Understanding Your 1099-R

ADVERTISEMENT

Understanding Your 1099-R

Understanding Your 1099-R

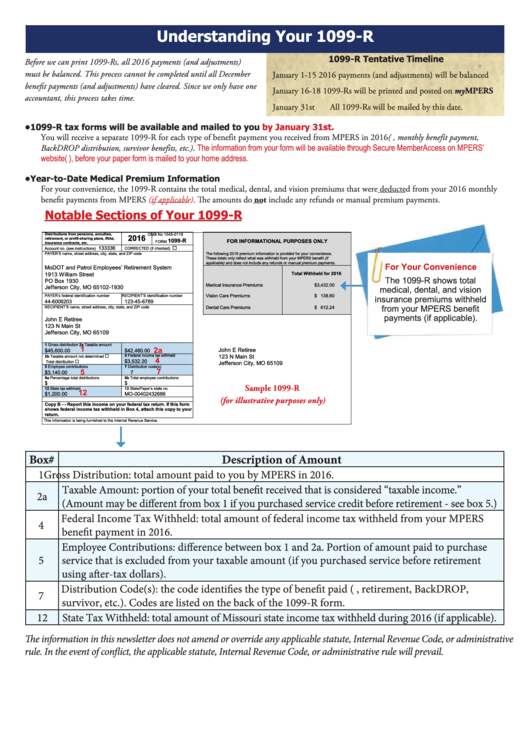

1099-R Tentative Timeline

Before we can print 1099-Rs, all 2016 payments (and adjustments)

must be balanced. This process cannot be completed until all December

January 1-15

2016 payments (and adjustments) will be balanced

1099-R Tentative Timeline

Before we can print 1099-Rs, all 2016 payments (and adjustments)

benefit payments (and adjustments) have cleared. Since we only have one

January 16-18 1099-Rs will be printed and posted on myMPERS

must be balanced. This process cannot be completed until all December

January 1-15

2016 payments (and adjustments) will be balanced

accountant, this process takes time.

January 31st

All 1099-Rs will be mailed by this date.

benefit payments (and adjustments) have cleared. Since we only have one

January 16-18 1099-Rs will be printed and posted on myMPERS

accountant, this process takes time.

•

1099-R tax forms will be available and mailed to you

by January 31st.

January 31st

All 1099-Rs will be mailed by this date.

You will receive a separate 1099-R for each type of benefit payment you received from MPERS in 2016 (e.g., monthly benefit payment,

The information from your form will be available through Secure Member Access on MPERS’

•

1099-R tax forms will be available and mailed to you

by January 31st.

BackDROP distribution, survivor benefits, etc.).

website ( ), before your paper form is mailed to your home address.

You will receive a separate 1099-R for each type of benefit payment you received from MPERS in 2016 (e.g., monthly benefit payment,

The information from your form will be available through Secure Member Access on MPERS’

BackDROP distribution, survivor benefits, etc.).

•

Year-to-Date Medical Premium Information

website ( ), before your paper form is mailed to your home address.

For your convenience, the 1099-R contains the total medical, dental, and vision premiums that were deducted from your 2016 monthly

•

Year-to-Date Medical Premium Information

benefit payments from MPERS

(if

applicable). The amounts do not include any refunds or manual premium payments.

For your convenience, the 1099-R contains the total medical, dental, and vision premiums that were deducted from your 2016 monthly

benefit payments from MPERS

(if

applicable). The amounts do not include any refunds or manual premium payments.

Notable Sections of Your 1099-R

Notable Sections of Your 1099-R

Distributions from pensions, annuities,

OMB No 1545-0119

2016

retirement, or profit-sharing plans, IRAs,

1099-R

FOR INFORMATIONAL PURPOSES ONLY

FORM

insurance contracts, etc.

133336

Account no. (see instructions)

CORRECTED (if checked)

PAYER’S name, street address, city, state, and ZIP code

The following 2016 premium information is provided for your convenience.

Distributions from pensions, annuities,

OMB No 1545-0119

2016

These totals only reflect what was withheld from your MPERS benefit (if

retirement, or profit-sharing plans, IRAs,

1099-R

FOR INFORMATIONAL PURPOSES ONLY

FORM

applicable) and does not include any refunds or manual premium payments.

insurance contracts, etc.

For Your Convenience

MoDOT and Patrol Employees’ Retirement System

133336

Account no. (see instructions)

CORRECTED (if checked)

1913 William Street

Total Withheld for 2016

PAYER’S name, street address, city, state, and ZIP code

The following 2016 premium information is provided for your convenience.

The 1099-R shows total

These totals only reflect what was withheld from your MPERS benefit (if

PO Box 1930

applicable) and does not include any refunds or manual premium payments.

