Ucf-22 Financial Disclosure Form

ADVERTISEMENT

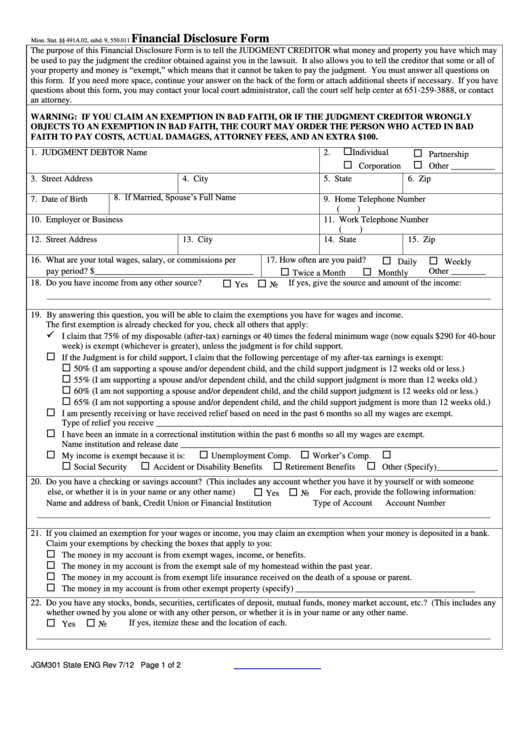

Financial Disclosure Form

Minn. Stat. §§ 491A.02, subd. 9, 550.011

The purpose of this Financial Disclosure Form is to tell the JUDGMENT CREDITOR what money and property you have which may

be used to pay the judgment the creditor obtained against you in the lawsuit. It also allows you to tell the creditor that some or all of

your property and money is “exempt,” which means that it cannot be taken to pay the judgment. You must answer all questions on

this form. If you need more space, continue your answer on the back of the form or attach additional sheets if necessary. If you have

questions about this form, you may contact your local court administrator, call the court self help center at 651-259-3888, or contact

an attorney.

WARNING: IF YOU CLAIM AN EXEMPTION IN BAD FAITH, OR IF THE JUDGMENT CREDITOR WRONGLY

OBJECTS TO AN EXEMPTION IN BAD FAITH, THE COURT MAY ORDER THE PERSON WHO ACTED IN BAD

FAITH TO PAY COSTS, ACTUAL DAMAGES, ATTORNEY FEES, AND AN EXTRA $100.

1. JUDGMENT DEBTOR Name

2.

Individual

Partnership

Corporation

Other __________

3. Street Address

4. City

5. State

6. Zip

8. If Married, Spouse’s Full Name

7. Date of Birth

9. Home Telephone Number

(

)

10. Employer or Business

11. Work Telephone Number

(

)

12. Street Address

13. City

14. State

15. Zip

16. What are your total wages, salary, or commissions per

17. How often are you paid?

Daily

Weekly

pay period? $____________________________________

Other ________

Twice a Month

Monthly

18. Do you have income from any other source?

If yes, give the source and amount of the income:

Yes

No

19. By answering this question, you will be able to claim the exemptions you have for wages and income.

The first exemption is already checked for you, check all others that apply:

I claim that 75% of my disposable (after-tax) earnings or 40 times the federal minimum wage (now equals $290 for 40-hour

week) is exempt (whichever is greater), unless the judgment is for child support.

If the Judgment is for child support, I claim that the following percentage of my after-tax earnings is exempt:

50% (I am supporting a spouse and/or dependent child, and the child support judgment is 12 weeks old or less.)

55% (I am supporting a spouse and/or dependent child, and the child support judgment is more than 12 weeks old.)

60% (I am not supporting a spouse and/or dependent child, and the child support judgment is 12 weeks old or less.)

65% (I am not supporting a spouse and/or dependent child, and the child support judgment is more than 12 weeks old.)

I am presently receiving or have received relief based on need in the past 6 months so all my wages are exempt.

Type of relief you receive _______________________________________________________________________________

I have been an inmate in a correctional institution within the past 6 months so all my wages are exempt.

Name institution and release date _________________________________________________________________________

Worker’s Comp.

My income is exempt because it is:

Unemployment Comp.

V.A. Benefits

Social Security

Accident or Disability Benefits

Retirement Benefits

Other (Specify)______________

20. Do you have a checking or savings account? (This includes any account whether you have it by yourself or with someone

else, or whether it is in your name or any other name)

For each, provide the following information:

Yes

No

Name and address of bank, Credit Union or Financial Institution

Type of Account

Account Number

21. If you claimed an exemption for your wages or income, you may claim an exemption when your money is deposited in a bank.

Claim your exemptions by checking the boxes that apply to you:

The money in my account is from exempt wages, income, or benefits.

The money in my account is from the exempt sale of my homestead within the past year.

The money in my account is from exempt life insurance received on the death of a spouse or parent.

The money in my account is from other exempt property (specify) _________________________________________

22. Do you have any stocks, bonds, securities, certificates of deposit, mutual funds, money market account, etc.? (This includes any

whether owned by you alone or with any other person, or whether it is in your name or any other name.

If yes, itemize these and the location of each.

Yes

No

JGM301

State

ENG

Rev 7/12

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2