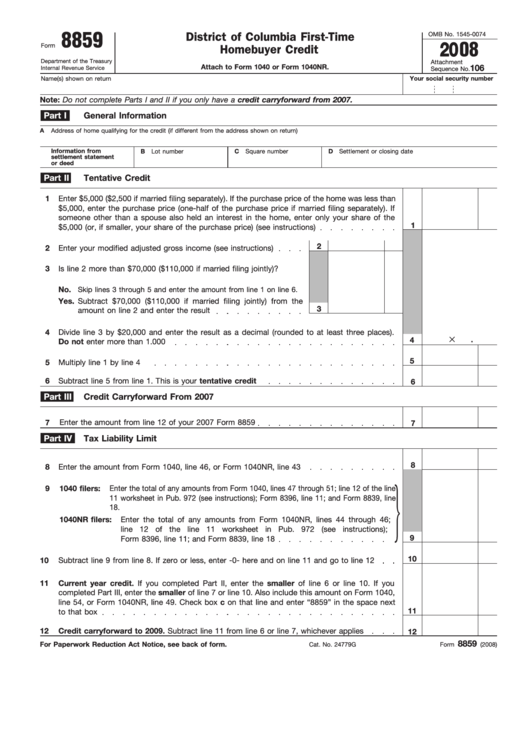

Form 8859 - District Of Columbia First-Time Homebuyer Credit

ADVERTISEMENT

8859

OMB No. 1545-0074

District of Columbia First-Time

2008

Form

Homebuyer Credit

Department of the Treasury

Attachment

Attach to Form 1040 or Form 1040NR.

106

Internal Revenue Service

Sequence No.

Name(s) shown on return

Your social security number

Note: Do not complete Parts I and II if you only have a credit carryforward from 2007.

General Information

Part I

A

Address of home qualifying for the credit (if different from the address shown on return)

Information from

B

Lot number

C

Square number

D

Settlement or closing date

settlement statement

or deed

Part II

Tentative Credit

1

Enter $5,000 ($2,500 if married filing separately). If the purchase price of the home was less than

$5,000, enter the purchase price (one-half of the purchase price if married filing separately). If

someone other than a spouse also held an interest in the home, enter only your share of the

1

$5,000 (or, if smaller, your share of the purchase price) (see instructions)

2

2

Enter your modified adjusted gross income (see instructions)

3

Is line 2 more than $70,000 ($110,000 if married filing jointly)?

No.

Skip lines 3 through 5 and enter the amount from line 1 on line 6.

Subtract $70,000 ($110,000 if married filing jointly) from the

Yes.

3

amount on line 2 and enter the result

4

Divide line 3 by $20,000 and enter the result as a decimal (rounded to at least three places).

×

.

4

Do not enter more than 1.000

5

5

Multiply line 1 by line 4

6

Subtract line 5 from line 1. This is your tentative credit

6

Part III

Credit Carryforward From 2007

7

Enter the amount from line 12 of your 2007 Form 8859

7

Part IV

Tax Liability Limit

8

8

Enter the amount from Form 1040, line 46, or Form 1040NR, line 43

9

1040 filers:

Enter the total of any amounts from Form 1040, lines 47 through 51; line 12 of the line

11 worksheet in Pub. 972 (see instructions); Form 8396, line 11; and Form 8839, line

18.

1040NR filers:

Enter the total of any amounts from Form 1040NR, lines 44 through 46;

line 12 of the line 11 worksheet in Pub. 972 (see instructions);

9

Form 8396, line 11; and Form 8839, line 18

10

10

Subtract line 9 from line 8. If zero or less, enter -0- here and on line 11 and go to line 12

11

Current year credit. If you completed Part II, enter the smaller of line 6 or line 10. If you

completed Part III, enter the smaller of line 7 or line 10. Also include this amount on Form 1040,

line 54, or Form 1040NR, line 49. Check box c on that line and enter “8859” in the space next

11

to that box

12

Credit carryforward to 2009. Subtract line 11 from line 6 or line 7, whichever applies

12

8859

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 24779G

Form

(2008)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2