Instructions For Form 8863 Education Credits (American Opportunity And Lifetime Learning Credits) - 2015

ADVERTISEMENT

2015

Department of the Treasury

Internal Revenue Service

Instructions for Form 8863

Education Credits (American Opportunity and Lifetime Learning Credits)

eligible educational institution (postsecondary). For 2015, there

General Instructions

are two education credits.

The American opportunity credit, part of which may be

Section references are to the Internal Revenue Code unless

refundable.

otherwise noted.

The lifetime learning credit, which is nonrefundable.

Future Developments

A refundable credit can give you a refund even if you owe no

tax and are not otherwise required to file a tax return. A

For the latest information about developments related to Form

nonrefundable credit can reduce your tax, but any excess is

8863 and its instructions, such as legislation enacted after they

not refunded to you.

were published, go to

What's New

Both of these credits have different rules that can affect your

eligibility to claim a specific credit. These differences are shown

in Table 1 below.

Limits on modified adjusted gross income (MAGI). The

lifetime learning credit MAGI limit increases to $130,000 if you

Who Can Claim an Education Credit

are filing married filing jointly ($65,000 if you are filing single,

You may be able to claim an education credit if you, your

head of household, or qualifying widow(er)). The American

opportunity credit MAGI limits remain unchanged. See Table 1

spouse, or a dependent you claim on your tax return was a

and the instructions for line 3 or line 14.

student enrolled at or attending an eligible educational

institution. For 2015, the credits are based on the amount of

Purpose of Form

adjusted qualified education expenses paid for the student in

2015 for academic periods beginning in 2015 or beginning in the

Use Form 8863 to figure and claim your education credits, which

first 3 months of 2016.

are based on adjusted qualified education expenses paid to an

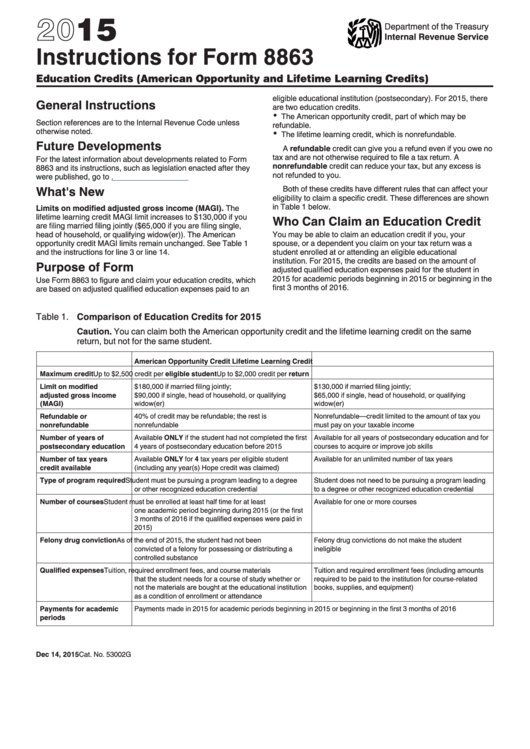

Table 1.

Comparison of Education Credits for 2015

Caution. You can claim both the American opportunity credit and the lifetime learning credit on the same

return, but not for the same student.

American Opportunity Credit

Lifetime Learning Credit

Maximum credit

Up to $2,500 credit per eligible student

Up to $2,000 credit per return

Limit on modified

$180,000 if married filing jointly;

$130,000 if married filing jointly;

adjusted gross income

$90,000 if single, head of household, or qualifying

$65,000 if single, head of household, or qualifying

(MAGI)

widow(er)

widow(er)

Refundable or

40% of credit may be refundable; the rest is

Nonrefundable—credit limited to the amount of tax you

nonrefundable

nonrefundable

must pay on your taxable income

Number of years of

Available ONLY if the student had not completed the first

Available for all years of postsecondary education and for

postsecondary education

4 years of postsecondary education before 2015

courses to acquire or improve job skills

Number of tax years

Available ONLY for 4 tax years per eligible student

Available for an unlimited number of tax years

credit available

(including any year(s) Hope credit was claimed)

Type of program required

Student must be pursuing a program leading to a degree

Student does not need to be pursuing a program leading

or other recognized education credential

to a degree or other recognized education credential

Number of courses

Student must be enrolled at least half time for at least

Available for one or more courses

one academic period beginning during 2015 (or the first

3 months of 2016 if the qualified expenses were paid in

2015)

Felony drug conviction

As of the end of 2015, the student had not been

Felony drug convictions do not make the student

convicted of a felony for possessing or distributing a

ineligible

controlled substance

Qualified expenses

Tuition, required enrollment fees, and course materials

Tuition and required enrollment fees (including amounts

that the student needs for a course of study whether or

required to be paid to the institution for course-related

not the materials are bought at the educational institution

books, supplies, and equipment)

as a condition of enrollment or attendance

Payments for academic

Payments made in 2015 for academic periods beginning in 2015 or beginning in the first 3 months of 2016

periods

Dec 14, 2015

Cat. No. 53002G

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7