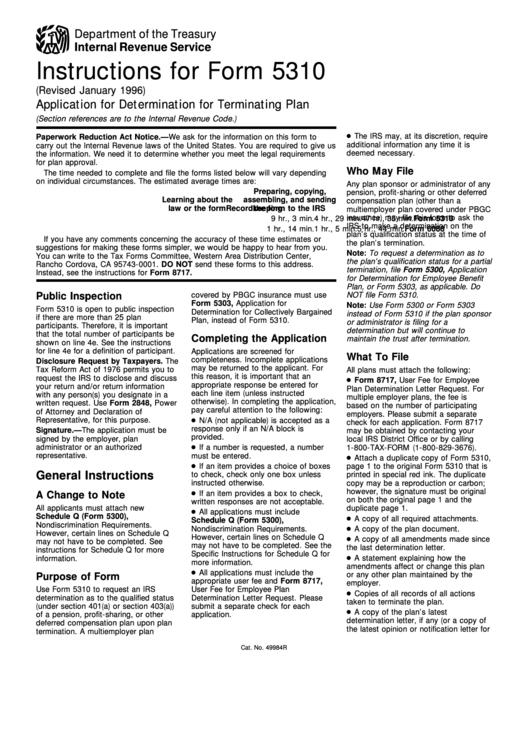

Instructions For Form 5310 (Revised January 1996) Application For Determination For Terminating Plan

ADVERTISEMENT

Department of the Treasury

Internal Revenue Service

Instructions for Form 5310

(Revised January 1996)

Application for Determination for Terminating Plan

(Section references are to the Internal Revenue Code.)

The IRS may, at its discretion, require

Paperwork Reduction Act Notice.—We ask for the information on this form to

additional information any time it is

carry out the Internal Revenue laws of the United States. You are required to give us

deemed necessary.

the information. We need it to determine whether you meet the legal requirements

for plan approval.

Who May File

The time needed to complete and file the forms listed below will vary depending

on individual circumstances. The estimated average times are:

Any plan sponsor or administrator of any

Preparing, copying,

pension, profit-sharing or other deferred

Learning about the

assembling, and sending

compensation plan (other than a

Recordkeeping

law or the form

the form to the IRS

multiemployer plan covered under PBGC

insurance) may file this form to ask the

Form 5310

47 hr., 35 min.

4 hr., 29 min.

9 hr., 3 min.

IRS to make a determination on the

Form 6088

5 hr., 44 min.

1 hr., 5 min.

1 hr., 14 min.

plan’s qualification status at the time of

If you have any comments concerning the accuracy of these time estimates or

the plan’s termination.

suggestions for making these forms simpler, we would be happy to hear from you.

Note: To request a determination as to

You can write to the Tax Forms Committee, Western Area Distribution Center,

the plan’s qualification status for a partial

Rancho Cordova, CA 95743-0001. DO NOT send these forms to this address.

termination, file Form 5300, Application

Instead, see the instructions for Form 8717.

for Determination for Employee Benefit

Plan, or Form 5303, as applicable. Do

Public Inspection

covered by PBGC insurance must use

NOT file Form 5310.

Form 5303, Application for

Note: Use Form 5300 or Form 5303

Form 5310 is open to public inspection

Determination for Collectively Bargained

instead of Form 5310 if the plan sponsor

if there are more than 25 plan

Plan, instead of Form 5310.

or administrator is filing for a

participants. Therefore, it is important

determination but will continue to

that the total number of participants be

Completing the Application

maintain the trust after termination.

shown on line 4e. See the instructions

for line 4e for a definition of participant.

Applications are screened for

What To File

completeness. Incomplete applications

Disclosure Request by Taxpayers. The

may be returned to the applicant. For

Tax Reform Act of 1976 permits you to

All plans must attach the following:

this reason, it is important that an

request the IRS to disclose and discuss

Form 8717, User Fee for Employee

appropriate response be entered for

your return and/or return information

Plan Determination Letter Request. For

each line item (unless instructed

with any person(s) you designate in a

multiple employer plans, the fee is

otherwise). In completing the application,

written request. Use Form 2848, Power

based on the number of participating

pay careful attention to the following:

of Attorney and Declaration of

employers. Please submit a separate

Representative, for this purpose.

N/A (not applicable) is accepted as a

check for each application. Form 8717

response only if an N/A block is

Signature.—The application must be

may be obtained by contacting your

provided.

signed by the employer, plan

local IRS District Office or by calling

administrator or an authorized

If a number is requested, a number

1-800-TAX-FORM (1-800-829-3676).

representative.

must be entered.

Attach a duplicate copy of Form 5310,

If an item provides a choice of boxes

page 1 to the original Form 5310 that is

General Instructions

to check, check only one box unless

printed in special red ink. The duplicate

instructed otherwise.

copy may be a reproduction or carbon;

however, the signature must be original

If an item provides a box to check,

A Change to Note

on both the original page 1 and the

written responses are not acceptable.

All applicants must attach new

duplicate page 1.

All applications must include

Schedule Q (Form 5300),

A copy of all required attachments.

Schedule Q (Form 5300),

Nondiscrimination Requirements.

Nondiscrimination Requirements.

A copy of the plan document.

However, certain lines on Schedule Q

However, certain lines on Schedule Q

A copy of all amendments made since

may not have to be completed. See

may not have to be completed. See the

the last determination letter.

instructions for Schedule Q for more

Specific Instructions for Schedule Q for

A statement explaining how the

information.

more information.

amendments affect or change this plan

All applications must include the

or any other plan maintained by the

Purpose of Form

appropriate user fee and Form 8717,

employer.

Use Form 5310 to request an IRS

User Fee for Employee Plan

Copies of all records of all actions

determination as to the qualified status

Determination Letter Request. Please

taken to terminate the plan.

(under section 401(a) or section 403(a))

submit a separate check for each

A copy of the plan’s latest

of a pension, profit-sharing, or other

application.

determination letter, if any (or a copy of

deferred compensation plan upon plan

the latest opinion or notification letter for

termination. A multiemployer plan

Cat. No. 49984R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4