Alternative Documentation Of Income - Gsmr

ADVERTISEMENT

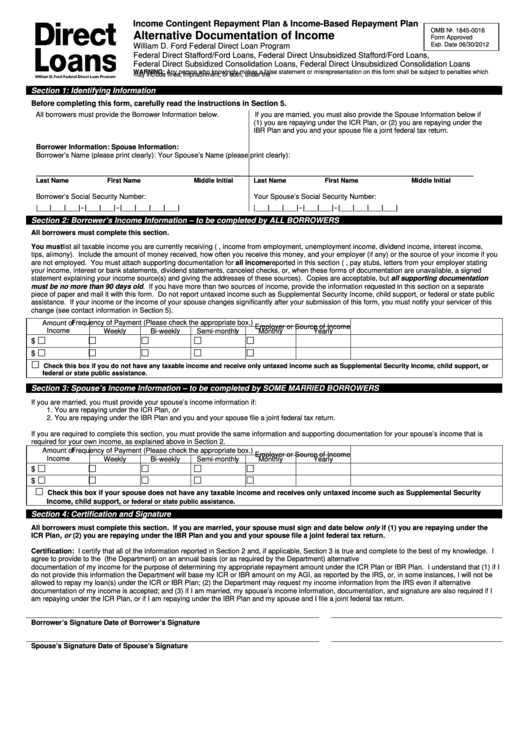

Income Contingent Repayment Plan

Income-Based Repayment Plan

&

OMB No. 1845-0016

Alternative Documentation of Income

Form Approved

Exp. Date 06/30/2012

William D. Ford Federal Direct Loan Program

Federal Direct Stafford/Ford Loans, Federal Direct Unsubsidized Stafford/Ford Loans,

Federal Direct Subsidized Consolidation Loans, Federal Direct Unsubsidized Consolidation Loans

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form shall be subject to penalties which

may include fines, imprisonment, or both, under the U.S. Criminal Code and 20 U.S.C. 1097.

Section 1: Identifying Information

Before completing this form, carefully read the instructions in Section 5.

All borrowers must provide the Borrower Information below.

If you are married, you must also provide the Spouse Information below if

(1) you are repaying under the ICR Plan, or (2) you are repaying under the

IBR Plan and you and your spouse file a joint federal tax return.

Borrower Information:

Spouse Information:

Borrower’s Name (please print clearly):

Your Spouse’s Name (please print clearly):

________________________________________________

________________________________________________________

Last Name

First Name

Middle Initial

Last Name

First Name

Middle Initial

Borrower’s Social Security Number:

Your Spouse’s Social Security Number:

|__|__|__|-|__|__|-|__|__|__|__|

|__|__|__|-|__|__|-|__|__|__|__|

Section 2: Borrower’s Income Information – to be completed by ALL BORROWERS

All borrowers must complete this section.

You must list all taxable income you are currently receiving (i.e., income from employment, unemployment income, dividend income, interest income,

tips, alimony). Include the amount of money received, how often you receive this money, and your employer (if any) or the source of your income if you

are not employed. You must attach supporting documentation for all income reported in this section (e.g., pay stubs, letters from your employer stating

your income, interest or bank statements, dividend statements, canceled checks, or, when these forms of documentation are unavailable, a signed

statement explaining your income source(s) and giving the addresses of these sources). Copies are acceptable, but all supporting documentation

must be no more than 90 days old. If you have more than two sources of income, provide the information requested in this section on a separate

piece of paper and mail it with this form. Do not report untaxed income such as Supplemental Security Income, child support, or federal or state public

assistance. If your income or the income of your spouse changes significantly after your submission of this form, you must notify your servicer of this

change (see contact information in Section 5).

Amount of

Frequency of Payment (Please check the appropriate box.)

Employer or Source of Income

Income

Weekly

Bi-weekly

Semi-monthly

Monthly

Yearly

$

$

Check this box if you do not have any taxable income and receive only untaxed income such as Supplemental Security Income, child support, or

federal or state public assistance.

Section 3: Spouse’s Income Information – to be completed by SOME MARRIED BORROWERS

If you are married, you must provide your spouse’s income information if:

1.

You are repaying under the ICR Plan, or

2.

You are repaying under the IBR Plan and you and your spouse file a joint federal tax return.

If you are required to complete this section, you must provide the same information and supporting documentation for your spouse’s income that is

required for your own income, as explained above in Section 2.

Amount of

Frequency of Payment (Please check the appropriate box.)

Employer or Source of Income

Income

Weekly

Bi-weekly

Semi-monthly

Monthly

Yearly

$

$

Check this box if your spouse does not have any taxable income and receives only untaxed income such as Supplemental Security

Income, child support,

or federal or state public assistance

.

Section 4: Certification and Signature

All borrowers must complete this section. If you are married, your spouse must sign and date below only if (1) you are repaying under the

ICR Plan, or (2) you are repaying under the IBR Plan and you and your spouse file a joint federal tax return.

Certification: I certify that all of the information reported in Section 2 and, if applicable, Section 3 is true and complete to the best of my knowledge. I

agree to provide to the U.S. Department of Education (the Department) on an annual basis (or as required by the Department) alternative

documentation of my income for the purpose of determining my appropriate repayment amount under the ICR Plan or IBR Plan. I understand that (1) if I

do not provide this information the Department will base my ICR or IBR amount on my AGI, as reported by the IRS, or, in some instances, I will not be

allowed to repay my loan(s) under the ICR or IBR Plan; (2) the Department may request my income information from the IRS even if alternative

documentation of my income is accepted; and (3) if I am married, my spouse’s income information, documentation, and signature are also required if I

am repaying under the ICR Plan, or if I am repaying under the IBR Plan and my spouse and I file a joint federal tax return.

Borrower’s Signature

Date of Borrower’s Signature

Spouse’s Signature

Date of Spouse’s Signature

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2