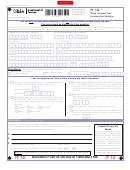

Form It-10 - Subcontractor Tax Information Authorization Page 2

ADVERTISEMENT

Where to File

Generally, this form is to be executed and provided to the General Contractor of

the named project, who will then submit it to the City of Columbus, Income Tax

Division Withholding Compliance Section. It also may be sent or taken directly

to the Withholding Compliance Section, 50 West Gay Street, Columbus, Ohio

43215.

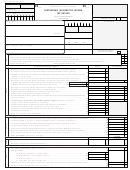

Revocation of or Withdrawal from an Existing Authorization

If you want to revoke an existing tax information authorization, send a copy of

the executed form to the City of Columbus, Income Tax Division Withholding

Compliance Section. The copy of the form must have a current date and signature

of the taxpayer under the original date and signature. Write “REVOKE” across

the top of the form. If you do not have a copy of the Subcontractor Tax Information

Authorization form you want to revoke, send a statement to the Withholding

Compliance Section. The statement of revocation must indicate that the authority

of the Appointee is revoked and must be signed and dated by the taxpayer or

representative. If the Appointee is withdrawing, list the name, EIN, and address

of the taxpayer on a copy of the form originally submitted to the Withholding

Account Section.

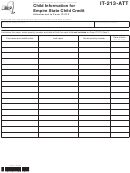

We ask for the information on this form in order to comply with the laws of the

City of Columbus, State of Ohio and the federal government. This form is

provided by the City of Columbus, Income Tax Division for your convenience

and its use is voluntary. If you designate an appointee to inspect and/or receive

confidential tax information with regard to the status of any and all City of

Columbus income tax accounts you hold, you are required to provide the

information requested on this form. If you do not provide all of the information

requested, on this form, we may not be able to honor the authorization.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2