BOE-571-L (P4) REV. 21 (05-15)

OFFICIAL REQUEST

DO NOT RETURN THESE INSTRUCTIONS

California law prescribes a yearly ad valorem tax based on property as it exists at 12:01 a.m. on January 1 (tax lien date). This form

constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed,

possessed, controlled, or managed on the tax lien date, and that you sign (under penalty of perjury) and return the statement to the

Assessor’s Office by the date cited on the face of the form as required by law. Failure to file the statement during the time provided in

section 441 of the Revenue and Taxation Code will compel the Assessor to estimate the value of your property from other information in

the Assessor’s possession and add a penalty of 10 percent of the assessed value as required by section 463 of the Code.

If you own taxable personal property in any other county whose aggregate cost is $100,000 or more for any assessment year, you must

file a property statement with the Assessor of that county whether or not you are requested to do so. Any person not otherwise required

to file a statement shall do so upon request of the Assessor regardless of aggregate cost of property. The Assessor of the county will

supply you with a form upon request.

Except for the "DECLARATION BY ASSESSEE" section, you may furnish attachments in lieu of entering the

information on this property statement. However, such attachments must contain all the information requested by the

statement and these instructions. The attachments must be in a format acceptable to the Assessor, and the property statement must

contain appropriate references to the attachments and must be properly signed. In all instances, you must return the original

BOE-571-L.

THIS

THIS STATEMENT IS NOT

IF ANY SITUATION EXISTS WHICH

STATEMENT

A PUBLIC DOCUMENT. THE

NECESSITATES A DEVIATION FROM

IS SUBJECT

INFORMATION DECLARED WILL

TOTAL COST PER BOOKS AND RECORDS,

TO AUDIT.

BE HELD SECRET BY THE ASSESSOR.

FULLY EXPLAIN ALL ADJUSTMENTS.

INSTRUCTIONS

(complete the statement as follows)

NAME. If the information has been preprinted by the Assessor, make necessary corrections. INDIVIDUALS, enter the last name first, then

the first name and middle initial. PARTNERSHIPS must enter at least two names, showing last name, first name and middle initial for each

partner. CORPORATIONS report the full corporate name. If the business operates under a DBA (Doing Business As) or FICTITIOUS

NAME, enter the DBA (Fictitious) name under which you are operating in this county below the name of the sole owner, partnership, or

corporation.

LOCATION OF THE PROPERTY. Enter the complete street address. Forms for additional business or warehouse locations will be

furnished upon request. A listing may be attached to a single property statement for your vending equipment leased or rented to others,

when any such properties are situated at many locations within this county.

USE TAX INFORMATION

California use tax is imposed on consumers of tangible personal property that is used, consumed, given away or stored in this state.

Businesses must report and pay use tax on items purchased from out-of-state vendors not required to collect California tax on their

sales. If your business is not required to have a seller’s permit with the State Board of Equalization, the use tax may be reported and

paid on your California State Income Tax Return or directly to the State Board of Equalization using our pay use tax on one-time

purchase option available online. Obtain additional use tax information by calling the State Board of Equalization Information

Center at 1-800-400-7115 or from the website -

Part I: GENERAL INFORMATION

[complete items (a) through (g)]

OWNERSHIP OF LAND — (c). Check either the YES or the NO box to indicate whether you own the land at the LOCATION OF THE

PROPERTY shown on this statement. If YES is checked, verify the official RECORDED NAME on your DEED. If it agrees with the name

shown on this statement, check the second YES box. If it does not agree, check the second NO box.

LOCATION OF RECORDS — (e and f). Enter the address or addresses at which your general ledger and all related accounting records

are maintained and available for audit. If you enter your tax agent or representative’s address, indicate whether all or only part of the

records are at that address, and the location of the remainder, if applicable.

PROPERTY TRANSFER — (g).

Real Property – For purposes of reporting a change in control, real property includes land, structures, or fixtures owned or held under

lease from (1) a private owner if the remaining term of the lease exceeds 35 years, including written renewal options, (2) a public owner

(any arm or agency of local, state, or federal government) for any term or (3) mineral rights owned or held on lease for any term, whether

in production or not.

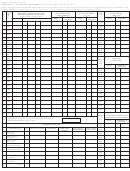

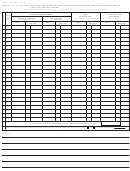

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9