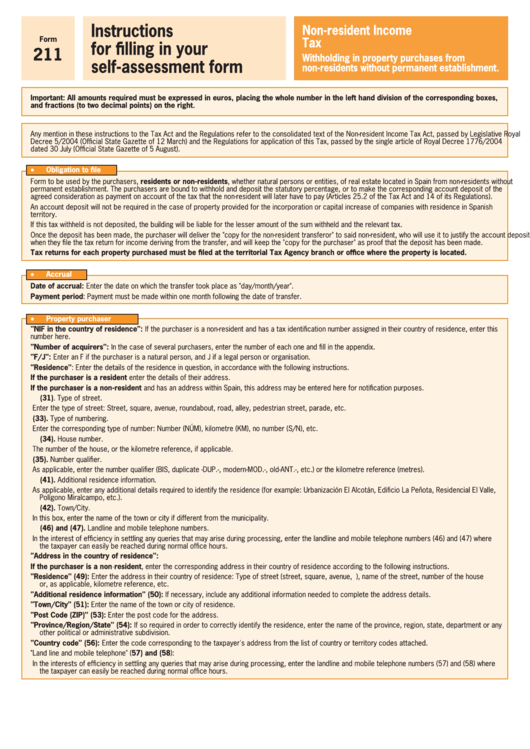

Form 211 Instructions For Filling In Your Self-Assessment Form

ADVERTISEMENT

Instructions

Non-resident Income

Form

Tax

for filling in your

211

Withholding in property purchases from

self-assessment form

non-residents without permanent establishment.

Important: All amounts required must be expressed in euros, placing the whole number in the left hand division of the corresponding boxes,

and fractions (to two decimal points) on the right.

Any mention in these instructions to the Tax Act and the Regulations refer to the consolidated text of the Non-resident Income Tax Act, passed by Legislative Royal

Decree 5/2004 (Official State Gazette of 12 March) and the Regulations for application of this Tax, passed by the single article of Royal Decree 1776/2004

dated 30 July (Official State Gazette of 5 August).

Obligation to file

l

Form to be used by the purchasers, residents or non-residents, whether natural persons or entities, of real estate located in Spain from non-residents without

permanent establishment. The purchasers are bound to withhold and deposit the statutory percentage, or to make the corresponding account deposit of the

agreed consideration as payment on account of the tax that the non-resident will later have to pay (Articles 25.2 of the Tax Act and 14 of its Regulations).

An account deposit will not be required in the case of property provided for the incorporation or capital increase of companies with residence in Spanish

territory.

If this tax withheld is not deposited, the building will be liable for the lesser amount of the sum withheld and the relevant tax.

Once the deposit has been made, the purchaser will deliver the "copy for the non-resident transferor" to said non-resident, who will use it to justify the account deposit

when they file the tax return for income deriving from the transfer, and will keep the "copy for the purchaser" as proof that the deposit has been made.

Tax returns for each property purchased must be filed at the territorial Tax Agency branch or office where the property is located.

Accrual

l

Date of accrual: Enter the date on which the transfer took place as "day/month/year".

Payment period: Payment must be made within one month following the date of transfer.

Property purchaser

l

"NIF in the country of residence": If the purchaser is a non-resident and has a tax identification number assigned in their country of residence, enter this

number here.

"Number of acquirers": In the case of several purchasers, enter the number of each one and fill in the appendix.

"F/J": Enter an F if the purchaser is a natural person, and J if a legal person or organisation.

"Residence": Enter the details of the residence in question, in accordance with the following instructions.

If the purchaser is a resident enter the details of their address.

If the purchaser is a non-resident and has an address within Spain, this address may be entered here for notification purposes.

(31). Type of street.

Enter the type of street: Street, square, avenue, roundabout, road, alley, pedestrian street, parade, etc.

(33). Type of numbering.

Enter the corresponding type of number: Number (NÚM), kilometre (KM), no number (S/N), etc.

(34). House number.

The number of the house, or the kilometre reference, if applicable.

(35). Number qualifier.

As applicable, enter the number qualifier (BIS, duplicate -DUP.-, modern-MOD.-, old-ANT.-, etc.) or the kilometre reference (metres).

(41). Additional residence information.

As applicable, enter any additional details required to identify the residence (for example: Urbanización El Alcotán, Edificio La Peñota, Residencial El Valle,

Polígono Miralcampo, etc.).

(42). Town/City.

In this box, enter the name of the town or city if different from the municipality.

(46) and (47). Landline and mobile telephone numbers.

In the interest of efficiency in settling any queries that may arise during processing, enter the landline and mobile telephone numbers (46) and (47) where

the taxpayer can easily be reached during normal office hours.

"Address in the country of residence":

If the purchaser is a non-resident, enter the corresponding address in their country of residence according to the following instructions.

"Residence" (49): Enter the address in their country of residence: Type of street (street, square, avenue, road...), name of the street, number of the house

or, as applicable, kilometre reference, etc.

"Additional residence information" (50): If necessary, include any additional information needed to complete the address details.

"Town/City" (51): Enter the name of the town or city of residence.

"Post Code (ZIP)" (53): Enter the post code for the address.

"Province/Region/State" (54): If so required in order to correctly identify the residence, enter the name of the province, region, state, department or any

other political or administrative subdivision.

"Country code" (56): Enter the code corresponding to the taxpayer's address from the list of country or territory codes attached.

"Land line and mobile telephone" (57) and (58):

In the interests of efficiency in settling any queries that may arise during processing, enter the landline and mobile telephone numbers (57) and (58) where

the taxpayer can easily be reached during normal office hours.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3