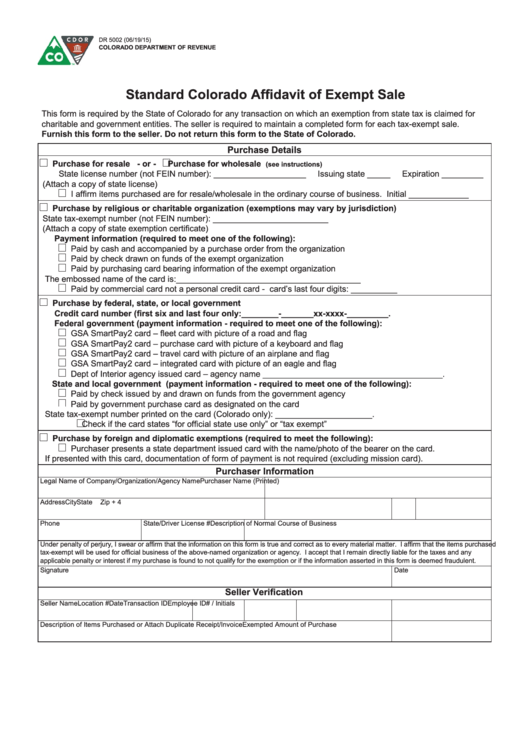

DR 5002 (06/19/15)

COLORADO DEPARTMENT OF REVENUE

Standard Colorado Affidavit of Exempt Sale

This form is required by the State of Colorado for any transaction on which an exemption from state tax is claimed for

charitable and government entities. The seller is required to maintain a completed form for each tax-exempt sale.

Furnish this form to the seller. Do not return this form to the State of Colorado.

Purchase Details

Purchase for resale - or -

Purchase for wholesale

(see instructions)

State license number (not FEIN number): ____________________

Issuing state _____

Expiration _________

(Attach a copy of state license)

I affirm items purchased are for resale/wholesale in the ordinary course of business. Initial _____________

Purchase by religious or charitable organization (exemptions may vary by jurisdiction)

State tax-exempt number (not FEIN number): _________________________

(Attach a copy of state exemption certificate)

Payment information (required to meet one of the following):

Paid by cash and accompanied by a purchase order from the organization

Paid by check drawn on funds of the exempt organization

Paid by purchasing card bearing information of the exempt organization

The embossed name of the card is:________________________________________

Paid by commercial card not a personal credit card - card’s last four digits: __________

Purchase by federal, state, or local government

Credit card number (first six and last four only:________-_______xx-xxxx-_________.

Federal government (payment information - required to meet one of the following):

GSA SmartPay2 card – fleet card with picture of a road and flag

GSA SmartPay2 card – purchase card with picture of a keyboard and flag

GSA SmartPay2 card – travel card with picture of an airplane and flag

GSA SmartPay2 card – integrated card with picture of an eagle and flag

Dept of Interior agency issued card – agency name _______________________________________.

State and local government (payment information - required to meet one of the following):

Paid by check issued by and drawn on funds from the government agency

Paid by government purchase card as designated on the card

State tax-exempt number printed on the card (Colorado only): _____________________.

Check if the card states “for official state use only” or “tax exempt”

Purchase by foreign and diplomatic exemptions (required to meet the following):

Purchaser presents a state department issued card with the name/photo of the bearer on the card.

If presented with this card, documentation of form of payment is not required (excluding mission card).

Purchaser Information

Legal Name of Company/Organization/Agency Name

Purchaser Name (Printed)

Address

City

State

Zip + 4

Phone

State/Driver License #

Description of Normal Course of Business

Under penalty of perjury, I swear or affirm that the information on this form is true and correct as to every material matter. I affirm that the items purchased

tax-exempt will be used for official business of the above-named organization or agency. I accept that I remain directly liable for the taxes and any

applicable penalty or interest if my purchase is found to not qualify for the exemption or if the information asserted in this form is deemed fraudulent.

Signature

Date

Seller Verification

Seller Name

Location #

Date

Transaction ID

Employee ID# / Initials

Description of Items Purchased or Attach Duplicate Receipt/Invoice

Exempted Amount of Purchase

1

1 2

2 3

3