Texas Application For Exemption

Download a blank fillable Texas Application For Exemption in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Texas Application For Exemption with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

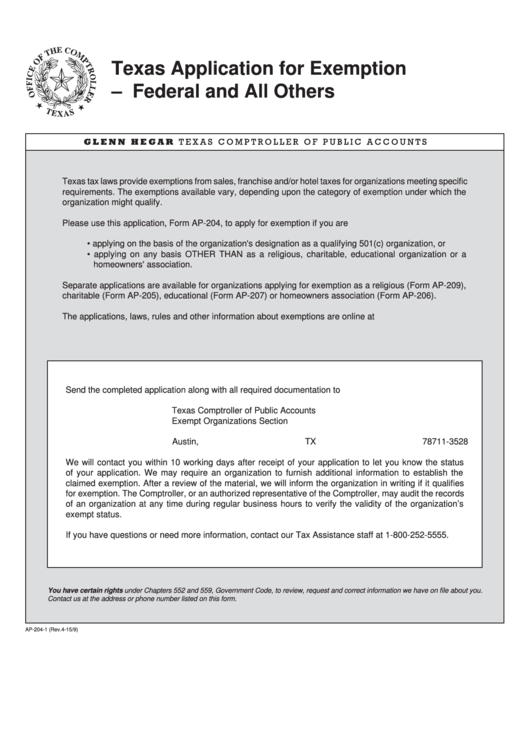

Texas Application for Exemption

– Federal and All Others

G L E N N H E G A R

T E X A S C O M P T R O L L E R O F P U B L I C A C C O U N T S

Texas tax laws provide exemptions from sales, franchise and/or hotel taxes for organizations meeting specific

requirements. The exemptions available vary, depending upon the category of exemption under which the

organization might qualify.

Please use this application, Form AP-204, to apply for exemption if you are

• applying on the basis of the organization's designation as a qualifying 501(c) organization, or

• applying on any basis OTHER THAN as a religious, charitable, educational organization or a

homeowners' association.

Separate applications are available for organizations applying for exemption as a religious (Form AP-209),

charitable (Form AP-205), educational (Form AP-207) or homeowners association (Form AP-206).

The applications, laws, rules and other information about exemptions are online at

Send the completed application along with all required documentation to

Texas Comptroller of Public Accounts

Exempt Organizations Section

P.O. Box 13528

Austin, TX 78711-3528

We will contact you within 10 working days after receipt of your application to let you know the status

of your application. We may require an organization to furnish additional information to establish the

claimed exemption. After a review of the material, we will inform the organization in writing if it qualifies

for exemption. The Comptroller, or an authorized representative of the Comptroller, may audit the records

of an organization at any time during regular business hours to verify the validity of the organization’s

exempt status.

If you have questions or need more information, contact our Tax Assistance staff at 1-800-252-5555.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you.

Contact us at the address or phone number listed on this form.

AP-204-1 (Rev.4-15/9)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2