BOE-571-L (P6) REV. 21 (05-15)

4.

VENDING EQUIPMENT. Report the model and description of the equipment; do not include in Schedule A.

5.

OTHER BUSINESSES. Report other businesses on your premises.

6.

GOVERNMENT-OWNED PROPERTY. If you possess or use government-owned land, improvements, or fixed

equipment, or government-owned property is located on your premises, report the name and address of the agency which

owns the property, and a description of the property.

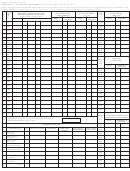

SCHEDULE A — COST DETAIL: EQUIPMENT

Do not include property already reported in Part III.

LINES 11-46. Enter in the appropriate column the cost of your equipment segregated by calendar year of acquisition, include short-lived

or expensed equipment. Total each column. Report full cost; do not deduct investment credits, trade-in allowances or depreciation. Include

equipment acquired through a lease-purchase agreement at the selling price effective at the inception of the lease and report the year

of the lease as the year of acquisition (if final payment has not been made, report such equipment in PART III). Report self-constructed

equipment used by you at the proper trade level in accordance with Title 18, section 10, of the California Code of Regulations. Exclude the

cost of normal maintenance and repair that does not extend the life nor modify the use of the equipment. Exclude the cost of equipment

actually removed from the site. The cost of equipment retired but not removed from the site must be reported. Segregate and report on

PART II, line 3, the cost of equipment out on lease or rent.

Include special mobile equipment (SE Plates). Exclude motor vehicles licensed for operation on the highways. However, you must

report overweight and oversized rubber-tired vehicles, except licensed commercial vehicles and cranes, which require permits

issued by the Department of Transportation to operate on the highways. If you have paid a license fee prior to January 1 on these large

vehicles, contact the Assessor for an Application for Deduction of Vehicle License Fees from Property Tax and file it with the Tax Collector.

Report overweight and oversized vehicles in Column 3.

Computers used in any application directly related to manufacturing, or used to control or monitor machinery or equipment, should

be reported in Column 1. Do not include application software costs in accordance with section 995.2 of the California Revenue and

Taxation Code. Personal Computers should be reported on Schedule A, column 5a; Local Area Network (LAN) equipment, including

LAN Components, and Mainframes should be reported on Schedule A, column 5b. Personal computers include the following: Desktops,

Docking Stations, Ink Jet Printers, Laptops, Laser Printers, Mini Towers, Monitors, Netbooks, Notebooks, PC Power Supply, Scanners,

Workstations. Local Area Network Equipment includes the following: External Storage Devices, Hubs, Mainframes, Network Attached

Storage Devices, Routers, Servers, Switches. LAN Components include, but are not limited to, the following: Network Disk & Tape Drives,

Network Fan Trays, Network Memory, Network Portable Storage Devices, Network Power Supply, Network Adaptors, Network Interface

Cards, Network Processors.

If necessary, asset titles in Schedule A may be changed to better fit your property holdings; however, the titles should be of such clarity

that the property is adequately defined.

LINES 18, 32, 33 and 45. For "prior" years acquisition, you must attach a separate schedule detailing the cost of such equipment by

year(s) of acquisition. Enter the total cost of all such acquisitions on lines 18, 32, 33 and 45.

LINE 35. Add totals on lines 19, Column 4; line 33, Column 5a; line 34, Columns 1, 2, 3; line 46, Column 5b; and any additional schedules.

Enter the same figure on PART II, line 2, that you entered in the box.

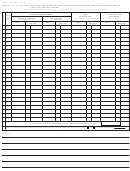

SCHEDULE B — COST DETAIL: BUILDINGS, BUILDING IMPROVEMENTS, AND/ OR LEASEHOLD

IMPROVEMENTS, LAND IMPROVEMENTS, LAND AND LAND DEVELOPMENT

LINES 47-71. Report by calendar year of acquisition the original or allocated costs (per your books and records) of buildings

and building or leasehold improvements; land improvements; land and land development owned by you at this location on

January 1. Include finance charges for buildings or improvements which have been constructed for an enterprise’s own use. If no

finance charges were incurred because funding was supplied by the owner, then indicate so in the remarks. In the appropriate

column enter costs, including cost of fully depreciated items, by the calendar year of acquisition and total each column. Do not include

items that are reported in Schedule A.

If you had any additions or disposals reported in Columns 1, 2, 3, or 4 during the period of January 1, 2015 through

December 31, 2015, attach a schedule showing the month and year and description of each addition and disposal. Enclosed

for this purpose is BOE-571-D, Supplemental Schedule for Reporting Monthly Acquisitions and Disposals of Property

Reported on Schedule B of the Business Property Statement. If additional forms are needed, photocopy the enclosed

BOE-571-D.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9