Alternative Document Of Income

ADVERTISEMENT

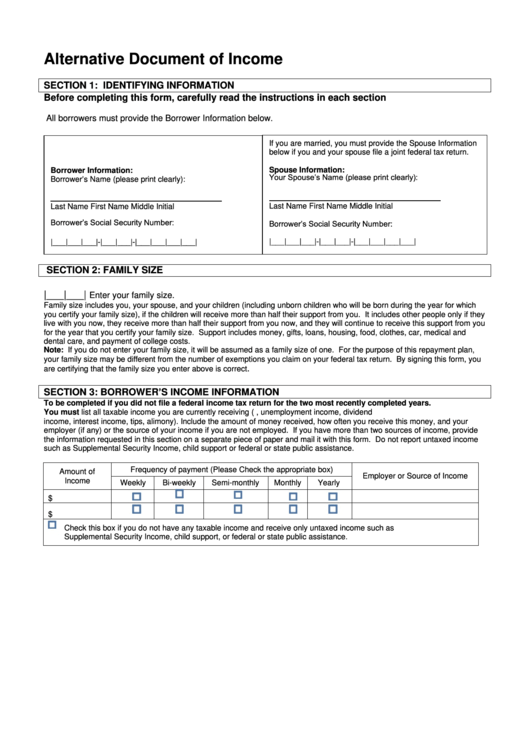

Alternative Document of Income

SECTION 1: IDENTIFYING INFORMATION

Before completing this form, carefully read the instructions in each section

All borrowers must provide the Borrower Information below.

If you are married, you must provide the Spouse Information

below if you and your spouse file a joint federal tax return.

Spouse Information:

Borrower Information:

Your Spouse’s Name (please print clearly):

Borrower’s Name (please print clearly):

m

m

Last Name

First Name

Middle Initial

Last Name

First Name

Middle Initial

Borrower’s Social Security Number:

Borrower’s Social Security Number:

|___|___|___|-|___|___|-|___|___|___|___|

|___|___|___|-|___|___|-|___|___|___|___|

SECTION 2: FAMILY SIZE

|___|___|

Enter your family size.

Family size includes you, your spouse, and your children (including unborn children who will be born during the year for which

you certify your family size), if the children will receive more than half their support from you. It includes other people only if they

live with you now, they receive more than half their support from you now, and they will continue to receive this support from you

for the year that you certify your family size. Support includes money, gifts, loans, housing, food, clothes, car, medical and

dental care, and payment of college costs.

Note: If you do not enter your family size, it will be assumed as a family size of one. For the purpose of this repayment plan,

your family size may be different from the number of exemptions you claim on your federal tax return. By signing this form, you

.

are certifying that the family size you enter above is correct

SECTION 3: BORROWER’S INCOME INFORMATION

To be completed if you did not file a federal income tax return for the two most recently completed years.

You must list all taxable income you are currently receiving (i.e. income from employment, unemployment income, dividend

income, interest income, tips, alimony). Include the amount of money received, how often you receive this money, and your

employer (if any) or the source of your income if you are not employed. If you have more than two sources of income, provide

the information requested in this section on a separate piece of paper and mail it with this form. Do not report untaxed income

such as Supplemental Security Income, child support or federal or state public assistance.

Frequency of payment (Please Check the appropriate box)

Amount of

Employer or Source of Income

Income

Weekly

Bi-weekly

Semi-monthly

Monthly

Yearly

$

$

Check this box if you do not have any taxable income and receive only untaxed income such as

Supplemental Security Income, child support, or federal or state public assistance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2