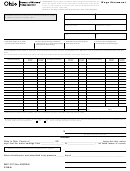

Sec Form 1a Regulation A Offering Statement Page 12

ADVERTISEMENT

interested, made in connection with the sale of such security.

2. Only commissions paid by the issuer in cash are to be indicated in the table. Commissions paid by

other persons or any form of non-cash compensation must be briefly identified in a footnote to the table with a

cross-reference to a more complete description elsewhere in the offering circular.

3. Before the commencement of sales pursuant to Regulation A, the issuer must inform the Commission

whether or not the amount of compensation to be allowed or paid to the underwriters, as described in the offer-

ing statement, has been cleared with FINRA.

4. If the securities are not to be offered for cash, state the basis upon which the offering is to be made.

5. Any fi nder’s fees or similar payments must be disclosed on the cover page with a reference to a more

complete discussion in the offering circular. Such disclosure must identify the fi nder, the nature of the services

rendered and the nature of any relationship between the fi nder and the issuer, its offi cers, directors, promoters,

principal stockholders and underwriters (including any affiliates of such persons).

6. The amount of the expenses of the offering borne by the issuer, including underwriting expenses to be

borne by the issuer, must be disclosed in a footnote to the table.

(f) The name of the underwriter or underwriters.

(g) Any legend or information required by the law of any state in which the securities are to be offered.

(h) A cross-reference to the risk factors section, including the page number where it appears in the offering cir-

cular. Highlight this cross-reference by prominent type or in another manner.

(i) Approximate date of commencement of proposed sale to the public.

(j) If the issuer intends to rely on Rule 253(b) and a preliminary offering circular is circulated, provide (1) a

bona fide estimate of the range of the maximum offering price and the maximum number of securities offered

or (2) a bona fide estimate of the principal amount of the debt securities offered. The range must not exceed $2

for offerings where the upper end of the range is $10 or less and 20% if the upper end of the price range is over

$10.

Instruction to Item 1(j):

The upper limit of the price range must be used in determining the aggregate offering price for purposes

of Rule 251(a).

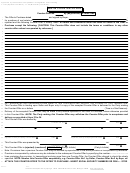

Item 2.

Table of Contents

On the page immediately following the cover page of the offering circular, provide a reasonably detailed table

of contents. It must show the page numbers of the various sections or subdivisions of the offering circular. In-

clude a specific listing of the risk factors section required by Item 3 of Part II of this Form 1-A.

Item 3.

Summary and Risk Factors

(a) An issuer may provide a summary of the information in the offering circular where the length or complexity

of the offering circular makes a summary useful. T he summary should be brief and must not contain all of the

12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29