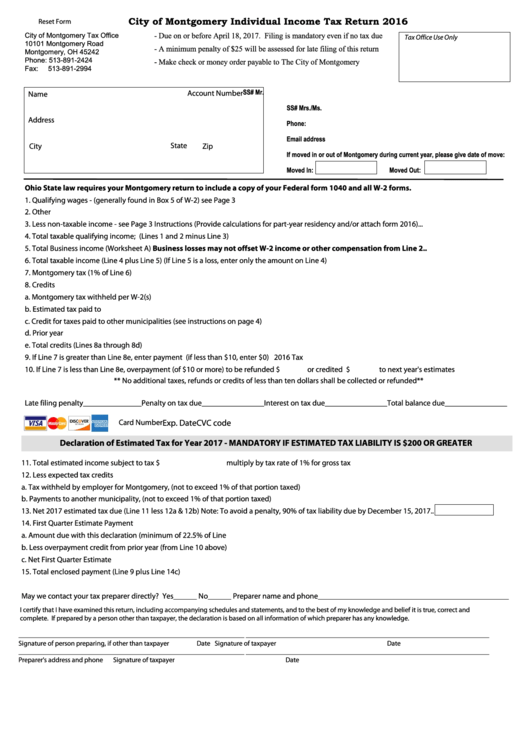

City of Montgomery Individual Income Tax Return 2016

Reset Form

City of Montgomery Tax Office

- Due on or before April 18, 2017. Filing is mandatory even if no tax due

Tax Office Use Only

10101 Montgomery Road

- A minimum penalty of $25 will be assessed for late filing of this return

Montgomery, OH 45242

Phone: 513-891-2424

- Make check or money order payable to The City of Montgomery

Fax:

513-891-2994

SS# Mr.

Account Number

Name

SS# Mrs./Ms.

Address

Phone:

Email address

State

City

Zip

If moved in or out of Montgomery during current year, please give date of move:

Moved In:

Moved Out:

Ohio State law requires your Montgomery return to include a copy of your Federal form 1040 and all W-2 forms.

1. Qualifying wages - (generally found in Box 5 of W-2) see Page 3 instructions............................................................................................

2. Other Income.......................................................................................................................................................................................................................

3. Less non-taxable income - see Page 3 Instructions (Provide calculations for part-year residency and/or attach form 2016)...

4. Total taxable qualifying income; (Lines 1 and 2 minus Line 3).........................................................................................................................

5. Total Business income (Worksheet A) Business losses may not offset W-2 income or other compensation from Line 2..

6. Total taxable income (Line 4 plus Line 5) (If Line 5 is a loss, enter only the amount on Line 4).............................................................

7. Montgomery tax (1% of Line 6).....................................................................................................................................................................................

8. Credits

a. Montgomery tax withheld per W-2(s).....................................................................................................

b. Estimated tax paid to Montgomery........................................................................................................

c. Credit for taxes paid to other municipalities (see instructions on page 4)................................

d. Prior year overpayment................................................................................................................................

e. Total credits (Lines 8a through 8d)...........................................................................................................................................................

9. If Line 7 is greater than Line 8e, enter payment (if less than $10, enter $0)

2016 Tax Due...........................

10. If Line 7 is less than Line 8e, overpayment (of $10 or more) to be refunded $

or credited $

to next year's estimates

** No additional taxes, refunds or credits of less than ten dollars shall be collected or refunded**

Late filing penalty_______________Penalty on tax due________________Interest on tax due________________Total balance due________________

CVC code

Card Number

Exp. Date

Declaration of Estimated Tax for Year 2017 - MANDATORY IF ESTIMATED TAX LIABILITY IS $200 OR GREATER

11. Total estimated income subject to tax $

multiply by tax rate of 1% for gross tax of..............................................

12. Less expected tax credits

a. Tax withheld by employer for Montgomery, (not to exceed 1% of that portion taxed)........................

b. Payments to another municipality, (not to exceed 1% of that portion taxed)..........................................

13. Net 2017 estimated tax due (Line 11 less 12a & 12b) Note: To avoid a penalty, 90% of tax liability due by December 15, 2017..

14. First Quarter Estimate Payment

a. Amount due with this declaration (minimum of 22.5% of Line 13................................................................

b. Less overpayment credit from prior year (from Line 10 above)......................................................................

c. Net First Quarter Estimate payment..................................................................................................................................................................

15. Total enclosed payment (Line 9 plus Line 14c)..............................................................................................................................................................

May we contact your tax preparer directly? Yes______ No______ Preparer name and phone_________________________________________________

I certify that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct and

complete. If prepared by a person other than taxpayer, the declaration is based on all information of which preparer has any knowledge.

________________________________________________________________

_____________________________________________________________________

Signature of person preparing, if other than taxpayer

Date

Signature of taxpayer

Date

________________________________________________________________

_____________________________________________________________________

Preparer's address and phone

Signature of taxpayer

Date

1

1 2

2 3

3 4

4