Withholding Certificate For Pension Or Annuity Payments - North Carolina

ADVERTISEMENT

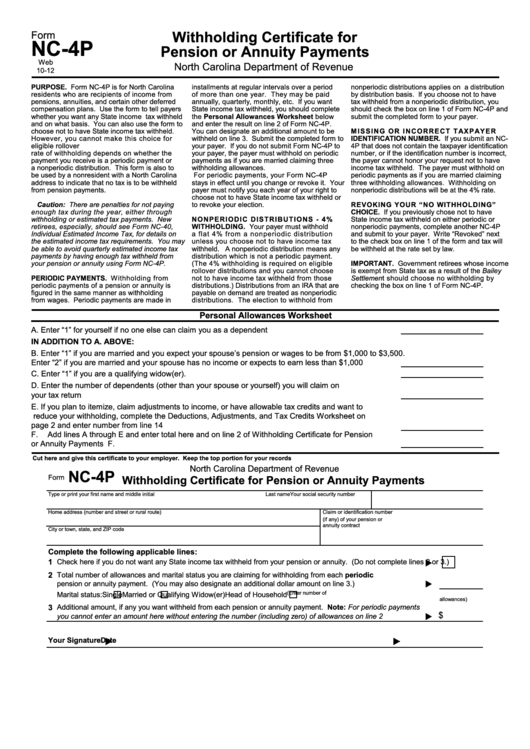

Withholding Certificate for

Form

NC-4P

Pension or Annuity Payments

Web

North Carolina Department of Revenue

10-12

PURPOSE. Form NC-4P is for North Carolina

installments at regular intervals over a period

nonperiodic distributions applies on a distribution

residents who are recipients of income from

of more than one year. They may be paid

by distribution basis. If you choose not to have

pensions, annuities, and certain other deferred

annually, quarterly, monthly, etc. If you want

tax withheld from a nonperiodic distribution, you

compensation plans. Use the form to tell payers

State income tax withheld, you should complete

should check the box on line 1 of Form NC-4P and

whether you want any State income tax withheld

the Personal Allowances Worksheet below

submit the completed form to your payer.

and on what basis. You can also use the form to

and enter the result on line 2 of Form NC-4P.

choose not to have State income tax withheld.

You can designate an additional amount to be

M I S S I N G O R I N C O R R E C T TA X PAY E R

However, you cannot make this choice for

withheld on line 3. Submit the completed form to

IDENTIFICATION NUMBER. If you submit an NC-

eligible rollover distributions.The method and

your payer. If you do not submit Form NC-4P to

4P that does not contain the taxpayer identification

rate of withholding depends on whether the

your payer, the payer must withhold on periodic

number, or if the identification number is incorrect,

payment you receive is a periodic payment or

payments as if you are married claiming three

the payer cannot honor your request not to have

a nonperiodic distribution. This form is also to

withholding allowances.

income tax withheld. The payer must withhold on

be used by a nonresident with a North Carolina

For periodic payments, your Form NC-4P

periodic payments as if you are married claiming

address to indicate that no tax is to be withheld

stays in effect until you change or revoke it. Your

three withholding allowances. Withholding on

from pension payments.

payer must notify you each year of your right to

nonperiodic distributions will be at the 4% rate.

choose not to have State income tax withheld or

Caution: There are penalties for not paying

to revoke your election.

REVOKING YOUR “NO WITHHOLDING”

CHOICE. If you previously chose not to have

enough tax during the year, either through

withholding or estimated tax payments. New

NONPERIODIC DISTRIBUTIONS - 4%

State income tax withheld on either periodic or

retirees, especially, should see Form NC-40,

WITHHOLDING. Your payer must withhold

nonperiodic payments, complete another NC-4P

a flat 4% from a nonperiodic distribution

and submit to your payer. Write “Revoked” next

Individual Estimated Income Tax, for details on

the estimated income tax requirements. You may

unless you choose not to have income tax

to the check box on line 1 of the form and tax will

be able to avoid quarterly estimated income tax

withheld. A nonperiodic distribution means any

be withheld at the rate set by law.

distribution which is not a periodic payment.

payments by having enough tax withheld from

your pension or annuity using Form NC-4P.

(The 4% withholding is required on eligible

IMPORTANT. Government retirees whose income

rollover distributions and you cannot choose

is exempt from State tax as a result of the Bailey

PERIODIC PAYMENTS. Withholding from

not to have income tax withheld from those

Settlement should choose no withholding by

periodic payments of a pension or annuity is

distributions.) Distributions from an IRA that are

checking the box on line 1 of Form NC-4P.

figured in the same manner as withholding

payable on demand are treated as nonperiodic

from wages. Periodic payments are made in

distributions. The election to withhold from

Personal Allowances Worksheet

A.

Enter “1” for yourself if no one else can claim you as a dependent ..................................................... A.

IN ADDITION TO A. ABOVE:

B.

Enter “1” if you are married and you expect your spouse’s pension or wages to be from $1,000 to $3,500.

Enter “2” if you are married and your spouse has no income or expects to earn less than $1,000 ..... B.

C. Enter “1” if you are a qualifying widow(er). ........................................................................................... C.

D. Enter the number of dependents (other than your spouse or yourself) you will claim on

your tax return ...................................................................................................................................... D.

E.

If you plan to itemize, claim adjustments to income, or have allowable tax credits and want to

reduce your withholding, complete the Deductions, Adjustments, and Tax Credits Worksheet on

page 2 and enter number from line 14 ................................................................................................. E.

F. Add lines A through E and enter total here and on line 2 of Withholding Certificate for Pension

or Annuity Payments ............................................................................................................................ F.

....................................................Cut here and give this certificate to your employer. Keep the top portion for your records .....................................................................

North Carolina Department of Revenue

NC-4P

Form

Withholding Certificate for Pension or Annuity Payments

Type or print your first name and middle initial

Last name

Your social security number

Home address (number and street or rural route)

Claim or identification number

(if any) of your pension or

annuity contract

City or town, state, and ZIP code

Complete the following applicable lines:

1

Check here if you do not want any State income tax withheld from your pension or annuity. (Do not complete lines 2 or 3.)

2

Total number of allowances and marital status you are claiming for withholding from each periodic

pension or annuity payment. (You may also designate an additional dollar amount on line 3.) ...............................

Marital status:

Single

Married or Qualifying Widow(er)

Head of Household

(Enter number of

allowances)

3

Additional amount, if any you want withheld from each pension or annuity payment. Note: For periodic payments

$

you cannot enter an amount here without entering the number (including zero) of allowances on line 2 .................

Your Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2