Fafsa Worksheets A, B And C - Untaxable Income

ADVERTISEMENT

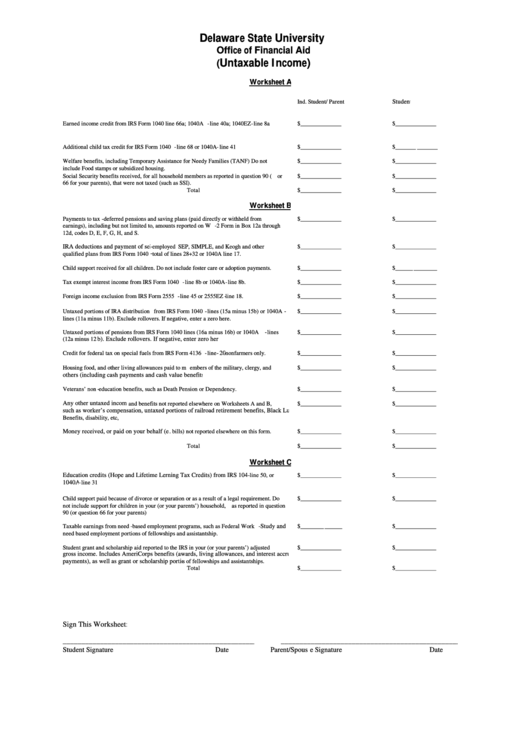

Delaware State University

Office of Financial Aid

Untaxable Income)

(

Worksheet A

Student

Ind. Student/ Parent

Earned income credit from IRS Form 1040 line 66a; 1040A-line 40a; 1040EZ-line 8a

$______________

$______________

Additional child tax credit for IRS Form 1040-line 68 or 1040A-line 41

$______________

$______________

Welfare benefits, inc luding Temporary Assistance for Needy Families (TANF) Do not

$______________

$______________

inc lude Food stamps or subsidized hous ing.

Social Security benefits received, for all household members as reported in question 90 (or

$______________

$______________

66 for your parents), that were not taxed (such as SSI).

Total

$______________

$______________

Worksheet B

-

Payments to tax

deferred pensions and saving plans (paid directly or withheld from

$______________

$______________

earnings), including but not limited to, amounts reported on W

-

2 Form in Box 12a through

12d, codes D, E, F, G, H, and S.

IRA deductions and payment of self-

employed SEP, SIMPLE, and Keogh and other

$______________

$______________

-

qualified plans from IRS Form 1040

tota l of lines 28+32 or 1040A line 17.

Child support received for all children. Do not include foster care or adoption payments.

$______________

$______________

Tax exempt interest income from IRS Form 1040-line 8b or 1040A-line 8b.

$______________

$______________

-

Foreign income exclus ion from IRS Form 2555-line 45 or 2555EZ

line 18.

$______________

$______________

-

Untaxed portions of IRA distribution from IRS Form 1040-lines (15a minus 15b) or 1040A

$______________

$______________

lines (11a minus 11b). Exclude rollovers. If negative, enter a zero here.

-

Untaxed portions of pensions from IRS Form 1040 lines (16a minus 16b) or 1040A

lines

$______________

$______________

(12a minus 12

b). Exclude rollovers. If negative, enter zero here.

Credit for federal tax on special fuels from IRS Form 4136

-

line

-20-

nonfarmers only.

$______________

$______________

Housing food, and other living a llowances paid to members of the military, clergy, and

$______________

$______________

others (including cash payments and cash value benefits.)

Veterans’ non

-

education benefits, such as Death Pension or Dependency.

$______________

$______________

Any other untaxed income

and benefits not reported elsewhere on Worksheets A and B,

$______________

$______________

such as worker’s compensation, untaxed portions of railroad retirement benefits, Black Lung

Benefits, disability, etc,

Money received, or paid on your behalf (e.g

. bills) not reported elsewhere on this form.

$______________

$______________

Total

$______________

$______________

Worksheet C

Education credits (Hope and Lifetime Learning Tax Credits) from IRS 1040-

line 50, or

$______________

$______________

1040A

-line 31

Child support paid because of divorce or separation or as a result of a legal requirement. Do

$______________

$______________

not include support for children in your (or your parents’) household, as reported in question

90 (or question 66 for your parents)

Taxable earnings from need

-

based employment programs, such as Federal Work

-Study and

$______________

$______________

need based employment portions of fellowships and assistantship.

Student grant and scholarship aid reported to the IRS in your (or your parents’) adjusted

$______________

$______________

gross income. Includes AmeriCorps benefits (awards, living allowances, and interest accrual

payments), as well as grant or scholarship portion

s of fellowships and assistantships.

Total

$______________

$______________

Sign This Worksheet:

____________________________________________________

________________________________________________

Student Signature

Date

Parent/Spouse Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1