2014 Instructions For Form M-1040ez - City Of Muskegon Page 2

ADVERTISEMENT

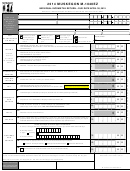

2014 MUSKEGON M-1040EZ

INDIVIDUAL INCOME TAX RETURN – DUE DATE APRIL 30, 2015

REFER TO INSTRUCTIONS ON BACK TO SEE WHO CAN USE THIS FORM

YOUR FIRST NAME AND MIDDLE INITIAL

LAST NAME

YOUR SOCIAL SECURITY NUMBER

USE THE

MUSKEGON

IF JOINT, SPOUSE'S FIRST NAME AND MIDDLE INITIAL

LAST NAME

YOUR SPOUSE'S SOCIAL SECURITY NUMBER

MAILING

LABEL

HOME ADDRESS (NUMBER AND STREET OR RURAL ROUTE)

YOUR PHONE NUMBER

OTHERWISE

PLEASE

PRINT

CITY, TOWN, OR POST OFFICE

STATE

ZIP CODE

RESIDENCY STATUS

MARRIED FILING SEPARATELY

SEE

Check box if this is

Check box if your

Check box if you

SPOUSE'S NAME

RESIDENT

INSTRUCTIONS

the first time you

address has

do not need a

filed a Muskegon

changed since last

return form mailed

SSN

ON BACK

NON-RESIDENT

return.

year .

to you next year.

1.

Total wages, salaries, and tips. (See instructions on back.)

RESIDENTS: Total from Box 1 of all your W-2 forms.

1.

0

0

NON-RESIDENTS: Total from Box 1 of the W-2 forms for work done in the City of Muskegon. Attach

,

.

your W-2 form(s).

INCOME

2.

Interest income. (See instructions on back.)

2.

RESIDENTS: Report all taxable interest income.

0

0

ATTACH

,

.

NON-RESIDENTS: Leave blank.

COPY 2

3.

Dividend income. (See instructions on back.)

OF YOUR

3.

0

0

RESIDENTS: Report all dividend income.

W-2 FORM(S)

,

.

NON-RESIDENTS: Leave blank.

HERE

4.

0

4.

Add lines 1, 2 and 3. This is your total Muskegon income.

0

0

,

.

5.

EXEMPTION

Enter amount from Exemptions Worksheet on back; or if SINGLE enter $600.00; or if

5.

0

0

MARRIED filing jointly enter $1,200.00.

AMOUNT

,

.

6.

TAXABLE

0

6.

Subtract line 5 from line 4. This is your taxable income.

0

0

INCOME

,

.

7.

RESIDENTS: Multiply line 6 by one percent (.01).

0

7.

0

0

TAX

This form is for non-residents

NON-RESIDENTS: Multiply line 6 by one-half of one percent (.005).

,

.

8.

Total Muskegon tax withheld by employers (attach W-2 forms showing Muskegon withheld)

8.

0

0

,

.

9.

PAYMENTS

9.

Payments on 2014 Declaration of Muskegon Estimated Income Tax.

0

0

AND

,

.

CREDITS

10.

Credit for income tax paid to another Michigan city (RESIDENTS ONLY).

10.

0

0

(Attach copy of other city's return.) USE CITY CREDIT WORKSHEET.

,

.

11.

0

11.

0

0

Add lines 8. 9 and 10 and enter here.

TOTAL

,

.

12.

If line 7 is larger than line 11, subtract line 11 from line 7. This is the amount you owe. Please attach your

12.

payment. Make check payable to: City of Muskegon. If payment due is greater than $100.00, you may be

0

0

TAX DUE

,

.

assessed additional penalties and interest if you were required to pay estimated taxes.

13.

Please see sample on the back page of the M-1040TC

a.

If line 11 is larger than line 7, subtract line 7 from line 11. This is your refund. Allow at least 45 days.

b.

Routing number:

c.

Type:

Checking

Savings

REFUNDS

13.

0

0

d.

,

.

Account number:

AND

CREDITS

14.

Please check the appropriate box to donate your refund. Choose only one program.

14.

0

0

Lakeshore Trail Improvements

Muskegon Recreational Center

Downtown Main Street

,

.

15.

Check this box to credit this refund to the 2015 estimated tax liability.

15.

0

0

,

.

For City of Muskegon use.

I have read this return. Under the penalties of perjury, I declare that to the best of my knowledge and belief the return

Please do not write in box.

is true, correct and accurately lists all amounts and sources of Muskegon income I received during the tax year.

Mail return to: Income Tax Department, P.O. Box 29, Muskegon, MI 49443-0029.

YOUR SIGNATURE

DATE

SPOUSE'S SIGNATURE (IF JOINT RETURN)

DATE

PLEASE SIGN HERE

KEEP A COPY OF THIS

FOR YOUR RECORDS.

Machine Certification

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3