Hawaii Tax Form G45

ADVERTISEMENT

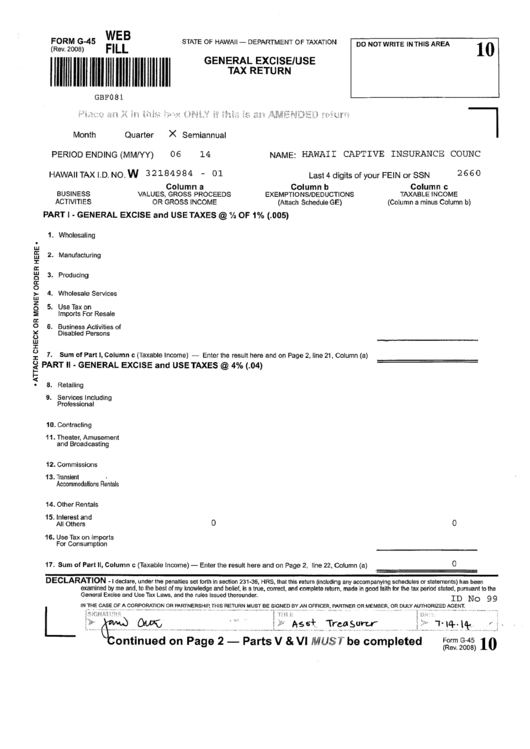

FORM G-45

WEB

STATE OF HAWAII

—

DEPARTMENT OF TAXATION

(Rev. 2008)

FILL

GENERAL EXCISE/USE

I 1 1 1 1 1 1 1 I I ~ l I 1 1 1 1 1 1 1 1 I I U II I I ~ HI ~ f ~

TAX

RETU RN

GBFO81

~

~

Month

Quarter

X

Semiannual

PERIOD ENDING (MM/YY)

06

14

NAME: HAWAII CAPTIVE INSURANCE COtJNC

HAWAIITAXI.D.NO.W 32184984

-

01

Last4digitsofyourFElNorSSN

2660

Column a

Column

b

Column c

BUSINESS

VALUES, GROSS PROCEEDS

EXEMPTIONS/DEDUCTIONS

TAXABLE INCOME

ACTIVITIES

OR GROSS INCOME

(Attach Schedule GE)

(Column a minus Column b)

PART I

-

GENERAL EXCISE and USE TAXES

@1/2

OF 1% (.005)

1. Wholesaling

LU

2. Manufacturing

3. Producing

Ix

0

>-

4. Wholesale Services

LU

5. UseTaxon

~

Imports For Resale

Ix

O

6. Business Activities of

Disabled Persons

LU

7.

Sum of Part I, Column c (Taxable Income)

—

Enter the result here and on Page 2, line 21, Column (a)

~ PART II

-

GENERAL EXCISE and USE TAXES @4% (.04)

•

8. Retailing

9. Services Including

Professional

10. Contracting

11. Theater, Amusement

and Broadcasting

12. Commissions

13. Transient

Accommodations F~entals

14. Other Rentals

15. Interest and

All Others

0

0

16. Use Tax on Imports

For Consumption

17. Sum of Part II, Column c (Taxable Income)

—

Enter the result here and on Page 2, line 22, Column (a)

0

DECLARATION

-

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been

examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made

in

good faith for the tax period stated, pursuant to the

General Excise and Use Tax Laws, and the rules issued thereunder.

ID No 9 9

IN

THE CA5E OF A CORPORATION OR PARTNERSHIP,

THIS

RETURN

MUST

BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

~

~rs*Tr~c*Suir-cr

j~~’

Thi4•ij.

-:

‘Continued on Page 2

—

Parts V & VI MUST’ be completed

~

10

I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4