Home Purchase Plan Worksheet Page 13

ADVERTISEMENT

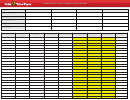

Use the following table to compare mortgage products:

Questions

Lender 1

Lender 2

Lender 3

Do they have any special first-time

buyer financing?

What is the interest rate I qualify for?

What is the total mortgage loan I qualify

for?

Mortgage term in years?

Type of mortgage: fixed, variable, etc.?

Amount I need to pay for points up front

versus if they are rolled into the

mortgage?

Amount of other fees and charges I

need to pay?

What, if any, prepayment penalties

apply?

What happens if I am late on a

mortgage payment?

Do they plan to sell my mortgage to

another entity after your loan closes?

Will I get a complete copy of all my

mortgage documents to review before

closing?

What if I have trouble keeping up with

my mortgage payments? Who do I call

and will they work with me to correct

the problem?

Connecticut Department of Labor

Page 13

5/28/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35