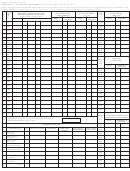

BOE-571-L (P7) REV. 21 (05-15)

Segregate the buildings and building or leasehold improvements into the two requested categories (items which have dual function will be

classified according to their primary function). Examples of some property items and their most common categorization are listed below:

EXAMPLES OF STRUCTURE ITEMS, Column 1

EXAMPLES OF FIXTURE ITEMS, Column 2

An improvement will be classified as a fixture if its use or purpose

An improvement will be classified as a structure when its

directly applies to or augments the process or function of a trade,

primary use or purpose is for housing or accommodation

industry, or profession.

of personnel, personalty, or fixtures and has no direct

application to the process or function of a trade, industry,

Air conditioning (process cooling)

or profession.

Boilers (manufacturing process)

Burglar alarm systems

Air conditioning (except process cooling)

Boilers (except manufacturing process)

Conveyors (to move materials and products)

Cranes — traveling

Central heating & cooling plants

Craneways

Environmental control devices (used in production process)

Fans & ducts (used for processing)

Elevators

Floors, raised computer rooms

Environmental control devices (if an integral part of the

Furnaces, process

structure)

Ice dispensers, coin operated

Fans & ducts (part of an air circulation system for the

building)

Machinery fdns. & pits (not part of normal flooring fdns.)

Permanent partitions (less than floor to ceiling)

Fire alarm systems

Partitions (floor to ceiling)

Pipelines, pipe supports, pumps used in the production process

Pits used as clarifiers, skimmers, sumps & for greasing in the trade

Pipelines, pipe supports & pumps used to operate the

or manufacturing process

facilities of a building

Plumbing — special purpose

Pits not used in the trade or process

Power wiring, switch gear & power panels used in mfg. process.

Railroad spurs

Refrigeration systems (not an integral part of the building)

Refrigeration systems (integral part of the building)

Refrigerators, walk-in unitized; including operating equipment

Refrigerators, walk-in (excluding operating equipment)

which are an integral part of the building

Restaurant equipment used in food & drink preparation or service

(plumbing fixtures, sinks, bars, soda fountains, booths & coun-

Restaurants — rough plumbing to fixtures

Safes — imbedded

ters, garbage disposals, dishwashers, hoods, etc.)

Scales including platform & pit

Signs which are an integral part of the building excluding

Signs — all sign cabinets (face) & free standing signs including

sign cabinet (face & lettering)

supports

Silos or tanks when primarily used for storage or

Silos or tanks when primarily used for processing

distribution

Sprinkler systems

Store fronts

Television & radio antenna towers

LINE 69. If you have items reportable in Schedule B which were acquired in 1992 or previously, you must attach a

separate schedule detailing the cost of such items by year(s) of acquisition. Enter the total cost of such items on line 69.

LINE 71. Add totals on line 70 and any additional schedules. Enter the same figure on PART II, line 4 that you entered in

the box.

LINE 72. Report tenant improvements for which you received allowances during this reporting period that are not reported on Schedule

B.

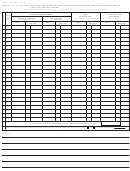

DECLARATION BY ASSESSEE

The law requires that this property statement, regardless of where it is executed, shall be declared to be true under penalty of perjury under

the laws of the State of California. The declaration must be signed by the assessee, a duly appointed fiduciary, or a person authorized to

sign on behalf of the assessee. In the case of a corporation, the declaration must be signed by an officer or by an employee or agent who

has been designated in writing by the board of directors, by name or by title, to sign the declaration on behalf of the corporation. In the

case of a partnership, the declaration must be signed by a partner or an authorized employee or agent. In the case of a Limited Liability

Company (LLC), the declaration must be signed by an LLC manager, or by a member where there is no manager, or by an employee or

agent designated by the LLC manager or by the members to sign on behalf of the LLC.

When signed by an employee or agent, other than a member of the bar, a certified public accountant, a public accountant, an enrolled

agent or a duly appointed fiduciary, the assessee’s written authorization of the employee or agent to sign the declaration on behalf of the

assessee must be filed with the Assessor. The Assessor may at any time require a person who signs a property statement and who is

required to have written authorization to provide proof of authorization.

A property statement that is not signed and executed in accordance with the foregoing instructions is not validly filed. The penalty imposed

by section 463 of the Revenue and Taxation Code for failure to file is applicable to unsigned property statements.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9