4-H Financial Peer Review Form - Wsu Extension

ADVERTISEMENT

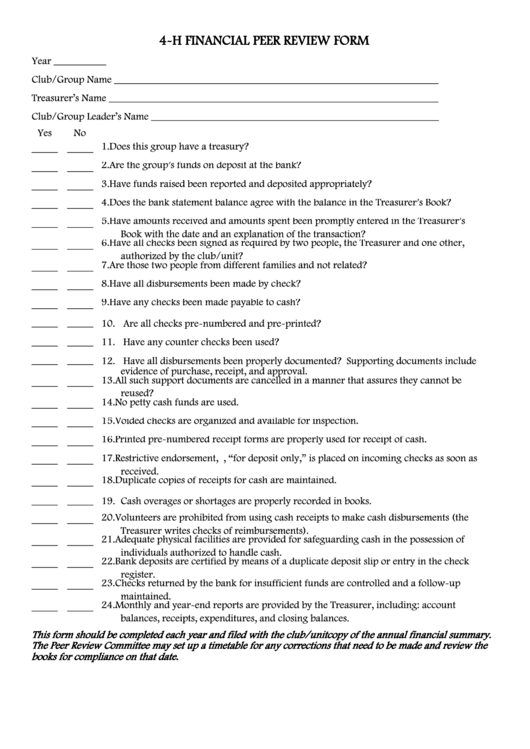

4-H FINANCIAL PEER REVIEW FORM

Year __________

Club/Group Name ______________________________________________________________

Treasurer’s Name _______________________________________________________________

Club/Group Leader’s Name _______________________________________________________

Yes

No

_____ _____ 1.

Does this group have a treasury?

_____ _____ 2.

Are the group’s funds on deposit at the bank?

_____ _____ 3.

Have funds raised been reported and deposited appropriately?

_____ _____ 4.

Does the bank statement balance agree with the balance in the Treasurer’s Book?

_____ _____ 5.

Have amounts received and amounts spent been promptly entered in the Treasurer’s

Book with the date and an explanation of the transaction?

_____ _____ 6.

Have all checks been signed as required by two people, the Treasurer and one other,

authorized by the club/unit?

_____ _____ 7.

Are those two people from different families and not related?

_____ _____ 8.

Have all disbursements been made by check?

_____ _____ 9.

Have any checks been made payable to cash?

_____ _____ 10. Are all checks pre-numbered and pre-printed?

_____ _____ 11. Have any counter checks been used?

_____ _____ 12. Have all disbursements been properly documented? Supporting documents include

evidence of purchase, receipt, and approval.

_____ _____ 13. All such support documents are cancelled in a manner that assures they cannot be

reused?

_____ _____ 14. No petty cash funds are used.

_____ _____ 15. Voided checks are organized and available for inspection.

_____ _____ 16. Printed pre-numbered receipt forms are properly used for receipt of cash.

_____ _____ 17. Restrictive endorsement, i.e., “for deposit only,” is placed on incoming checks as soon as

received.

_____ _____ 18. Duplicate copies of receipts for cash are maintained.

_____ _____ 19. Cash overages or shortages are properly recorded in books.

_____ _____ 20. Volunteers are prohibited from using cash receipts to make cash disbursements (the

Treasurer writes checks of reimbursements).

_____ _____ 21. Adequate physical facilities are provided for safeguarding cash in the possession of

individuals authorized to handle cash.

_____ _____ 22. Bank deposits are certified by means of a duplicate deposit slip or entry in the check

register.

_____ _____ 23. Checks returned by the bank for insufficient funds are controlled and a follow-up

maintained.

_____ _____ 24. Monthly and year-end reports are provided by the Treasurer, including: account

balances, receipts, expenditures, and closing balances.

This form should be completed each year and filed with the club/unit copy of the annual financial summary.

The Peer Review Committee may set up a timetable for any corrections that need to be made and review the

books for compliance on that date.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2