Transfer On Death Agreement Form Page 2

Download a blank fillable Transfer On Death Agreement Form in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Transfer On Death Agreement Form with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

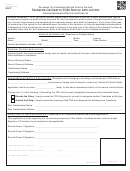

3. DISPOSITION OF DECEASED PRIMARY BENEFICIARY ASSETS (Please check one.)

If any beneficiary listed above is not living at the time of death of the account holder (or in the case of joint tenancy, the last surviving account holder) or

does not survive the (last surviving) account holder or tenant in common by 120 hours, that beneficiary's share shall pass:

to the remaining primary beneficiary(ies) pro rata (proportionate to the designated percentages)

to the contingent beneficiaries as listed below

(Please complete section 4; assets will be divided equally unless different percentages are indicated.)

to my estate and go through probate (This will be the default selection if no choice is indicated.)

4. CONTINGENT BENEFICIARY DESIGNATION (if applicable)

Contingent Beneficiary's Name

Date of Birth

Daytime Telephone Number

Designated Percentage

Address

Social Security or Tax ID Number

Relationship to Account Holder

City

State

ZIP

Name of Primary Beneficiary Received From

Country(ies) of Citizenship

Country of Legal Residence

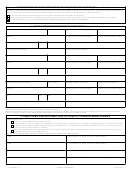

Contingent Beneficiary's Name

Date of Birth

Daytime Telephone Number

Designated Percentage

Address

Social Security or Tax ID Number

Relationship to Account Holder

City

State

ZIP

Name of Primary Beneficiary Received From

Country(ies) of Citizenship

Country of Legal Residence

Contingent Beneficiary's Name

Date of Birth

Daytime Telephone Number

Designated Percentage

Social Security or Tax ID Number

Relationship to Account Holder

Address

Name of Primary Beneficiary Received From

City

State

ZIP

Country(ies) of Citizenship

Country of Legal Residence

To list additional contingent beneficiaries, attach an additional Page 2.

Should all designated primary and contingent beneficiary(ies) disclaim the assets, predecease the account holder or not survive the (last surviving)

account holder by 120 hours, the assets will be distributed to the (last surviving) account holder's estate.

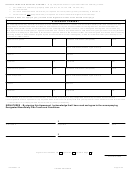

5. DIRECTIONS FOR DISTRIBUTIONS OF ASSETS TO MINOR BENEFICIARIES

Please check one:

A.

None of my designated beneficiaries are minors.

Please transfer any minor's assets to a custodial account at Scottrade, managed by the custodian(s) designated below. In each instance that

the assets pass to the designated custodian for the designated minor, the assets shall be transferred under the Uniform Transfer to Minor's

B.

Act of the account holder's state of residency.

I did not check 5B above and understand that a court-appointed guardian may be appointed to manage the minor's assets under on-going

C.

court supervision, which is acceptable to me.

If you have checked 5B, please list the custodian for each minor beneficiary.

Name

As Custodian For (Name of Minor Beneficiary)

Name

As Custodian For (Name of Minor Beneficiary)

Name

As Custodian For (Name of Minor Beneficiary)

Name

As Custodian For (Name of Minor Beneficiary)

SF1026/11-15

Page 2 of 4

PLEASE CONTINUE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4