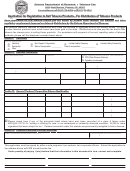

BOE-400-LT (S4) REV. 2 (1-11)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

CALIFORNIA CIGARETTE AND TOBACCO PRODUCTS LICENSING ACT OF 2003

APPLICATION AND CERTIFICATION FOR

MANUFACTURER/IMPORTER LICENSE PRIVACY NOTICE

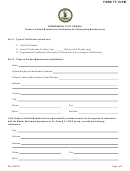

Information Provided to the State Board of Equalization

We ask you for information so that we can administer the California Cigarette and Tobacco Products Licensing Act

of 2003 under Division 8.6 (commencing with section 22970) of the California Business and Professions Code. The

information will be used to determine if you meet the requirements to obtain and maintain a Manufacturer/Importer

Tobacco Products license to manufacture or import tobacco products. You must provide all the information we

request.

What happens if I don't provide the information?

If your application is incomplete, we will not issue your license. Penalties may also apply if you do not provide other

information we request or that is required by law, or if you give us fraudulent information. In some cases, you may be

subject to criminal prosecution.

Can anyone else see my information?

Your information is covered by state laws that protect your privacy. However, we may share information regarding

your account with certain government agencies.

We may release to the public the information printed on your license, your license status, and names of business

owners or partners.

With your written permission, we can release information regarding your account to anyone you designate.

We may disclose information to the proper officials of the following agencies, among others:

Upon request, the BOE must provide to the State Department of Health Services, the office of the Attorney General,

a law enforcement agency, and any agency authorized to enforce local tobacco control ordinances, access to the

BOE's database of licenses issued to manufacturers or importers for locations within the jurisdiction of that agency

or law enforcement agency.

Can I review my records?

Yes. Please contact the Compliance Branch in Special Taxes and Fees by calling the telephone number or writing to

the address listed below. If you need additional information, you may contact our Disclosure Officer in Sacramento

by calling 916-445-2918. You may also want to obtain publication 58-A, How to Inspect and Correct Your Records.

You may download the publication from our website at or you may request a copy from our

Taxpayer Information Section at 800-400-7115 (TTY: 711).

Who is responsible for maintaining my records?

You may contact the Deputy Director of Special Taxes and Fees at the address or telephone number listed below.

Deputy Director

Property and Special Taxes Department

PO Box 942879

Sacramento, CA 94279-0063

800-400-7115 (TTY: 711)

1

1 2

2 3

3 4

4 5

5 6

6 7

7