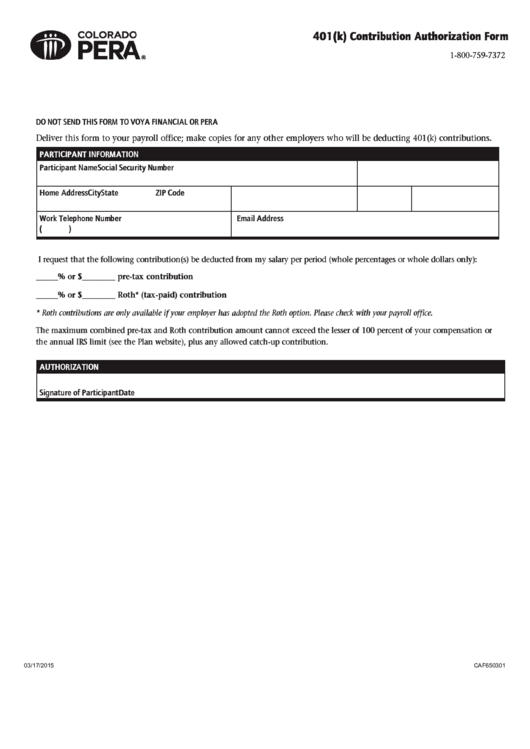

401(K) Contribution Authorization Form

ADVERTISEMENT

401(k) Contribution Authorization Form

1-800-759-7372

DO NOT SEND THIS FORM TO VOYA FINANCIAL OR PERA

Deliver this form to your payroll office; make copies for any other employers who will be deducting 401(k) contributions.

PARTICIPANT INFORMATION

Participant Name

Social Security Number

Home Address

City

State

ZIP Code

Work Telephone Number

Email Address

(

)

I request that the following contribution(s) be deducted from my salary per period (whole percentages or whole dollars only):

______% or $_________ pre-tax contribution

______% or $_________ Roth* (tax-paid) contribution

* Roth contributions are only available if your employer has adopted the Roth option. Please check with your payroll office.

The maximum combined pre-tax and Roth contribution amount cannot exceed the lesser of 100 percent of your compensation or

the annual IRS limit (see the Plan website), plus any allowed catch-up contribution.

AUTHORIZATION

Signature of Participant

Date

03/17/2015

CAF650301

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1