16 1 1

59

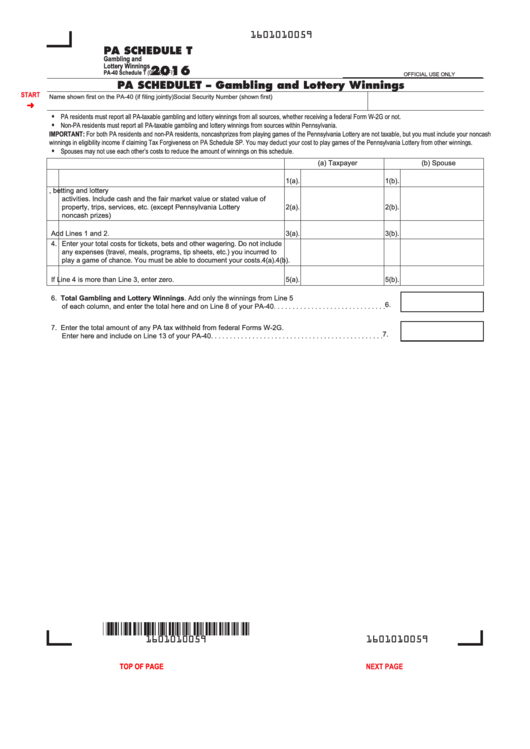

Gambling and

PA SCHEDULE T

Lottery Winnings

PA-40 Schedule T (08-16) (FI)

2016

OFFICIAL USE ONLY

PA SCHEDULE T – Gambling and Lottery Winnings

Name shown first on the PA-40 (if filing jointly)

Social Security Number (shown first)

START

•

PA residents must report all PA-taxable gambling and lottery winnings from all sources, whether receiving a federal Form W-2G or not.

•

Non-PA residents must report all PA-taxable gambling and lottery winnings from sources within Pennsylvania.

IMPORTANT: For both PA residents and non-PA residents, noncash prizes from playing games of the Pennsylvania Lottery are not taxable, but you must include your noncash

winnings in eligibility income if claiming Tax Forgiveness on PA Schedule SP. You may deduct your cost to play games of the Pennsylvania Lottery from other winnings.

•

Spouses may not use each other’s costs to reduce the amount of winnings on this schedule.

(a) Taxpayer

(b) Spouse

1. Enter your total winnings from all federal Forms W-2G.

1(a).

1(b).

2. Enter your total winnings from all other gambling, betting and lottery

activities. Include cash and the fair market value or stated value of

property, trips, services, etc. (except Pennsylvania Lottery

2(a).

2(b).

noncash prizes)

3. Total Winnings.

Add Lines 1 and 2.

3(a).

3(b).

4. Enter your total costs for tickets, bets and other wagering. Do not include

any expenses (travel, meals, programs, tip sheets, etc.) you incurred to

play a game of chance. You must be able to document your costs.

4(a).

4(b).

5. Gambling and lottery winnings. Subtract Line 4 from Line 3.

If Line 4 is more than Line 3, enter zero.

5(a).

5(b).

6. Total Gambling and Lottery Winnings. Add only the winnings from Line 5

of each column, and enter the total here and on Line 8 of your PA-40. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Enter the total amount of any PA tax withheld from federal Forms W-2G.

Enter here and include on Line 13 of your PA-40. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

1601010059

16 1 1

59

Reset Entire Form

TOP OF PAGE

NEXT PAGE

PRINT

1

1 2

2 3

3 4

4