Medical Insurance Premiums

$3,432.00

For Your Convenience

Jefferson City, MO 65102-1930

medical, dental, and vision

MoDOT and Patrol Employees’ Retirement System

1913 William Street

Total Withheld for 2016

Vision Care Premiums

$ 138.60

PAYER’s federal identification number

RECIPIENT’S identification number

insurance premiums withheld

The 1099-R shows total

44-6006203

123-45-6789

PO Box 1930

Medical Insurance Premiums

$3,432.00

from your MPERS benefit

Dental Care Premiums

$ 612.24

RECIPIENT’S name, street address, city, state, and ZIP code

Jefferson City, MO 65102-1930

medical, dental, and vision

payments (if applicable).

Vision Care Premiums

$ 138.60

PAYER’s federal identification number

RECIPIENT’S identification number

insurance premiums withheld

John E Retiree

44-6006203

123-45-6789

123 N Main St

from your MPERS benefit

RECIPIENT’S name, street address, city, state, and ZIP code

Dental Care Premiums

$ 612.24

Jefferson City, MO 65109

payments (if applicable).

John E Retiree

1 Gross distribution

2a Taxable amount

123 N Main St

1

2a

John E Retiree

$45,600.00

$42,460.00

Jefferson City, MO 65109

4 Federal income tax withheld

123 N Main St

2b Taxable amount not determined

4

$3,532.20

Total distribution

Jefferson City, MO 65109

1 Gross distribution

2a Taxable amount

5 Employee contributions

7 Distribution code(s)

1

2a

7

5

John E Retiree

$45,600.00

$42,460.00

$3,140.00

7

4 Federal income tax withheld

123 N Main St

9a Percentage total distributions

2b Taxable amount not determined

9b Total employee contributions

4

$3,532.20

$

$

Total distribution

Jefferson City, MO 65109

Sample 1099-R

5 Employee contributions

7 Distribution code(s)

12 State tax withheld

13 State/Payer’s state no.

12

7

5

$3,140.00

7

$1,200.00

MO-00402432686

(for illustrative purposes only)

9a Percentage total distributions

9b Total employee contributions

$

$

Copy B - - Report this income on your federal tax return. If this form

Sample 1099-R

shows federal income tax withheld in Box 4, attach this copy to your

12 State tax withheld

13 State/Payer’s state no.

12

return.

$1,200.00

MO-00402432686

(for illustrative purposes only)

This information is being furnished to the Internal Revenue Service.

Copy B - - Report this income on your federal tax return. If this form

shows federal income tax withheld in Box 4, attach this copy to your

return.

This information is being furnished to the Internal Revenue Service.

Box #

Description of Amount

Box#

Description of Amount

Distributions from pensions, annuities,

OMB No 1545-0119

Distributions from pensions, annuities,

OMB No 1545-0119

2015

2015

retirement, or profit-sharing plans, IRAs,

retirement, or profit-sharing plans, IRAs,

1

Gross Distributi

on: T

1099-R

1099-R

otal amount paid to you by MPERS in 2016

FORM

FORM

insurance contracts, etc.

insurance contracts, etc.

1

Gross Distribution: total amount paid to you by MPERS in 2016.

Box #

Description of Amount

133336

133336

CORRECTED (if checked)

CORRECTED (if checked)

Account no. (see instructions)

Account no. (see instructions)

Taxable Amount: Portion of your total benefit received that is considered “taxable income.” (Amount may be different from Box 1

PAYER’S name, street address, city, state, and ZIP code

PAYER’S name, street address, city, state, and ZIP code

Distributions from pensions, annuities,

OMB No 1545-0119

Distributions from pensions, annuities,

OMB No 1545-0119

2015

2015

2a

Taxable Amount: portion of your total benefit received that is considered “taxable income. ”

retirement, or profit-sharing plans, IRAs,

retirement, or profit-sharing plans, IRAs,

1

Gross Distributi

on: T

1099-R

1099-R

otal amount paid to you by MPERS in 2016

FORM

FORM

insurance contracts, etc.

if you purchased service credit before retirement - see Box 5.)

insurance contracts, etc.

2a

MoDOT and Patrol Employees’ Retirement System

MoDOT and Patrol Employees’ Retirement System

133336

133336

Account no. (see instructions)

CORRECTED (if checked)

Account no. (see instructions)

CORRECTED (if checked)

1913 William Street

(Amount may be different from box 1 if you purchased service credit before retirement - see box 5.)

1913 William Street

Taxable Amount: Portion of your total benefit received that is considered “taxable income.” (Amount may be different from Box 1

PAYER’S name, street address, city, state, and ZIP code

PAYER’S name, street address, city, state, and ZIP code

4

Federal Income Tax Withheld: Total amount of Federal income tax withheld from your MPERS benefit payment in 2016.

PO Box 1930

PO Box 1930

2a

Jefferson City, MO 65102-1930

Jefferson City, MO 65102-1930

if you purchased service credit before retirement - see Box 5.)

