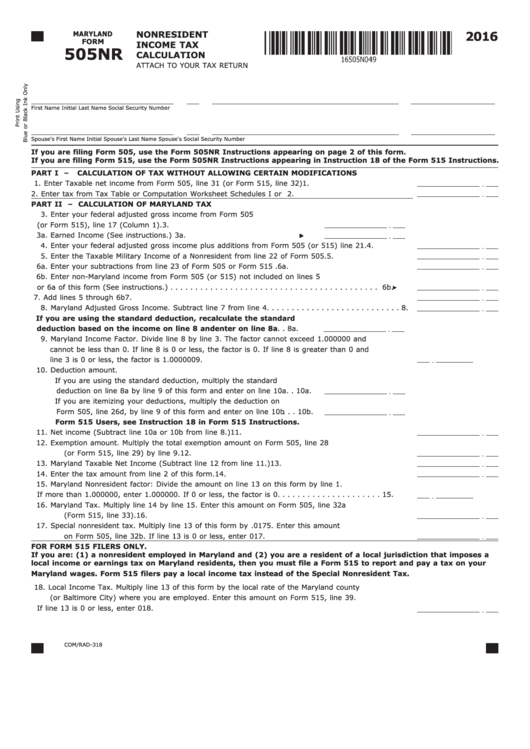

2016

NONRESIDENT

MARYLAND

FORM

INCOME TAX

505NR

CALCULATION

ATTACH TO YOUR TAX RETURN

First Name

Initial

Last Name

Social Security Number

Spouse's First Name

Initial

Spouse's Last Name

Spouse's Social Security Number

If you are filing form 505, use the form 505nR Instructions appearing on page 2 of this form.

If you are filing form 515, use the form 505nR Instructions appearing in Instruction 18 of the form 515 Instructions.

PART I – CAlCulATIon of TAx wIThouT AllowIng CeRTAIn ModIfICATIons

1. Enter Taxable net income from Form 505, line 31 (or Form 515, line 32) . . . . . . . . . . . . . . . . . . 1.

2. Enter tax from Tax Table or Computation Worksheet Schedules I or II. Continue to Part II. . . . . . 2.

PART II – CAlCulATIon of MARylAnd TAx

3. Enter your federal adjusted gross income from Form 505

(or Form 515), line 17 (Column 1). . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

3a. Earned Income (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . .

3a.

4. Enter your federal adjusted gross income plus additions from Form 505 (or 515) line 21. . . . . . . 4.

5. Enter the Taxable Military Income of a Nonresident from line 22 of Form 505. . . . . . . . . . . . . . . 5.

6a. Enter your subtractions from line 23 of Form 505 or Form 515 . . . . . . . . . . . . . . . . . . . . . . . . 6a.

6b. Enter non-Maryland income from Form 505 (or 515) not included on lines 5

or 6a of this form (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b.

7. Add lines 5 through 6b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Maryland Adjusted Gross Income. Subtract line 7 from line 4. . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

If you are using the standard deduction, recalculate the standard

deduction based on the income on line 8 and enter on line 8a . .8a.

9. Maryland Income Factor. Divide line 8 by line 3. The factor cannot exceed 1.000000 and

cannot be less than 0. If line 8 is 0 or less, the factor is 0. If line 8 is greater than 0 and

line 3 is 0 or less, the factor is 1.000000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Deduction amount.

If you are using the standard deduction, multiply the standard

deduction on line 8a by line 9 of this form and enter on line 10a . . 10a.

If you are itemizing your deductions, multiply the deduction on

Form 505, line 26d, by line 9 of this form and enter on line 10b . . . 10b.

form 515 users, see Instruction 18 in form 515 Instructions.

11. Net income (Subtract line 10a or 10b from line 8.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Exemption amount. Multiply the total exemption amount on Form 505, line 28

(or Form 515, line 29) by line 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Maryland Taxable Net Income (Subtract line 12 from line 11.) . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Enter the tax amount from line 2 of this form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Maryland Nonresident factor: Divide the amount on line 13 on this form by line 1.

If more than 1.000000, enter 1.000000. If 0 or less, the factor is 0. . . . . . . . . . . . . . . . . . . . . 15.

16. Maryland Tax. Multiply line 14 by line 15. Enter this amount on Form 505, line 32a

(Form 515, line 33). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Special nonresident tax. Multiply line 13 of this form by .0175. Enter this amount

on Form 505, line 32b. If line 13 is 0 or less, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

foR foRM 515 fIleRs only.

If you are: (1) a nonresident employed in Maryland and (2) you are a resident of a local jurisdiction that imposes a

local income or earnings tax on Maryland residents, then you must file a form 515 to report and pay a tax on your

Maryland wages. form 515 filers pay a local income tax instead of the special nonresident Tax.

18. Local Income Tax. Multiply line 13 of this form by the local rate of the Maryland county

(or Baltimore City) where you are employed. Enter this amount on Form 515, line 39.

If line 13 is 0 or less, enter 0 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

COM/RAD-318

1

1 2

2