2

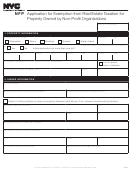

Form 4361 (Rev. 12-2002)

Page

Do not file Form 4361 if:

If your church assigns or designates you to

authorized to act for the organization stating

● You ever filed Form 2031, Revocation of

perform services for an organization that is

that the organization meets both of the above

neither a religious organization nor an integral

requirements.

Exemption From Self-Employment Tax for

agency of a religious organization, you are

Use by Ministers, Members of Religious

performing ministerial services even though

Orders, and Christian Science Practitioners;

Privacy Act and Paperwork Reduction Act

they may not involve conducting religious

or

Notice. The Privacy Act of 1974 and the

worship or ministering sacerdotal functions.

● You belong to a religious order and took a

Paperwork Reduction Act of 1980 require that

Your services are ordinarily not considered

when we ask you for information we must

vow of poverty. You are automatically exempt

assigned or designated by your church if any

first tell you our legal right to ask for the

from self-employment tax on earnings for

of the following is true.

information, why we are asking for it, and

services you perform for your church or its

● The organization for which you perform the

how it will be used. We must also tell you

agencies. No tax exemption applies to

services did not arrange with your church for

what could happen if we do not receive it and

earnings for services you perform for any

your services.

whether your response is voluntary, required

other organization.

● You perform the same services for the

to obtain a benefit, or mandatory under the

Additional information. See Pub. 517, Social

law.

organization as other employees not

Security and Other Information for Members

designated as you were.

Our authority to ask for information is

of the Clergy and Religious Workers.

● You perform the same services before and

Internal Revenue Code sections 6001, 6011,

When to file. File Form 4361 by the due date,

and 6012(a), which require you to file a return

after the designation.

including extensions, of your tax return for the

or statement with us for any tax for which

2nd tax year in which you had at least $400

Nonexempt earnings. Exemption from

you are liable. Your response is mandatory

of net earnings from self-employment, any of

self-employment tax does not apply to

under these sections. Section 6109 requires

which came from services performed as a

earnings from services that are not ministerial.

that you provide your social security number

minister, member of a religious order, or

Earnings from the following entities are not

on what you file. This is so we know who you

Christian Science practitioner.

exempt even if religious services are

are, and can process your return and other

Effective date of exemption. An exemption

conducted or sacerdotal functions are

papers. You must fill in all parts of the tax

from self-employment tax is effective for all

ministered: the United States; a state,

form that apply to you. If you fail to provide

tax years ending after 1967 in which you

territory, or possession of the United States;

all or part of the information requested on

have net self-employment earnings of $400 or

the District of Columbia; a foreign

Form 4361, your application may be denied.

more, if you receive any of it from ministerial

government; or a subdivision of any of these

You are not required to provide the

services. For example, if you had qualified net

bodies. For example, chaplains in the U.S.

information requested on a form that is

earnings of $400 or more in 2000 and not

Armed Forces are considered commissioned

subject to the Paperwork Reduction Act

again until 2002, a valid Form 4361 filed by

officers, not ministers. Similarly, chaplains in

unless the form displays a valid OMB control

April 15, 2003, would apply to 2000 and all

state prisons or universities are considered

number. Books or records relating to a form

later years. See Pub. 517 to find out if you

civil servants.

or its instructions must be retained as long as

are entitled to a refund of self-employment

Indicating exemption on Form 1040. If the

their contents may become material in the

tax paid in earlier years.

IRS returns your application marked

administration of any Internal Revenue law.

Where to file. Mail the original and two

“approved” and your only self-employment

Generally, tax returns and return

copies of this form to: Internal Revenue

income was from ministerial services, write

information are confidential, as stated in

Service, P.O. Box 245, Drop Point 8630,

“Exempt—Form 4361” on the

section 6103. However, section 6103 allows

Bensalem, PA 19020

self-employment tax line in the Other Taxes

or requires the Internal Revenue Service to

section of Form 1040. If you had other

Approval of application. Before your

disclose or give the information shown on

self-employment income, see Schedule SE

application can be approved, the IRS must

your tax return to others as described in the

(Form 1040).

verify that you are aware of the grounds for

Code. For example, we may disclose your tax

exemption and that you want the exemption

Specific Instructions

information to the Department of Justice to

on that basis. When your completed Form

enforce the tax laws, both civil and criminal,

4361 is received, the IRS will mail you a

Line 3. Enter the date you were ordained,

to cities, states, the District of Columbia, and

statement that describes the grounds for

commissioned, or licensed as a minister of a

U.S. commonwealths or possessions. We

receiving an exemption under section 1402(e).

church; became a member of a religious

may also disclose this information to other

You must certify that you have read the

order; or began practice as a Christian

countries under a tax treaty, or to Federal and

statement and seek exemption on the

Science practitioner. Do not file Form 4361

state agencies to enforce Federal nontax

grounds listed on the statement. The

before this date. Attach a copy of the

criminal laws and to combat terrorism.

certification must be made by signing a copy

certificate (or, if you did not receive one, a

Please keep this notice with your records. It

of the statement under penalties of perjury

letter from the governing body of your church)

may help you if we ask you for other

and mailing it to the IRS not later than 90

that establishes your status as an ordained,

information. If you have any questions about

days after the date the statement was mailed

commissioned, or licensed minister; a

the rules for filing and giving information,

to you. If it is not mailed by that time, your

member of a religious order; or a Christian

please call or visit any Internal Revenue

exemption will not be effective until the date

Science practitioner.

Service office.

the signed copy is received by the IRS.

Line 4. If you are a minister or belong to a

The time needed to complete and file this

If your application is approved, a copy of

religious order, enter the legal name, address,

form will vary depending on individual

Form 4361 will be returned to you marked

and employer identification number of the

circumstances. The estimated average time

“approved.” Keep this copy of Form 4361 for

denomination that ordained, commissioned,

is: Recordkeeping, 6 min.; Learning about

your permanent records. Once the exemption

or licensed you, or the order to which you

the law or the form, 19 min.; Preparing the

is approved, you cannot revoke it.

belong. Get the employer identification

form, 16 min.; Copying, assembling, and

Exempt earnings. Only earnings from

number from your church or order.

sending the form to the IRS, 16 min.

ministerial services are exempt from

You must be able to show that the body

If you have comments concerning the

self-employment tax.

that ordained, commissioned, or licensed you,

accuracy of these time estimates or

Conducting religious worship services or

or your religious order, is exempt from

suggestions for making this form simpler, we

ministering sacerdotal functions are ministerial

Federal income tax under section 501(a) as a

would be happy to hear from you. You can

services whether or not performed for a

religious organization described in section

write to the Tax Forms Committee, Western

religious organization.

501(c)(3). You must also be able to show that

Area Distribution Center, Rancho Cordova,

the body is a church (or convention or

Ministerial services also include those

CA 95743-0001. Do not send the form to this

association of churches) described in section

performed under the authority of a church or

address. Instead, see Where to file on this

170(b)(1)(A)(i). To assist the IRS in processing

church denomination. Examples are

page.

your application, you can attach a copy of the

controlling, conducting, and maintaining

exemption letter issued to the organization by

religious organizations, including religious

the IRS. If that is not available, you can

boards, societies, and other agencies integral

attach a letter signed by an individual

to these organizations.

1

1 2

2