Form Mt-15 - Mortgage Recording Tax Return Page 2

ADVERTISEMENT

Page 2 of 4 MT-15 (8/14)

New York State Department of Taxation and Finance

MT-15

Mortgage Recording Tax Return

(8/14)

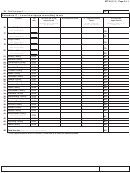

Prepare in duplicate. Please read the instructions on page 1 before completing this form.

Name of mortgagee

Amount of mortgage

Name of mortgagor

Mailing address of mortgagor

Date of mortgage

City

State

ZIP code

Schedule A - Basic and special additional mortgage recording taxes

Tax due

1

Amount of mortgage

...............................

(rounded to the nearest hundred dollars)

1.

2

Basic tax

......................................................................................................................

(multiply line 1 by .005)

2.

3

Special additional tax

.................................................................................................

(multiply line 1 by .0025)

3.

Schedule B - Additional mortgage recording tax

4

Mortgage amount after exclusion for mortgages on certain residential

real property

. If exemption does

(see instructions for exclusion criteria)

not apply, enter amount from line 1. .................................................................... 4.

5

Additional tax to be apportioned in MCTD

........................ 5.

(multiply line 4 by .0030)

MCTD counties imposing

Assessed value

6

Attach additional sheets if necessary

additional tax

Total of assessed value in MCTD counties

imposing additional tax ..........................................

6.

7

Additional tax to be apportioned outside MCTD

............... 7.

(multiply line 4 by .0025)

Counties imposing

Assessed value

8

Attach additional sheets if necessary

additional tax outside MCTD

Total of assessed value in counties outside MCTD

imposing additional tax ..........................................

8.

9

Counties suspending

Assessed value

Attach additional sheets if necessary

additional tax

Total assessed value in counties suspending

additional tax ..........................................................

9.

10

Total assessed value

................................................................ 10.

(add lines 6, 8, and 9)

.

*

11

Apportionment factor for MCTD counties

............................ 11.

(divide line 6 by line 10)

12

Additional mortgage recording tax apportioned to MCTD counties

(multiply line 5 by line 11 )

............................. 12.

.

*

13

Apportionment factor for counties outside MCTD

............... 13.

(divide line 8 by line 10)

14

Additional mortgage recording tax apportioned to counties outside MCTD

................ 14.

(multiply line 7 by line 13)

*

Carry apportionment factor on lines 11 and 13 to at least six decimal places.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4