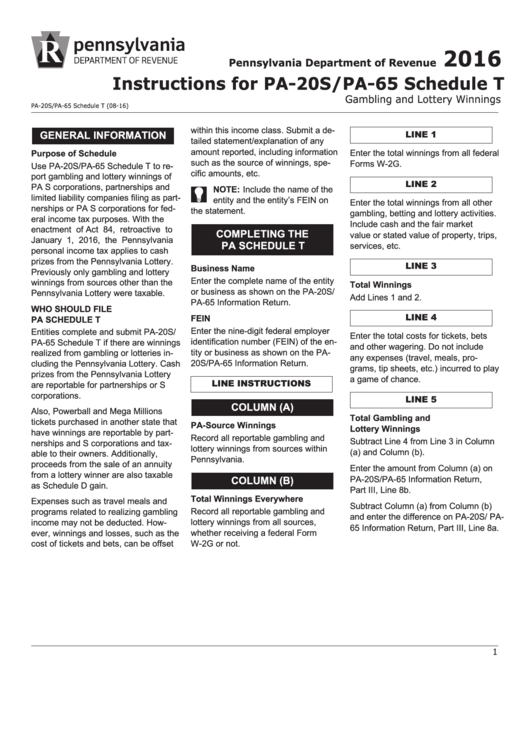

Instructions For Pa-20s/pa-65 Schedule T - Gambling And Lottery Winnings - 2016

ADVERTISEMENT

2016

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule T

Gambling and Lottery Winnings

PA-20S/PA-65 Schedule T (08-16)

within this income class. Submit a de-

GENERAL INFORMATION

LINE 1

tailed statement/explanation of any

amount reported, including information

Enter the total winnings from all federal

Purpose of Schedule

such as the source of winnings, spe-

Forms W-2G.

Use PA-20S/PA-65 Schedule T to re-

cific amounts, etc.

port gambling and lottery winnings of

LINE 2

PA S corporations, partnerships and

NOTE: Include the name of the

limited liability companies filing as part-

entity and the entity’s FEIN on

Enter the total winnings from all other

nerships or PA S corporations for fed-

the statement.

gambling, betting and lottery activities.

eral income tax purposes. With the

Include cash and the fair market

enactment of Act 84, retroactive to

COMPLETING THE

value or stated value of property, trips,

January 1, 2016, the Pennsylvania

PA SCHEDULE T

services, etc.

personal income tax applies to cash

prizes from the Pennsylvania Lottery.

LINE 3

Business Name

Previously only gambling and lottery

Enter the complete name of the entity

winnings from sources other than the

Total Winnings

or business as shown on the PA-20S/

Pennsylvania Lottery were taxable.

Add Lines 1 and 2.

PA-65 Information Return.

WHO SHOULD FILE

FEIN

LINE 4

PA SCHEDULE T

Enter the nine-digit federal employer

Entities complete and submit PA-20S/

Enter the total costs for tickets, bets

identification number (FEIN) of the en-

PA-65 Schedule T if there are winnings

and other wagering. Do not include

tity or business as shown on the PA-

realized from gambling or lotteries in-

any expenses (travel, meals, pro-

20S/PA-65 Information Return.

cluding the Pennsylvania Lottery. Cash

grams, tip sheets, etc.) incurred to play

prizes from the Pennsylvania Lottery

a game of chance.

are reportable for partnerships or S

LINE INSTRUCTIONS

corporations.

LINE 5

COLUMN (A)

Also, Powerball and Mega Millions

Total Gambling and

tickets purchased in another state that

PA-Source Winnings

Lottery Winnings

have winnings are reportable by part-

Record all reportable gambling and

Subtract Line 4 from Line 3 in Column

nerships and S corporations and tax-

lottery winnings from sources within

(a) and Column (b).

able to their owners. Additionally,

Pennsylvania.

proceeds from the sale of an annuity

Enter the amount from Column (a) on

from a lottery winner are also taxable

COLUMN (B)

PA-20S/PA-65 Information Return,

as Schedule D gain.

Part III, Line 8b.

Total Winnings Everywhere

Expenses such as travel meals and

Subtract Column (a) from Column (b)

Record all reportable gambling and

programs related to realizing gambling

and enter the difference on PA-20S/ PA-

lottery winnings from all sources,

income may not be deducted. How-

65 Information Return, Part III, Line 8a.

ever, winnings and losses, such as the

whether receiving a federal Form

cost of tickets and bets, can be offset

W-2G or not.

www revenue pa gov

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1