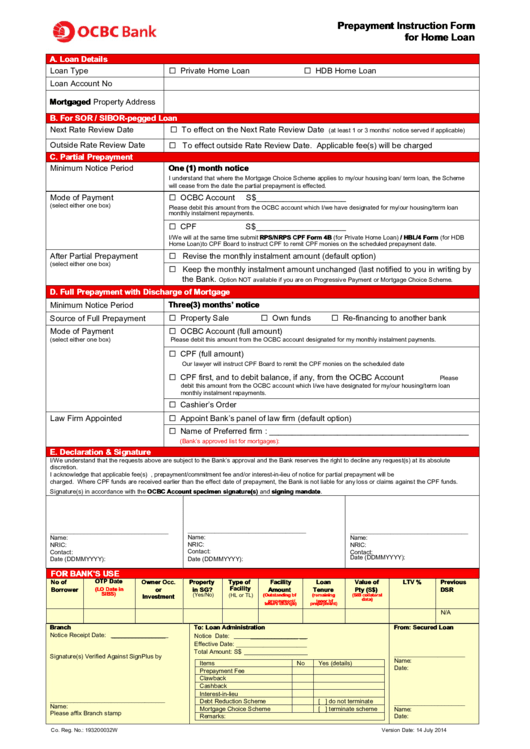

Prepayment Instruction Form For Home Loan

ADVERTISEMENT

Prepayment Instruction Form

for Home Loan

A. Loan Details

Private Home Loan

HDB Home Loan

Loan Type

Loan Account No

Mortgaged Property Address

B. For SOR / SIBOR-pegged Loan

To effect on the Next Rate Review Date

Next Rate Review Date

(at least 1 or 3 months’ notice served if applicable)

To effect outside Rate Review Date. Applicable fee(s) will be charged

Outside Rate Review Date

C. Partial Prepayment

Minimum Notice Period

One (1) month notice

I understand that where the Mortgage Choice Scheme applies to my/our housing loan/ term loan, the Scheme

will cease from the date the partial prepayment is effected.

OCBC Account

Mode of Payment

S$____________________

(select either one box)

Please debit this amount from the OCBC account which I/we have designated for my/our housing/term loan

monthly instalment repayments.

CPF

S$____________________

I/We will at the same time submit RPS/NRPS CPF Form 4B (for Private Home Loan) / HBL/4 Form (for HDB

Home Loan) to CPF Board to instruct CPF to remit CPF monies on the scheduled prepayment date.

Revise the monthly instalment amount (default option)

After Partial Prepayment

(select either one box)

Keep the monthly instalment amount unchanged (last notified to you in writing by

the Bank.

Option NOT available if you are on Progressive Payment or Mortgage Choice Scheme.

D. Full Prepayment with Discharge of Mortgage

Three(3) months’ notice

Minimum Notice Period

Property Sale

Own funds

Re-financing to another bank

Source of Full Prepayment

OCBC Account (full amount)

Mode of Payment

(select either one box)

Please debit this amount from the OCBC account designated for my monthly instalment payments.

CPF (full amount)

Our lawyer will instruct CPF Board to remit the CPF monies on the scheduled date

CPF first, and to debit balance, if any, from the OCBC Account

Please

debit this amount from the OCBC account which I/we have designated for my/our housing/term loan

monthly instalment repayments.

Cashier’s Order

Appoint Bank’s panel of law firm (default option)

Law Firm Appointed

Name of Preferred firm : ____________________________________________

(Bank’s approved list for mortgages):

E.

Declaration & Signature

I/We understand that the requests above are subject to the Bank’s approval and the Bank reserves the right to decline any request(s) at its absolute

discretion.

I acknowledge that applicable fee(s) e.g. administration fee, prepayment/commitment fee and/or interest-in-lieu of notice for partial prepayment will be

charged. Where CPF funds are received earlier than the effect date of prepayment, the Bank is not liable for any loss or claims against the CPF funds.

Signature(s) in accordance with the OCBC Account specimen signature(s) and signing mandate.

___________________________________

___________________________________

___________________________________

Name:

Name:

Name:

NRIC:

NRIC:

NRIC:

Contact:

Contact:

Contact:

Date (DDMMYYYY):

Date (DDMMYYYY):

Date (DDMMYYYY):

FOR BANK’S USE

No of

OTP Date

Owner Occ.

Property

Type of

Facility

Loan

Value of

LTV %

Previous

Borrower

(LO Date in

or

in SG?

Facility

Amount

Tenure

Pty (S$)

DSR

SIBS)

(Yes/No)

(HL or TL)

(Outstanding bf

(remaining

(SIB collateral

Investment

prepayment/

tenor bf

data)

tenure change)

prepayment)

N/A

Branch

To: Loan Administration

From: Secured Loan

Notice Receipt Date: ________________

Notice Date:

______________ __

Effective Date: _____________________

Total Amount: S$ _________

_______

_____________________

Signature(s) Verified Against SignPlus by

Name:

Items

No

Yes (details)

Date:

Prepayment Fee

Clawback

Cashback

Interest-in-lieu

__________________________________

Debt Reduction Scheme

[ ] do not terminate

_____________________

Name:

Mortgage Choice Scheme

[ ] terminate scheme

Name:

Please affix Branch stamp

Remarks:

Date:

Co. Reg. No.: 193200032W

Version Date: 14 July 2014

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1