2017 Instructions for Form 592-V

Payment Voucher for Resident and Nonresident Withholding

General Information

names and words in CAPITAL LETTERS. To ensure timely and proper

application of the payment, verify that all of the information entered is

Use Form 592-V, Payment Voucher for Resident and Nonresident

complete.

Withholding, to remit withholding payments reported on Form 592,

Private Mail Box (PMB) – Include the PMB in the address field. Write

Resident and Nonresident Withholding Statement, to the Franchise

“PMB” first, then the box number. Example: 111 Main Street PMB 123.

Tax Board (FTB). Use the voucher below to remit payment by check

or money order only, whether Form 592 is submitted electronically or

Foreign Address – Follow the country’s practice for entering the city,

by mail. Payments may also be automatically withdrawn from a bank

county, province, state, country, and postal code, as applicable, in the

account via an electronic funds transfer (EFT). For more information,

appropriate boxes. Do not abbreviate the country name.

go to ftb.ca.gov and search for eft, or call 916.845.4025. If submitting

Check the appropriate box for Electronic or Paper, depending on how

payment via EFT, do not file Form 592-V.

Form 592 is submitted. Check only one box.

Use Form 592-V to remit backup withholding payments. Backup

Enter the total number of payees reported on Form 592.

withholding supersedes all types of withholding. For more information on

backup withholding, go to ftb.ca.gov and search for backup withholding.

Where to File

Do not use Form 592-V to remit payments when there is a balance due

Using black or blue ink, make the check or money order payable to

on Form 592-F, Foreign Partner or Member Annual Return. For more

the “Franchise Tax Board.” Write the withholding agent’s identification

information, get Form 592-F.

number and “2017 Form 592-V” on the check or money order.

When To Pay

Make all checks or money orders payable in U.S. dollars and drawn

against a U.S. financial institution.

Remit withholding payments by the dates shown below:

• If Form 592 is submitted by mail, detach the payment voucher from

1st payment . . . . . . . . . . . . . . . . . . . . . . April 18, 2017

the bottom of this page and enclose, but do not staple, Form 592 and

2nd payment . . . . . . . . . . . . . . . . . . . . . June 15, 2017

Form 592-V, along with payment, and mail to the address below.

3rd payment . . . . . . . . . . . . . . . . . September 15, 2017

• If Form 592 is submitted electronically, detach the payment voucher

4th payment . . . . . . . . . . . . . . . . . . . January 16, 2018

from the bottom of this page and enclose, but do not staple,

When the due date falls on a weekend or holiday, the deadline to file and

Form 592-V, along with payment, and mail to:

pay without penalty is extended to the next business day.

WITHHOLDING SERVICES AND COMPLIANCE

Due to the federal Emancipation Day holiday observed on April 17, 2017,

FRANCHISE TAX BOARD

tax returns filed and payments mailed or submitted on April 18, 2017,

PO BOX 942867

will be considered timely.

SACRAMENTO CA 94267-0651

The withholding agent must send Form 592-V with the payment of tax

Do not mail paper copies of Form 592 to the FTB if submitted

withheld, along with Form 592, to the FTB.

electronically.

The withholding agent retains a copy of this form for a minimum of

Instructions

five years and must provide it to the FTB upon request.

The withholding agent completes this form. The withholding agent is

Interest and Penalties

the person or entity that has the control, receipt, custody, disposal, or

payment of California source income of a person subject to withholding.

Interest and penalties will be assessed on late payments of withholding,

The information on Form 592-V should match the withholding agent

unless failure was due to reasonable cause. Interest is computed from

information that is submitted to the FTB on Form 592.

the due date of the withholding to the date paid. For more information

Using black or blue ink, enter the withholding agent’s business or

get FTB Pub. 1150, Withhold at Source Penalty Information.

individual name, address, taxpayer identification number, the amount

of payment, and telephone number in the designated spaces. Print all

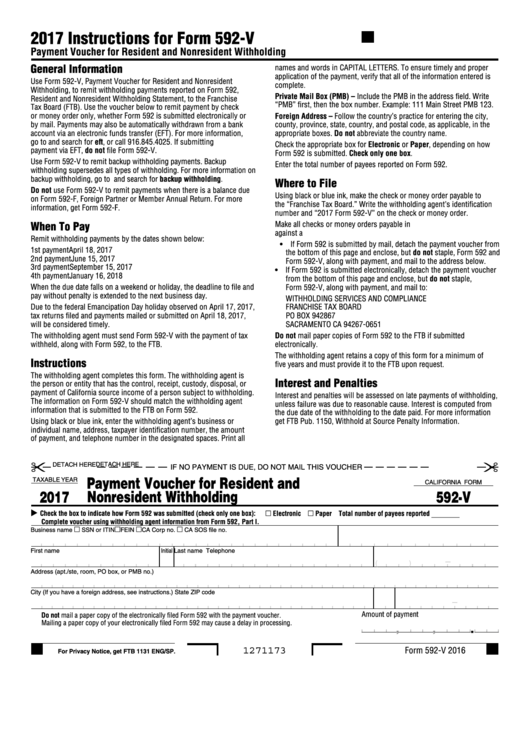

DETACH HERE

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS VOUCHER

Payment Voucher for Resident and

TAXABLE YEAR

CALIFORNIA FORM

2017

Nonresident Withholding

592-V

Check the box to indicate how Form 592 was submitted (check only one box):

Electronic Paper Total number of payees reported ________

Complete voucher using withholding agent information from Form 592, Part I.

Business name

SSN or ITIN

FEIN

CA Corp no.

CA SOS file no.

First name

Initial Last name

Telephone

(

)

Address (apt./ste, room, PO box, or PMB no.)

City (If you have a foreign address, see instructions.)

State

ZIP code

Amount of payment

Do not mail a paper copy of the electronically filed Form 592 with the payment voucher.

Mailing a paper copy of your electronically filed Form 592 may cause a delay in processing.

.

,

,

Form 592-V 2016

1271173

For Privacy Notice, get FTB 1131 ENG/SP.

1

1