Form Mt-15 - Mortgage Recording Tax Return Page 4

ADVERTISEMENT

Page 4 of 4 MT-15 (8/14)

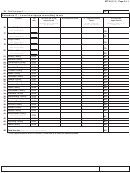

Rate tables –

Rate for each $100 and remaining major fraction thereof on principal debt secured by a mortgage

Table 1 – MCTD counties imposing the basic tax, special additional tax, and additional tax only ($1.05)

Dutchess

Nassau

Orange

Putnam

Suffolk

Table 2 – Counties outside the MCTD imposing the basic tax, special additional tax, and additional tax only ($1.00)

Allegany

Delaware

Fulton

Niagara

Ontario

Saratoga

Tompkins

Cayuga

Erie

Livingston

Orleans

Schuyler

Washington

Oneida

Clinton

Monroe

Oswego

Seneca

Franklin

Onondaga

Table 3 – Counties imposing the basic tax and special additional tax only ($ .75)

Chemung

Jefferson

Montgomery

St. Lawrence

Ulster

Chenango

Madison

Otsego

Tioga

Table 4 –

New York City counties of New York, Bronx, Kings, Queens, and Richmond imposing the basic tax, special

additional tax, additional tax, and New York City tax

New York

Special

City tax

Basic tax

additional tax

Additional tax

Total

– All mortgages securing less than $500,000 ....................... $1.00

$ .50

$ .25

$ .30

$2.05

– Mortgages of one-, two-, or three-family houses and

individual residential condominium units, securing

$500,000 or more .......................................................... $1.125

$ .50

$ .25

$ .30

$2.175

– All other mortgages securing $500,000 or more ............... $1.75

$ .50

$ .25

$ .30

$2.80

Other counties and cities imposing a local tax

Table 5 –

Taxing

Local Basic

Special

Additional

Total

Taxing

Local Basic

Special

Additional

Total

jurisdiction

tax

tax

additional

tax

tax

jurisdiction

tax

tax

additional

tax

tax

tax

tax

Albany County

$ .25

$ .50

$ .25

$ .25

$1.25

Rensselaer County

$ .25

$ .50

$ .25

$ .25

$1.25

Broome County

$ .25

$ .50

$ .25

$1.00

Rockland County

$ .25

$ .50

$ .25

$ .30

$1.30

Cattaraugus County $ .25

$ .50

$ .25

$ .25

$1.25

Schenectady County

$ .25

$ .50

$ .25

$ .25

$1.25

Chautauqua County $ .25

$ .50

$ .25

$ .25

$1.25

Schoharie County

$ .25

$ .50

$ .25

$1.00

Columbia County

$ .50

$ .50

$ .25

$1.25

Steuben County

$ .25

$ .50

$ .25

$ .25

$1.25

Cortland County

$ .25

$ .50

$ .25

$1.00

Sullivan County

$ .25

$ .50

$ .25

$1.00

Essex County

$ .25

$ .50

$ .25

$ .25

$1.25

Warren County

$ .25

$ .50

$ .25

$ .25

$1.25

Genesee County

$ .25

$ .50

$ .25

$ .25

$1.25

Wayne County

$ .25

$ .50

$ .25

$ .25

$1.25

Greene County

$ .50

$ .50

$ .25

$1.25

Westchester County $ .25

$ .50

$ .25

$ .30

$1.30

Hamilton County

$ .25

$ .50

$ .25

$1.00

Yonkers (city)

$ .50

$ .50

$ .25

$ .30

$1.80 *

Herkimer County

$ .25

$ .50

$ .25

$1.00

Wyoming County

$ .25

$ .50

$ .25

$ .25

$1.25

Lewis County

$ .25

$ .50

$ .25

$1.00

Yates County

$ .25

$ .50

$ .25

$1.00

*

Includes the $ .25 Westchester County local tax. See the note and example in the instructions for Schedule C, Column B, on page 1.

If you have any questions or require technical assistance with Form MT-15, please call (518) 457-8637.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4