401(K) Deferral Election Form

ADVERTISEMENT

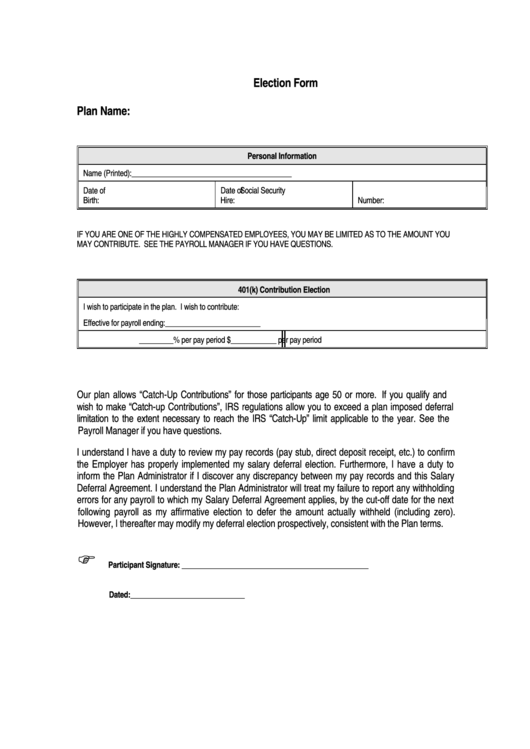

Election Form

Plan Name:

Personal Information

Name (Printed):__________________________________________

Date of

Date of

Social Security

Birth:

Hire:

Number:

IF YOU ARE ONE OF THE HIGHLY COMPENSATED EMPLOYEES, YOU MAY BE LIMITED AS TO THE AMOUNT YOU

MAY CONTRIBUTE. SEE THE PAYROLL MANAGER IF YOU HAVE QUESTIONS.

401(k) Contribution Election

I wish to participate in the plan. I wish to contribute:

Effective for payroll ending:_________________________

_________% per pay period

$____________ per pay period

Our plan allows “Catch-Up Contributions” for those participants age 50 or more. If you qualify and

wish to make “Catch-up Contributions”, IRS regulations allow you to exceed a plan imposed deferral

limitation to the extent necessary to reach the IRS “Catch-Up” limit applicable to the year. See the

Payroll Manager if you have questions.

I understand I have a duty to review my pay records (pay stub, direct deposit receipt, etc.) to confirm

the Employer has properly implemented my salary deferral election. Furthermore, I have a duty to

inform the Plan Administrator if I discover any discrepancy between my pay records and this Salary

Deferral Agreement. I understand the Plan Administrator will treat my failure to report any withholding

errors for any payroll to which my Salary Deferral Agreement applies, by the cut-off date for the next

following payroll as my affirmative election to defer the amount actually withheld (including zero).

However, I thereafter may modify my deferral election prospectively, consistent with the Plan terms.

Participant Signature: _________________________________________________

Dated:______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1