Form 13614-C - Intake/interview & Quality Review Sheet, Form W-2 - Wage And Tax Statement Etc. Page 2

ADVERTISEMENT

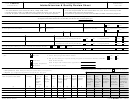

13614-C

Department of the Treasury - Internal Revenue Service

Form

OMB Number

Intake/Interview & Quality Review Sheet

1545-1964

(October 2014)

You will need:

• Please complete pages 1-3 of this form.

• Tax Information such as Forms W-2, 1099, 1098.

• You are responsible for the information on your return. Please provide

• Social security cards or ITIN letters for all persons on your tax return.

complete and accurate information.

• Picture ID (such as valid driver's license) for you and your spouse.

• If you have questions, please ask the IRS certified volunteer preparer.

Part I – Your Personal Information

1. Your first name

M.I.

Last name

Are you a U.S. citizen?

Yes

No

Albert

Meadows

2. Your spouse’s first name

M.I.

Last name

Is your spouse a U.S. citizen?

Yes

No

Lois

Meadows

3. Mailing address

Apt #

City

State

ZIP code

34 North Street

Your City

Your State

Your Zip

4. Telephone number(s)

Email address (optional)

352-222-xxxx

5. Your Date of Birth

6. Your job title

7. Last year, were you:

a. Full time student

Yes

No

b. Totally and permanently disabled

c. Legally blind

Yes

No

Yes

No

1/17/1954

Retired

8. Your spouse’s Date of Birth 9. Your spouse’s job title

10. Last year, was your spouse:

a. Full time student

Yes

No

b. Totally and permanently disabled

Yes

No

c. Legally blind

Yes

No

3/15/1975

Teacher

11. Can anyone claim you or your spouse on their tax return?

Yes

No

Unsure

12. Have you or your spouse:

a. Been a victim of identity theft?

Yes

No

b. Adopted a child?

Yes

No

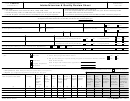

Part II – Marital Status and Household Information

1. As of December 31 of last year,

Single (This includes registered domestic partnerships, civil unions, or other formal relationships under state law)

were you:

Married

Yes

No

a. Did you live with your spouse during any part of the last six months of 2014?

b. Was your marriage recognized under the laws of the state(s) you are filing in?

Yes

No

Unsure

Date of final decree or separate maintenance agreement

Divorced or Legally Separated

Year of spouse’s death

Widowed

2. List the names below of:

If additional space is needed check here

and list on page 3

• everyone who lived with you last year (other than you or your spouse)

To be completed by a Certified Volunteer Preparer

• anyone you supported but did not live with you last year

Name (first, last) Do not enter your

Date of Birth

Relationship to

Number of

US

Resident

Single or

Full-time

Totally and

Can this

Did this

Did this

Did the

Did the

name or spouse’s name below

you (for

months

Citizen

of US,

Married as

Student

Permanently

person be

person

person

taxpayer(s)

taxpayer(s)

(mm/dd/yy)

lived in

Canada,

of 12/31/14

last year

Disabled

claimed by

provide

have less

provide more

pay more than

example: son,

(yes/no)

your home

or Mexico

someone

more than

than $3950

than 50% of

half the cost of

daughter,

(S/M)

(yes/no)

(yes/no)

last year

last year

else as a

50% of

of income?

support for

maintaining a

parent, none,

dependent on

their own

this person?

home for this

etc)

(yes/no)

(yes/no)

their return?

support?

person?

(yes/no)

(a)

(b)

(c)

(d)

(e)

(f)

(g)

(h)

(i)

(yes/no)

(yes/no)

(yes/no)

Warren Meadows

6/21/2000 Son

12

Y

Y

S

Y

N

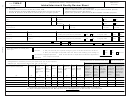

Volunteers are trained to provide high quality service and uphold the highest ethical standards.

To report unethical behavior to the IRS, email us at wi.voltax@irs.gov or call toll free 1-877-330-1205

13614-C

Catalog Number 52121E

Form

(Rev. 10-2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7