Earned Income Tax Credit Chart

ADVERTISEMENT

EARNED INCOME TAX CREDIT

ELIGIBILITY

The Earned Income Tax Credit (EITC) is a tax benefit for

working people who earn lower or moderate incomes.

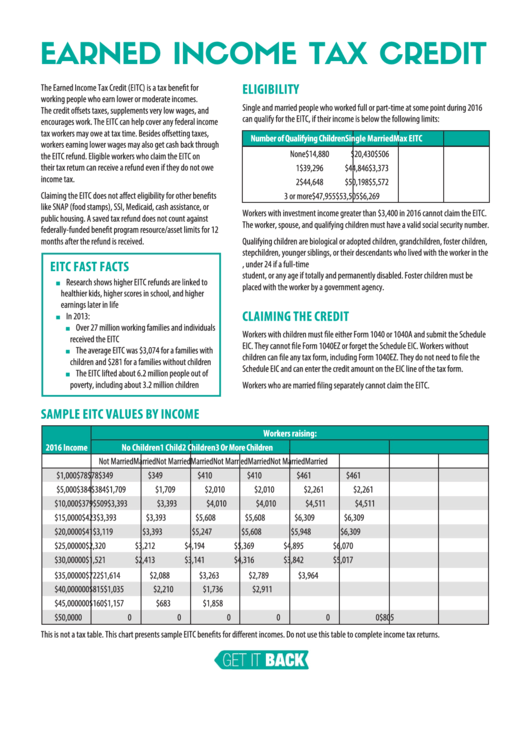

Single and married people who worked full or part-time at some point during 2016

The credit offsets taxes, supplements very low wages, and

can qualify for the EITC, if their income is below the following limits:

encourages work. The EITC can help cover any federal income

tax workers may owe at tax time. Besides offsetting taxes,

Number of Qualifying Children

Single

Married

Max EITC

workers earning lower wages may also get cash back through

None

$14,880

$20,430

$506

the EITC refund. Eligible workers who claim the EITC on

their tax return can receive a refund even if they do not owe

1

$39,296

$44,846

$3,373

income tax.

2

$44,648

$50,198

$5,572

Claiming the EITC does not affect eligibility for other benefits

3 or more

$47,955

$53,505

$6,269

like SNAP (food stamps), SSI, Medicaid, cash assistance, or

Workers with investment income greater than $3,400 in 2016 cannot claim the EITC.

public housing. A saved tax refund does not count against

The worker, spouse, and qualifying children must have a valid social security number.

federally-funded benefit program resource/asset limits for 12

months after the refund is received.

Qualifying children are biological or adopted children, grandchildren, foster children,

stepchildren, younger siblings, or their descendants who lived with the worker in the

EITC FAST FACTS

U.S. for more than half the year. Children must be under 19, under 24 if a full-time

student, or any age if totally and permanently disabled. Foster children must be

■

Research shows higher EITC refunds are linked to

placed with the worker by a government agency.

healthier kids, higher scores in school, and higher

earnings later in life

CLAIMING THE CREDIT

■

In 2013:

■

Over 27 million working families and individuals

Workers with children must file either Form 1040 or 1040A and submit the Schedule

received the EITC

EIC. They cannot file Form 1040EZ or forget the Schedule EIC. Workers without

■

The average EITC was $3,074 for a families with

children can file any tax form, including Form 1040EZ. They do not need to file the

children and $281 for a families without children

Schedule EIC and can enter the credit amount on the EIC line of the tax form.

■

The EITC lifted about 6.2 million people out of

poverty, including about 3.2 million children

Workers who are married filing separately cannot claim the EITC.

SAMPLE EITC VALUES BY INCOME

Workers raising:

2016 Income

No Children

1 Child

2 Children

3 Or More Children

Not Married

Married

Not Married

Married

Not Married

Married

Not Married

Married

$1,000

$78

$78

$349

$349

$410

$410

$461

$461

$5,000

$384

$384

$1,709

$1,709

$2,010

$2,010

$2,261

$2,261

$10,000

$379

$509

$3,393

$3,393

$4,010

$4,010

$4,511

$4,511

$15,000

0

$423

$3,393

$3,393

$5,608

$5,608

$6,309

$6,309

$20,000

0

$41

$3,119

$3,393

$5,247

$5,608

$5,948

$6,309

$25,000

0

0

$2,320

$3,212

$4,194

$5,369

$4,895

$6,070

$30,000

0

0

$1,521

$2,413

$3,141

$4,316

$3,842

$5,017

$35,000

0

0

$722

$1,614

$2,088

$3,263

$2,789

$3,964

$40,000

0

0

0

$815

$1,035

$2,210

$1,736

$2,911

$45,000

0

0

0

$16

0

$1,157

$683

$1,858

$50,000

0

0

0

0

0

0

0

$805

This is not a tax table. This chart presents sample EITC benefits for different incomes. Do not use this table to complete income tax returns.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1