY” is Checked Above, How Will You be Taxed for Federal Purposes?

Single Member-Disregarded Entity, member taxed as:

A. Partnership

C. S Corporation

E. Individual

B. Corporation

D. Non-Profi t

F. Other (Specify)

14–17. OWNERSHIP DISCLOSURE–RESPONSIBLE PARTIES (REQUIRED FOR ALL OWNERSHIP TYPES)

Social Security Number

Name (Last, First, MI)

Business Title

Residential Address, City, State, Zip Code

(REQUIRED)

18. Contact’s Name

19. Contact’s Title

20. Contact’s E-Mail Address

(By supplying your e-mail address you grant the Department of Revenue permission to contact you via the Internet.)

(_______) _______ – _______________

_______________

Fax (_______) _______ – _______________

21. Daytime Telephone

Extension

1

1 2

2 3

3 4

4