NOTE TO TAXPAYERS & PREPARERS

IMPORTANT POLICY CHANGE: Since 2006, the Sonoma County Assessor’s Office

discontinued the practice of returning incomplete or inaccurate Business Property Statements.

This practice allowed taxpayers to amend their filing and thereby avoid the ten percent penalty.

Returning and tracking those statements has become time consuming and inefficient. Taxpayers

filing incomplete or inaccurate statements will be considered non-filers and will be assessed a ten

percent penalty. We encourage you to file complete, accurate statements.

Our office has developed the following checklist to help you review your property statement for

completeness and accuracy prior to sending it to us.

Is Part I (General Information) complete?

Did you report all machinery, equipment, furniture, fixtures and improvements (old and

new) that are being used in the business that is owned as well as equipment leased or

rented to/from others? Report equipment leased from others on Part III. If you have none

(zero) of the above to report, please indicate why.

“Same as last year” and “No Change” statements are not acceptable. Copy costs reported

on your last year’s property statement to this year’s.

Did you post cost data to the appropriate schedules?

Are your in-lieu schedules in the same format as our schedules?

Did you attach your computer-generated property statement to ours?

Do you have the proper signature on our form (not your computer-generated

form)? The property statement must be signed by one of the following:

a) The owner, if a sole proprietor;

b) A partner, if a partnership or Limited Liability Partnership (LLP);

c) A corporate officer (President, VP, Secretary, Treasurer), if a corporation;

d) A manager or member, if a Limited Liability Company (LLC);

e) CPA, a public accountant, an enrolled agent, or an attorney;

f) An employee of the company or agent, but ONLY IF a written authorization is

attached bearing the signature of an owner, partner, or LLC manager/member.

In the case of a corporation, the authorization has to be designated in writing

by the board of directors.

If you have any questions, please contact us at (707) 565-1330 or visit us at 585 Fiscal Dr., Rm

104, Santa Rosa, CA 95403.

1

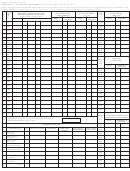

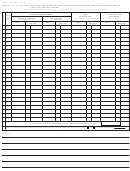

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9