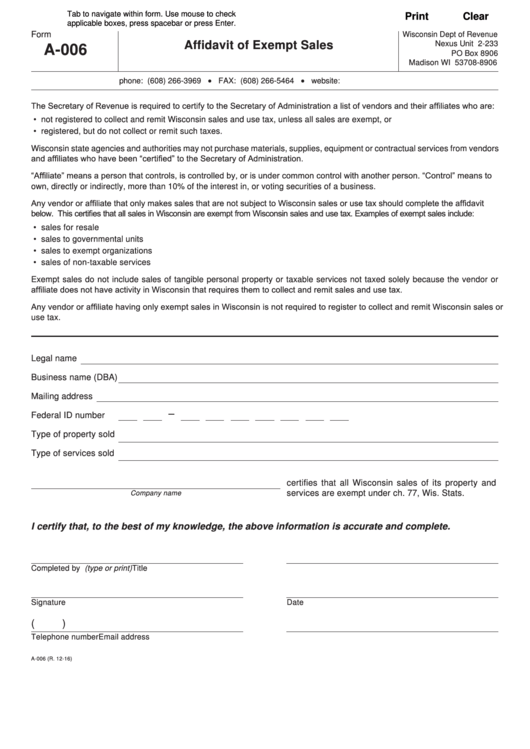

Tab to navigate within form. Use mouse to check

Print

Clear

applicable boxes, press spacebar or press Enter.

Form

Wisconsin Dept of Revenue

Nexus Unit 2‑233

Affidavit of Exempt Sales

A-006

PO Box 8906

Madison WI 53708‑8906

•

•

phone: (608) 266‑3969

FAX: (608) 266‑5464

website: revenue.wi.gov

The Secretary of Revenue is required to certify to the Secretary of Administration a list of vendors and their affiliates who are:

• not registered to collect and remit Wisconsin sales and use tax, unless all sales are exempt, or

• registered, but do not collect or remit such taxes.

Wisconsin state agencies and authorities may not purchase materials, supplies, equipment or contractual services from vendors

and affiliates who have been “certified” to the Secretary of Administration.

“Affiliate” means a person that controls, is controlled by, or is under common control with another person. “Control” means to

own, directly or indirectly, more than 10% of the interest in, or voting securities of a business.

Any vendor or affiliate that only makes sales that are not subject to Wisconsin sales or use tax should complete the affidavit

below. This certifies that all sales in Wisconsin are exempt from Wisconsin sales and use tax. Examples of exempt sales include:

• sales for resale

• sales to governmental units

• sales to exempt organizations

• sales of non‑taxable services

Exempt sales do not include sales of tangible personal property or taxable services not taxed solely because the vendor or

affiliate does not have activity in Wisconsin that requires them to collect and remit sales and use tax.

Any vendor or affiliate having only exempt sales in Wisconsin is not required to register to collect and remit Wisconsin sales or

use tax.

Legal name

Business name (DBA)

Mailing address

Federal ID number

Type of property sold

Type of services sold

certifies that all Wisconsin sales of its property and

services are exempt under ch. 77, Wis. Stats.

Company name

I certify that, to the best of my knowledge, the above information is accurate and complete.

Completed by (type or print)

Title

Signature

Date

(

)

Telephone number

Email address

A-006 (R. 12-16)

1

1