Form 13614-C - Intake/interview & Quality Review Sheet, Form W-2 - Wage And Tax Statement Etc. Page 3

ADVERTISEMENT

Page 2

Yes No Unsure

Check appropriate box for each question in each section

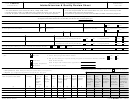

Part III – Income – Last Year, Did You (or Your Spouse) Receive

1. (B) Wages or Salary? (Form W-2)

If yes, how many jobs did you have last year?

2. (A) Tip Income?

3. (B) Scholarships? (Forms W-2, 1098-T)

4. (B) Interest/Dividends from: checking/savings accounts, bonds, CDs, brokerage? (Forms 1099-INT, 1099-DIV)

5. (B) Refund of state/local income taxes? (Form 1099-G)

6. (B) Alimony income?

7. (A) Self-Employment income? (Form 1099-MISC, cash)

8. (A) Cash/check payments for any work performed not reported on Forms W-2 or 1099?

9. (A) Income (or loss) from the sale of Stocks, Bonds or Real Estate? (including your home) (Forms 1099-S,1099-B)

10. (B) Disability income? (such as payments from insurance, or workers compensation) (Forms 1099-R, W-2)

11. (A) Distribution from Pensions, Annuities, and/or IRA? (Form 1099-R)

12. (B) Unemployment compensation? (Form 1099-G)

13. (B) Social Security or Railroad Retirement Benefits? (Forms SSA-1099, RRB-1099)

14. (M) Income (or loss) from Rental Property?

15. (B) Other income? (gambling, lottery, prizes, awards, jury duty, Sch K-1, etc.) (Forms W-2G) Specify

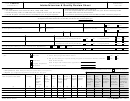

Part IV – Expenses – Last Year, Did You (or Your Spouse) Pay

1. (B) Alimony?

If yes, do you have the recipient’s SSN?

Yes

No

2. Contributions to a retirement account?

IRA (A)

401K (B)

Roth IRA (B)

Other

3. (B) Post secondary educational expenses for yourself, spouse or dependents? (Form 1098-T)

4. (B) Unreimbursed employee business expenses? (such as uniforms or mileage)

5. (B) Medical expenses? (including health insurance premiums)

6. (B) Home mortgage interest? (Form 1098)

7. (B) Real estate taxes for your home or personal property taxes for your vehicle? (Form 1098)

8. (B) Charitable contributions?

9. (B) Child or dependent care expenses such as daycare?

10. (B) For supplies used as an eligible educator such as a teacher, teacher’s aide, counselor, etc.?

11. (A) Expenses related to self-employment income or any other income you received?

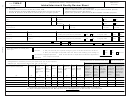

Part V – Life Events – Last Year, Did You (or Your Spouse)

1. (HSA) Have a Health Savings Account? (Forms 5498-SA, 1099-SA, W-2 with code W in box 12)

2. (COD) Have debt from a mortgage or credit card cancelled/forgiven by a commercial lender? (Forms 1099-C, 1099-A)

3. (A) Buy, sell or have a foreclosure (COD) of your home? (Form 1099-A)

4. (B) Have Earned Income Credit (EIC) disallowed in a prior year?

If yes, for which tax year?

5. (A) Purchase and install energy-efficient home items? (such as windows, furnace, insulation, etc.)

6. (B) Live in an area that was affected by a natural disaster?

If yes, where?

7. (A) Receive the First Time Homebuyers Credit in 2008?

8. (B) Pay any student loan interest? (Form 1098-E)

9. (B) Make estimated tax payments or apply last year’s refund to this year’s tax?

If so how much?

10. (A) File a federal return last year containing a “capital loss carryover” on Form 1040 Schedule D?

13614-C

Catalog Number 52121E

Form

(Rev. 10-2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7