Page 3

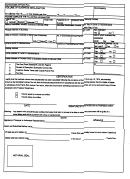

Business Volume Calculation for Gasoline Station

Gasoline

23. Gallons of gasoline purchased per certification from supplier ........................................................................

23a. Income from sales ...............................................................................................................................

23b. % Income per gallon sold* ..................................................................................................................

23c. Acquisition cost ...................................................................................................................................

23d. % Acquisition cost per gallon* .............................................................................................................

23e. Gross Margin ......................................................................................................................................

24. Total Business Volume from Gasoline sales (Multiply 23 x 23e) ....................................................................

25. Plus: Other operational gross income (Sales from other Products and Services,

Accessories, mini-market etc.) ....................................................................................................................

$

26. Total adjusted gross income (Schedule 6, Line 27E, Column A, Page 3) ......................................................

* To determine Income per gallon sold and Acquisition cost per gallon please use four (4) decimal

places.

A

B

Calculation of Tax to be Paid:

Non-Financial Business

Financial Business

27. Business Volume for taxable year immediately preceding the actual:

a.

From Schedule 2, Line 3, Page 2 ....................................................................................

$

b.

From Schedule 2, Line 4, Page 2 ....................................................................................

$

c.

From Schedule 3, Line 19, Page 2 ..................................................................................

d.

From Schedule 4, Line 22, Page 2 ..................................................................................

e.

From Schedule 5, Line 26, Page 2 ..................................................................................

28. Add: All the categories of Business Volume from taxable years

immediately preceding actual ..................................................................................................

29. Rate of tax set by the Municipal Assembly . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30. Tax due (Multiply item 28 by item 29, for columns A and B and enter

the products here) ..................................................................................................................

$

31. Total due excluding penalty or discount (Add columns A and B from item 30 and enter the total here.) . . . . . . . . . . . . . . . . .

32. Penalty (Enter the penalty for late filing, if applicable. See instructions.) ..........................................................................

33. Discount (Enter discount for anticipated payment, if applicable. See instructions.) ...........................................................

34. Credit for Similar Taxes paid outside of Puerto Rico .........................................................................................................

35. Total Due (Add item 31 and 32 and deduct item 33, if applicable. Then subtract item, 34 if applicable. Enter the result here

$

and in Schedule 1, Line Total Tax Due, Page 1.) ..............................................................................................................

lf this declaration is for the main or home office; include the municipalities and the business volumes rendered in each one of them,

where offices, warehouses, manufacturing plants, etc. are operating.

Business Volume for

Business Volume for

Municipality

Municipality

Services Rendered

Services Rendered

$

$

$

$

$

$

See instructions on Page 4 before completing this Declaration.

1

1 2

2 3

3 4

4