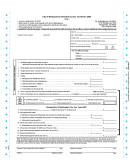

City of Montgomery Individual Income Tax Return 2016 Page 3

Montgomery Individual Income Tax Return: General Information

Notice: The State of Ohio made significant changes to the Ohio Municipal Income Tax laws (Chapter 718 of the Ohio

Revised Code) effective January 1, 2016. Please read below to learn how these changes may impact you.

Any person under 18 years of age who has not previously filed a return and has no earned income. Any permanently disabled or retired

EXEMPTIONS TO

person with only non-taxable sources of income; and who has previously filed a return establishing their status with the City’s tax office

MANDATORY FILING

and who will continue to have no earned income.

Make checks or money orders payable to the City of Montgomery. The Tax Office accepts VISA, Mastercard, Discover and American

PAYMENTS

Express cards with no processing charge. If the balance due with your return is $10.00 or less, payment need not accompany your

return.

Taxpayers who have requested a 6-month extension for filing their federal income tax return shall automatically receive a 6-month

extension for the filing of their city tax return. Taxpayers who have not requested a 6-month extension for their federal income tax return

EXTENSIONS

may be granted a 6-month extension by submitting a request to the Tax Administrator by the due date of the return. An extension of time

to file is not an extension to pay tax due. Penalty and interest charges will apply to all payments received after the return due date. A

copy of your Federal extension form must be attached to your return when filed.

Employee business expenses reported on Federal Form 2106 are deductible only from W-2 wage income that is taxable to Montgomery.

FORM 2106

If wages are allocated between cities, Form 2106 expenses should likewise be allocated, and tax credit reduced accordingly. Please

EXPENSES

attach a copy of the 2106 form to your return.

Taxpayers who anticipate a net tax liability of $200.00 or more are required under Ohio law to remit estimated tax payments. Quarterly

ESTIMATED TAX

estimated tax payments are due on April 15, June 15, September 15 and December 15.

A minimum of 90% of tax liability must be received by the December 15 due date.

REFUNDS AND

Refunds are allowed only when city income tax has been paid to or withheld for Montgomery. Note: There is a three (3) year statute of

CREDITS

limitations for claiming a refund or credit of any overpayment of city tax. Overpayments of $10.00 or less will not be refunded.

All income or loss from self-employment, rentals, partnerships, fees, ordinary gains and losses reported on

Form 4797, and any other business activity must be netted together to arrive at an overall net profit or loss

for the current year. If the netting results in an overall loss, the loss may be carried forward for a period not to exceed five (5) years.

LOSS CALCULATION

Please note: The methodology for computing overall net profit or loss has changed effective January 1, 2016 as a

result of changes made to Chapter 718 of the Ohio Revised Code. Please refer to the worksheets and instructions

for calculation details.

Effective beginning the 2016 tax year:

Late filing penalty will be imposed for the failure to timely file a return (regardless of liability shown) at the rate of $25.00 per month or

PENALTY AND

fraction thereof, up to a maximum of $150.00.

INTEREST

Penalty will be imposed on all tax remaining unpaid after becoming due. The penalty rate is 15% of the amount not timely paid.

Interest will be imposed on all tax remaining unpaid after becoming due. The rate is adjusted annually based on the federal short-term

rate plus 5%.

Ohio State law requires that your Montgomery return include a copy of your Federal 1040 form and all W-2 forms. Please attach a

ATTACHMENTS

supporting document to verify each income, loss or deduction item reported on your city return. Examples include Federal Schedules C,

E, F, K-1 and/or 1099-Misc.

Definitions and instructions are illustrative only. The City of Montgomery Income Tax Ordinance and the Ohio

DISCLAIMER

Revised Code supersede any interpretation presented.

Instructions for Individual Income Tax Returns

(For complete line-by-line instructions in more detail, visit our website at and click on Tax Forms)

This form is to be used by individuals who receive income reported on Federal Forms W-2, W-2G, Form 5754, 1099-MISC, or

Federal Schedules C, E, F or K-1. Individuals who file as Sole Proprietors of Single Member LLCs should also use this form.

LINE 1:

List total of qualifying wages from all W-2 forms. Qualifying wages generally include amounts reported in the Medicare wage base

(Box 5 of W-2); however, there are exceptions. Qualifying wages include, but are not limited to: Deferred Compensation i.e.

401(k) and 457(b), Deferred annuity plans and stock options.

**Interest, dividends, pension/retirement, alimony received, active military pay and allowances, unemployment and

workers compensation and Social Security income are not taxable. Capital gains are not taxable unless considered

ordinary income.**

LINE 2:

Other taxable income: - Includes, but is not limited to, Federal 1040, Line 21 income, gambling and prize

winnings, director’s fees, taxable HSA withdrawals and scholarship distributions.

.

LINE 3:

Less non-taxable income: Deductible expenses: Allowable only on W-2 wages taxable to Montgomery. Attach Federal Form

2106 for unreimbursed employee business expenses included in qualifying wages (Line 1). Moving expense deduction may not

be used unless reimbursement is included in qualifying wages (Line 1). Attach Federal Form 3903.

Part-year residents: Income may be pro-rated for residents who move into or out of Montgomery during the current year. It is also

necessary to adjust any credit claimed for other city tax withheld or paid.

LINE 5:

Total Business income: To calculate total taxable business income from Schedules C, E, F; Form 4797 and K-1, please complete

Worksheet A. Enter the total from Column D, Line 7 of the worksheet. See example on the following page.

1

1 2

2 3

3 4

4