The Fidelity Self-Employed 401(K) Contribution

ADVERTISEMENT

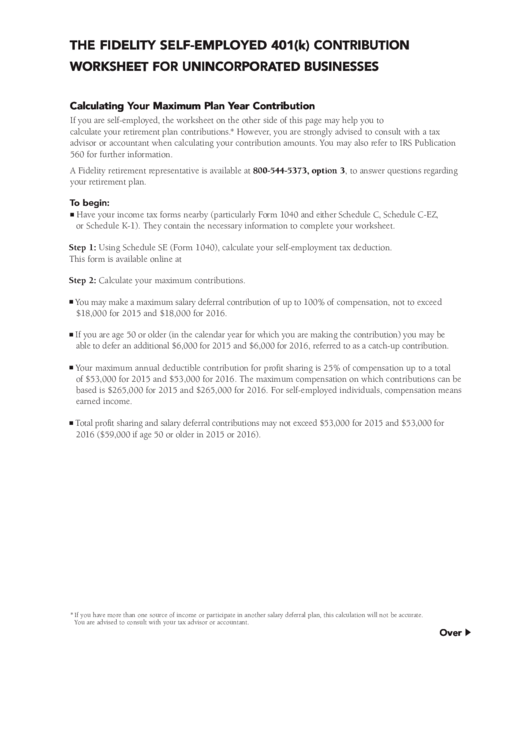

The FideliTy SelF-employed 401(k) ConTribuTion

WorkSheeT For uninCorporaTed buSineSSeS

Calculating your maximum plan year Contribution

If you are self-employed, the worksheet on the other side of this page may help you to

calculate your retirement plan contributions.* However, you are strongly advised to consult with a tax

advisor or accountant when calculating your contribution amounts. You may also refer to IRS Publication

560 for further information.

A Fidelity retirement representative is available at 800-544-5373, option 3, to answer questions regarding

your retirement plan.

To begin:

Have your income tax forms nearby (particularly Form 1040 and either Schedule C, Schedule C-EZ,

■

or Schedule K-1). They contain the necessary information to complete your worksheet.

Step 1: Using Schedule SE (Form 1040), calculate your self-employment tax deduction.

This form is available online at

Step 2: Calculate your maximum contributions.

You may make a maximum salary deferral contribution of up to 100% of compensation, not to exceed

■

$18,000 for 2015 and $18,000 for 2016.

If you are age 50 or older (in the calendar year for which you are making the contribution) you may be

■

able to defer an additional $6,000 for 2015 and $6,000 for 2016, referred to as a catch-up contribution.

Your maximum annual deductible contribution for profit sharing is 25% of compensation up to a total

■

of $53,000 for 2015 and $53,000 for 2016. The maximum compensation on which contributions can be

based is $265,000 for 2015 and $265,000 for 2016. For self-employed individuals, compensation means

earned income.

Total profit sharing and salary deferral contributions may not exceed $53,000 for 2015 and $53,000 for

■

2016 ($59,000 if age 50 or older in 2015 or 2016).

* If you have more than one source of income or participate in another salary deferral plan, this calculation will not be accurate.

You are advised to consult with your tax advisor or accountant.

Over

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2