MoDOT and Patrol Employees’ Retirement System

MoDOT and Patrol Employees’ Retirement System

Federal Income Tax Withheld: total amount of federal income tax withheld from your MPERS

Employee Contributions: Difference between Box 1 and 2a. Portion of amount paid to purchase service that is excluded from

PAYER’s federal identification number

RECIPIENT’S identification number

PAYER’s federal identification number

RECIPIENT’S identification number

1913 William Street

1913 William Street

4

5

44-6006203

44-6006203

4

Federal Income Tax Withheld: Total amount of Federal income tax withheld from your MPERS benefit payment in 2016.

PO Box 1930

PO Box 1930

benefit payment in 2016.

your taxable amount (if you purchased service before retirement using after-tax dollars).

RECIPIENT’S name, street address, city, state, and ZIP code

RECIPIENT’S name, street address, city, state, and ZIP code

Jefferson City, MO 65102-1930

Jefferson City, MO 65102-1930

Name

Employee Contributions: Difference between Box 1 and 2a. Portion of amount paid to purchase service that is excluded from

PAYER’s federal identification number

RECIPIENT’S identification number

PAYER’s federal identification number

RECIPIENT’S identification number

Name

Distribution Code(s): The code identifies the type of benefit paid (e.g. retirement, BackDROP, survivor, etc). Codes are listed on

Employee Contributions: difference between box 1 and 2a. Portion of amount paid to purchase

5

Address

44-6006203

44-6006203

7

Address

your taxable amount (if you purchased service before retirement using after-tax dollars).

RECIPIENT’S name, street address, city, state, and ZIP code

Address

RECIPIENT’S name, street address, city, state, and ZIP code

the back of the 1099-R form.

Address

5

service that is excluded from your taxable amount (if you purchased service before retirement

Address

Name

Address

Name

Distribution Code(s): The code identifies the type of benefit paid (e.g. retirement, BackDROP, survivor, etc). Codes are listed on

12

State Tax Withheld: Total amount of Missouri State income tax withheld during 2016 (if applicable).

Address

7

1 Gross distribution

2a Taxable amount

1 Gross distribution

2a Taxable amount

Address

using after-tax dollars).

$

$

$

Address

$

the back of the 1099-R form.

Address

4 Federal income tax withheld

4 Federal income tax withheld

Address

2b Taxable amount not determined

2b Taxable amount not determined

Address

$

$

Total distribution

Total distribution

The information in this newsletter does not amend or overrule any applicable statute, Internal Revenue Code, or administrative rule.

Distribution Code(s): the code identifies the type of benefit paid (e.g., retirement, BackDROP,

12

State Tax Withheld: Total amount of Missouri State income tax withheld during 2016 (if applicable).

1 Gross distribution

2a Taxable amount

1 Gross distribution

2a Taxable amount

5 Employee contributions

7 Distribution code(s)

5 Employee contributions

7 Distribution code(s)

7

$

$

$

$

$

$

In the event of conflict, the applicable statute, Internal Revenue Code, or administrative rule will prevail.

survivor, etc.). Codes are listed on the back of the 1099-R form.

4 Federal income tax withheld

4 Federal income tax withheld

9a Percentage total distributions

2b Taxable amount not determined

9b Total employee contributions

9a Percentage total distributions

2b Taxable amount not determined

9b Total employee contributions

$

$

$

$

$

$

Total distribution

Total distribution

The information in this newsletter does not amend or overrule any applicable statute, Internal Revenue Code, or administrative rule.

12 State tax withheld

5 Employee contributions

13 State/Payer’s state no.

7 Distribution code(s)

12 State tax withheld

5 Employee contributions

13 State/Payer’s state no.

7 Distribution code(s)

12

State Tax Withheld: total amount of Missouri state income tax withheld during 2016 (if applicable).

$

$

MO-00402432686

$

$

MO-00402432686

In the event of conflict, the applicable statute, Internal Revenue Code, or administrative rule will prevail.

9a Percentage total distributions

9b Total employee contributions

9a Percentage total distributions

9b Total employee contributions

$

$

$

$

Copy C - - For Recipient’s Records (keep for your records). This

Copy 2 - - File this copy with your state, city, or local income tax

information is being furnished to the Internal Revenue Service.

return, when required.

12 State tax withheld

13 State/Payer’s state no.

12 State tax withheld

13 State/Payer’s state no.

The information in this newsletter does not amend or override any applicable statute, Internal Revenue Code, or administrative

$

MO-00402432686

$

MO-00402432686

Copy C - - For Recipient’s Records (keep for your records). This

Copy 2 - - File this copy with your state, city, or local income tax

rule. In the event of conflict, the applicable statute, Internal Revenue Code, or administrative rule will prevail.

information is being furnished to the Internal Revenue Service.

return, when required.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1